Written by

Updated :

Reviewed by

IN UNIT LINKED PRODUCTS, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER.

This year, I will turn 40! It’s another milestone they say. While my paycheck reflects my accomplishments, I know it’s time to plan for retirement or it may be too late to accumulate a retirement corpus I require.

Viren, my financially savvy friend advised, “This milestone is the best time for you to think smart about investments and insurance if you haven't already!" I immediately checked for insurance and investment options online and to be honest, I was stumped. There were so many options!

While there are many investment options, the relevance is contextual to your age, goals, risk appetite, and even lifestyle. Investing in an instrument, therefore, needs to be well-thought and a deliberate decision. Personal financial planning entails providing for the requirements in a life-stage such as home-ownership, wedding, education, childcare, healthcare and retirement. It also needs to provide for the luxuries and comforts you aspire for, be it travel, gadgets, or entertainment. And there are options for every purpose. You will make the right choice when you have all the information on these options at your finger-tips.

Life insurance is a versatile investment tool providing for not only retirement but also tax benefits (as per prevailing tax laws), collateral for loans (home, automobile, and education), and protection against medical exigencies. Basically, in a life insurance policy, the investor receives a lumpsum payment, either at the end of a predetermined tenure or death, in exchange for regular premium payments. Out of the five types of life insurance products, ULIPs have been hailed for their hybrid design.

You can invest in a ULIP (Unit Linked Insurance Plan), a low-cost, long-term investment option to strengthen your retirement plans. It’s a pension scheme that combines both, insurance and investment. It’s a modern way to invest in market-linked pension products, which give high returns."

"What is ULIP?"

It is a type of insurance plan that combines investment and protection.

1. One portion of your premium is invested in stocks, bonds and other financial instruments so that your money grows based on the market’s performance.

2. The remaining amount is invested in life insurance that will provide financial protection to your family.

Based on your risk ability and investment appetite, you can choose from several fund options such as:

1. High-risk funds - If you are willing to take a higher risk, invest in equity funds.

2. Balanced risks funds - On the other hand, you can invest in the balanced fund in which your premium is distributed between high-risk equity and fixed interest units.

3. Moderate risk funds - Here, your premium is invested in government securities, corporate bonds and various other investments that give you a fixed income. It comes with relatively moderate risk.

4. Low-risk funds - Your premium amount is invested in cash or bank deposits, which have a low-risk profile.

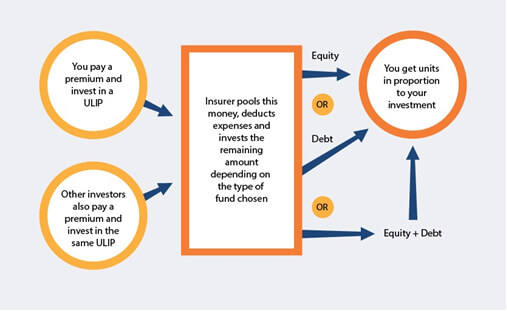

How does the ULIP scheme work?

A unit-linked pension plan (or a market-linked pension plan) works in two phases:

a) Accumulation Phase

1. This period includes the time when you pay premiums to accumulate money.

2. The regular contribution (premium) you make is invested by your insurance company on your behalf.

b) Reaping Phase

1. One-third of the corpus is paid to the policyholder while the remaining is invested in an annuity scheme.

2. At the end of the second phase, the investments, along with the benefits from the scheme are paid to you at regular intervals.”

What are the key features of a ULIP?

A Unit Linked Pension Plan…

a. Offers market-linked returns which may sometimes be higher than the initial investment.

b. It also allows a policyholder to choose to invest in debt funds (a type of low-risk investment) or equity funds (for those who are willing to take a higher risk).

3c. The invested amount grows over the years and is made available to you at the time of retirement. The returns are market-linked and so returns may be adverse too.

1. The charges applicable

ULIPs from different insurance companies have varied charge structures When making a decision on buying a ULIP scheme, you must be aware of the charges applicable

Charges Applicable |

Definition |

1. Fund management charges |

It is levied for managing the fund as a percentage of the value of the assets. |

2. Discontinuation charges |

It is to be paid at the time of discontinuation with the ULIP before the lock-in period. |

3. Mortality charges |

It is charged in case a policyholder does not live to the assumed age. |

4. Surrender charges |

It is levied in case of partial or premature withdrawal of units. |

5. Premium allocation charges |

It is a charge that is incurred towards issuing of a policy. |

6. Policy administrative charges |

It is a charge incurred for maintaining the ULIP policies. |

7. Fund switching charges |

A fee that is applicable for switching your fund type. |

8. Other charges |

The insurance provider deducts certain charges such as administration charges, fund management charges, mortality charges, etc. in the form of units. The premium amount is used to buy units, and the investment amount is quantified in the form of units bought. |

As an investor, it is beneficial to stay invested in a ULIP scheme for the entire term because the structure of overall charges reduces over a long period of time."

2. The flexibility to change the premium amount

Policyholders can pay a single premium in a lump sum at the beginning of the policy term or pay regular premiums. Regular premiums are pre-determined amounts that the policyholder must pay annually, semi-annually, quarterly or monthly for a specified period. With ULIPs, you can pay a top-up amount in addition to your existing premium.

3. The flexibility to opt for a rider

With ULIPs you can customize your plan and include additional protection by choosing optional features or riders. One of the most common riders offered is the Unit Linked accidental disability benefit rider. One of the best features of ULIP schemes is the flexibility to customize plans. Check out this ULIP scheme, it offers additional protection or rider for your spouse."

4. The flexibility to extend vesting age

Vesting or maturity age is the age when you start receiving your pension. You can choose the vesting age between 50 to 75 years according to your need, subject to a minimum policy term of 10 years. In some ULIP plans, you can extend the vesting age according to your changing requirements.

5. The investment options available

Since ULIP schemes are market-linked investments, What is your investment risk appetite? Would you prefer investing more in equity or debt, or a combination of both? Because, if you’re investing in ULIPs you will need to know that."

A ULIP scheme allows investors to choose from the given assets. It can be anything - 100% equity, 100% debt, or a combination of two - depending on the risk profile you choose. In ULIP schemes you can switch between plans that enable you, as an investor, to change your fund-profile. A ULIP not only offers flexibility to switch from equity to debt but also guarantees a pay-out of fund value after the policyholder’s death.

It’s best to start with 100% equity and gradually switch to debt in your late 50s. When you retire, you can withdraw one-third of the accumulated corpus, which is tax-free.

For instance, this ULIP scheme offers additional features that allow you to avail benefits based on your choices. The investment options in this scheme include:

Investment Option |

Definition |

Risk Profile |

The asset allocation of the fund |

||

Government Securities & Corporate Bonds |

Money Market & Cash Instruments |

Equity & Equity related securities |

|||

Pension Maximiser Option |

An amount equal to a higher of fund value or 101% of the cumulative premiums are paid at maturity. |

The risk profile of the investment option is medium. |

40% - 80% |

0% - 40% |

20% - 60% |

Pension Preserver Option (Not applicable for all products of all insurers) |

An amount equal to a higher of fund value or 110% of the cumulative premiums are paid at maturity. |

The risk profile of the investment option is low.

|

60% - 90% |

0% - 40% |

10% - 35% |

Please note - You can choose your investment option only at inception and no change in the option is allowed during the Policy Term.

On the back of flexibility and transparency, ULIPs encourage goal-based savings and offer tax benefits (as per prevailing tax laws) to investors. Designed as a long-term systematic investment tool, ULIP can address key financial goals. As ULIPs bring in a disciplined approach to investment, it helps an investor fulfill life goals such as homeownership, higher education, and retirement planning.

What about you? What is your investment appetite? Have you planned for retirement yet? If not, start planning for your retirement now!

THE LINKED INSURANCE PRODUCTS DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICYHOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF FIFTH YEAR.

Unit Linked Insurance products are different from the traditional insurance products and are subject to the risk factors. The Premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the policyholder/insured is responsible for his/her decisions. Max Life Insurance Company Limited is only the name of the Insurance Company. The names of the linked insurance products do not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges from your insurance agent or the intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these funds, their future prospects and returns. The past performance of the funds does not indicate the future performance of the funds.

ARN:-Jul21/BG/19