Online Term Plan

Written by

Reviewed by

Understanding Online Term Insurance?

An term plan is a type of life insurance that you can buy over the internet. Unlike traditional term insurance, online term plans allow you to compare, analyse, and select the appropriate financial life insurance coverage from the convenience of your own home.

Term insurance purchased online allows you to:

- Examine the features and benefits of various term insurance policies.

- Determine how much of a premium you will have to pay for the term insurance coverage you want.

- Recognize the many rider alternatives available with these plans.

- Save money on premiums when compared to purchasing a normal term insurance plan offline.

- Significantly reduce the time it takes to buy something.

What to Look for in Term Plan?

Max Life Smart Secure Plus Plan

₹ 1 Cr

64

₹ 46K*

- Return of Premium : Get back all premiums paid on survival till maturity

- Limited pay option : Pay premium till 60 years for a life cover till 85 years

Disclaimers:

~This is applicable for a 24-Year Old Healthy Male, Non-Smoker, 25 Years Policy Term, 25 Year Premium Payment Term (exclusive of GST) for Max Life Smart Secure Plus Plan. *Tax benefits as per prevailing tax laws, subject to change. Save Rs. 46,800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are a regular Individual, falling under 30% income tax slab having taxable income less than Rs. 50 lakh and Opt for Old tax regime.

MAX LIFE CRITICAL ILLNESS AND DISABILITY RIDER (UIN- 104B033V01) available as a rider on payment of additional premium. Extended cover of up to 85 years is available with gold and platinum variant only. @64 critical illnesses covered in platinum and platinum plus variant on payment.

ARN: PC/SSPP/190424

Why Should You Buy Online Term Plan?

With the online world becoming increasingly user-friendly, many insurance firms now provide the option of purchasing coverage online. Traditional term insurance policies have been replaced by online term plans as the new-age alternative. Policyholders may now choose the best plan for them online, and even calculate the premium they will have to pay based on the coverage they need.

Simply put, online term plans provide greater convenience and allow policyholders to take advantage of the best features from the comfort of their own home.

Let's take a look at some other benefits of buying term insurance online:

1. Lower Premiums

2. Time - Saving

When it comes to term insurance, there is no such thing as a one-size-fits-all solution. Your term plan should be tailored to your specific needs and ensure that your family is not financially disadvantaged in the case of your death.

So, when you are looking for suitable online term plans, the following considerations can assist you in selecting the best plan for your needs:

Step One

Make A Thorough Evaluation of Your Requirements

If you are the sole breadwinner of your family, it is best to figure out how much money is needed to ensure that the family can meet their living expenditures and maintain their level of life in case of an unfortunate event. To arrive at a figure, you should consider the family's living expenses as well as the rate of inflation. There are other factors such as your liabilities which should be factored in to estimate the ideal coverage when you are looking for online term plans. This will enable you to find the best online term insurance plans that fits your financial requirements appropriately.

Step Two

Arrive at a Suitable Sum Assured

When you buy term plans online, look for the variety of payout options as well as the premium paying options available with the plan. Most importantly, you, as the policy buyer should have the ability to customize the coverage offered by the online term insurance plan.

Step Three

Add Relevant Riders

Aside from the death benefit provided by a term plan, several riders provide additional coverage. You will find a variety of such riders when you buy term plans online. Common riders such as disability coverage, critical illness coverage, and premium waiver coverage can be added for a little additional price.

How to Choose the Right Term Insurance Plan Online?

When it comes to term insurance, there is no such thing as a one-size-fits-all solution. Your term plan should be tailored to your specific needs and ensure that your family is not financially disadvantaged in the case of your death.

So, when you are looking for suitable online term plans, the following considerations can assist you in selecting the best plan for your needs:

Step One

Make A Thorough Evaluation of Your Requirements

If you are the sole breadwinner of your family, it is best to figure out how much money is needed to ensure that the family can meet their living expenditures and maintain their level of life in case of an unfortunate event. To arrive at a figure, you should consider the family's living expenses as well as the rate of inflation. There are other factors such as your liabilities which should be factored in to estimate the ideal coverage when you are looking for online term plans. This will enable you to find the best online term insurance plans that fits your financial requirements appropriately.

Step Two

Arrive at a Suitable Sum Assured

When you buy term plans online, look for the variety of payout options as well as the premium paying options available with the plan. Most importantly, you, as the policy buyer should have the ability to customize the coverage offered by the online term insurance plan.

Step Three

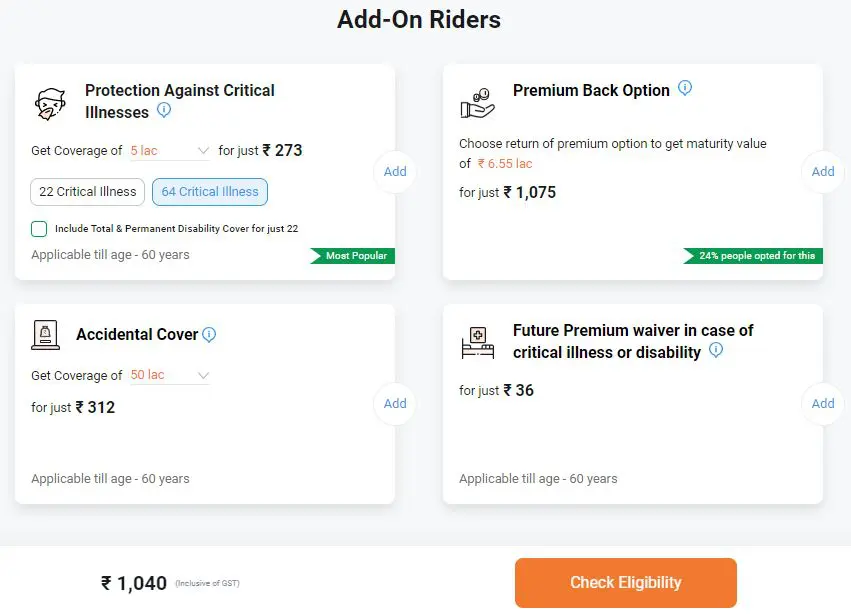

Add Relevant Riders

Aside from the death benefit provided by a term plan, several riders provide additional coverage. You will find a variety of such riders when you buy term plans online. Common riders such as disability coverage, critical illness coverage, and premium waiver coverage can be added for a little additional price.

Steps to Buy Online Term Plan

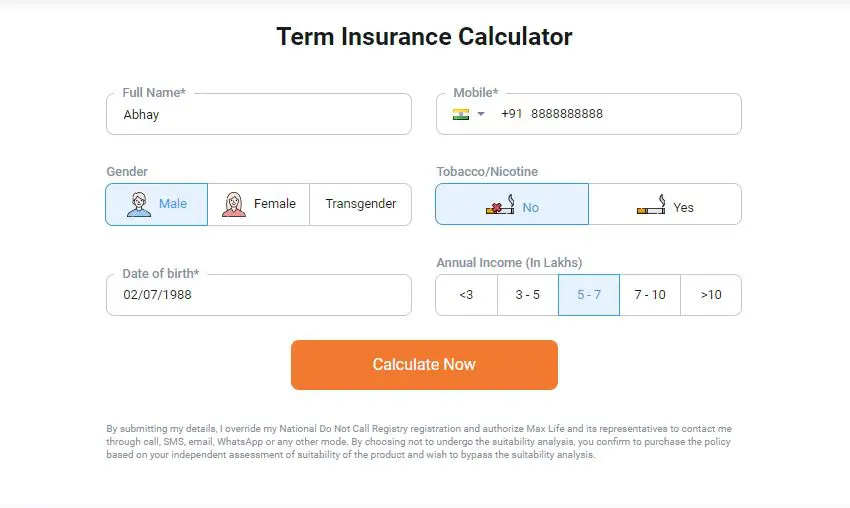

We, at Max Life Insurance are committed to making financial security more accessible to people with diverse financial backgrounds. Hence, our term plans are available for hassle-free online purchase. With the help of an online term plan calculator, you can evaluate your insurance requirements in a few quick steps.Let’s follow the purchase journey of Abhay, a 33-year-old man looking for online term plan to understand how it works:

STEP 1

The first step for Abhay is to enter basic personal details such as his name, contact details, gender, smoking habits, date of birth and annual income range. These are crucial factors which will determine the coverage amount and duration when he is buying an online term plan.

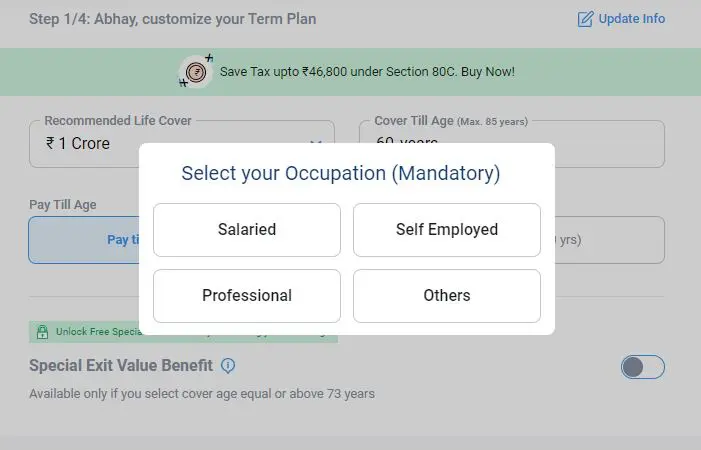

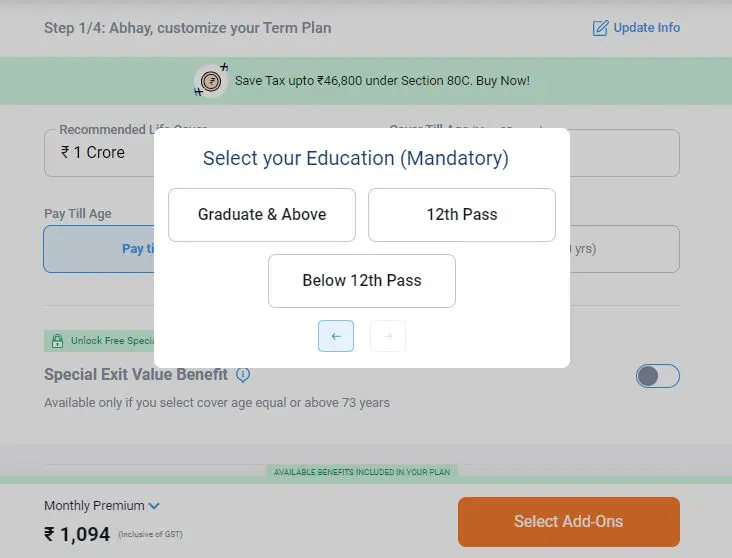

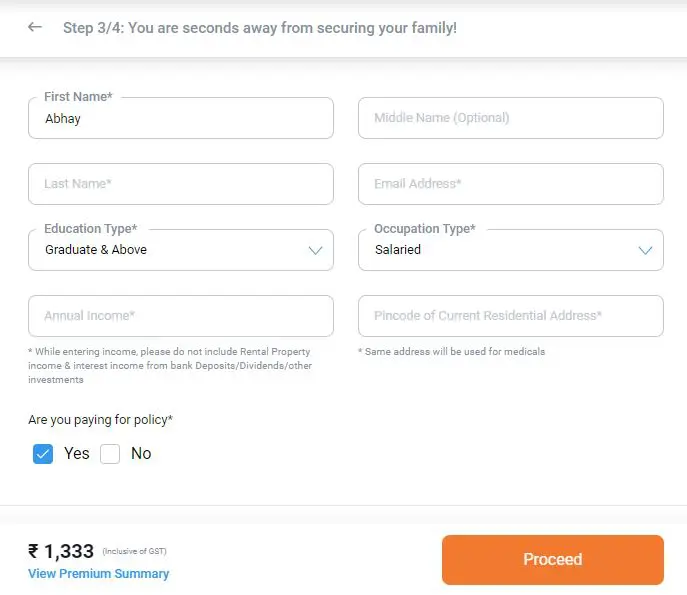

STEP 2

Next, Abhay selects the nature of his occupation, which is salaried and his education level. Depending on these factors, the online term plan calculator may show varying results for coverage amount, duration and consequently, the premium rates.

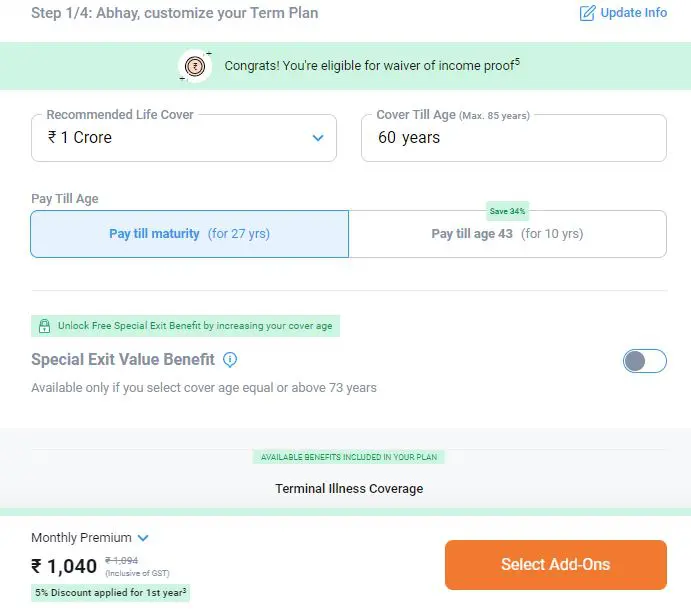

STEP 3

At this stage, Abhay can see an estimated premium amount for a cover of Rs. 1 crore which will last till he is 60 years old. He has the option to pay the premiums till the maturity of the policy, which is 27 years, or to wrap up the premium liabilities within the first 10 years of the policy period. Depending on what he chooses, varying premium rates will be displayed.

STEP 4

Next step is to attach rider benefits to his policy. These riders will come with a nominal additional premium with the online term policy. Adding these will lead to a changed premium rate along with enhanced coverage benefits for Abhay.

STEP 5

Once he has decided the rider benefits to be added to his online term plan, he must provide other personal details such as email address, full name and click on proceed.

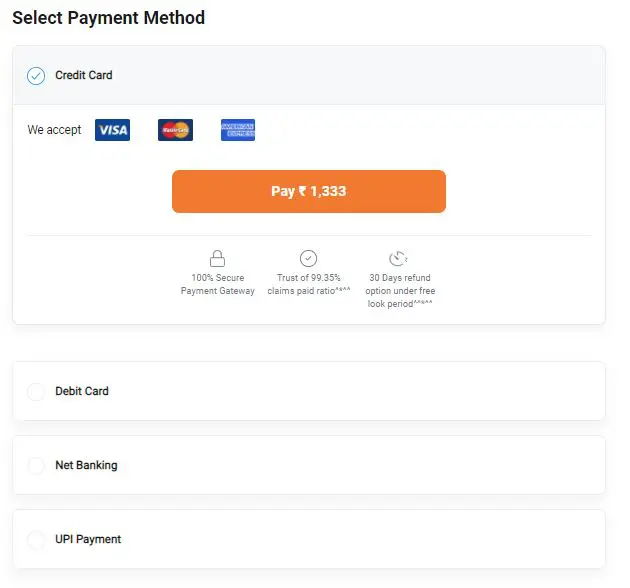

STEP 6

Lastly, he must select the payment method to complete the purchase of the online term plan, depending on the mode of payment most suitable to him.

STEP 7

Once this process is complete, he will receive a confirmation e-mail and message from Max Life Insurance with the policy document of the online term plan.

Choosing the Right Sum Assured Option for your Online Term Plan

Selecting the right sum assured is crucial in order to financially protect your loved ones in case of an unforeseen event. You can know more about choosing the adequate sum assured for your term insurance. You can select from the below sum assured options:

Disclaimer: *Standard daily premium for 24-year old healthy male, non-smoker, 25 years policy term, 25 year premium payment term (exclusive of GST) for Max Life Smart Secure Plus Plan (UIN:104N118V08). %*Standard daily premium for 24-year old healthy male, non-smoker, 25 years policy term, 25 year premium payment term (exclusive of GST) for Max Life Smart Total Elite Protection Term Plan (UIN: 104N125V04). ARN: C/SA/190424

Additional Benefits Through Riders| Max Life Insurance

Max Life Waiver of Premium Plus Rider (UIN: 104B029V04)

Max Life Waiver of Premium Plus Rider (UIN: 104B029V04) provides waiver of all future premiums in case of Critical Illness or dismemberment or Death (only when Life Insured and Policyholder are different individuals). This product doesn’t have an in-built Waiver of Premium benefit and thus rider benefit is an additional benefit. For more details on the Rider and various terms and conditions, please refer to the Max Life Waiver of Premium Plus Rider Prospectus/Brochure, Rider Contract, Rider Rates & Rider Leaflet

Downloads

Max Life Critical Illness and Disability Rider (UIN: 104B033V01)

Max Life brings a comprehensive insurance plan that covers up to 64 critical illnesses along with total and permanent disability coverage. You can choose the best variant for you from the five available variants. You will be also be eligible for a discounted renewal premium based on the number of steps monitored on Max fit app. You can even choose to get a cover up to age 85 years. (For further details, please refer to Max Life Critical Illness and Disability Rider, UIN – 104B033V01, prospectus/brochure

Downloads

Frequently Asked Questions

The following documents are required to purchase term life insurance online:

● Proof of age● Proof of address

● Proof of income/Salary slips

● Passport-sized photos taken recently

● Necessary medical reports

Please keep in mind that an insurance company's paperwork requirements may vary from case to case.

ARN NO: PCP/OTP/190424

Online Insurance Plans by Max Life Insurance

Why Choose Max Life Term Plan?

Get ₹2 crore Life Cover @ just ₹1103**/month

Popular Searches

- 0124 648 8900(09:00 AM to 09:00 PM Monday to Saturday)

- service.helpdesk@maxlifeinsurance.comEmail

- SMS ‘LIFE’ to 5616188Message

- Let us call you back

- 1860 120 5577(9:00 AM to 6:00 PM Monday to Saturday)

- Chat with us

- Write to usPlease write to us incase of any escalation/feedback/queries.

- 011-71025900, 011-61329950(9:00 AM to 6:00 PM Monday to Saturday)

- nri.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Do you have any thoughts you’d like to share?