Online Top Selling Plans

Top-rated insurance plans by existing customers of Max Life Insurance.

Hassle-Free Selection of Insurance Plans

- High Life Cover at Cost-effective Premiums

- Critical Illness Coverage

- Policy Break in Adverse Circumstances

- Tax Benefits4

- Different Premium Payment Options

- STEP Term Plan

We have come pretty far, beating our own claims paid percentage

And with that, our claims paid percentage has been rising consistently

2019

2020

2021

2022

Claims Paid Percentage

2023

BENEFITS

Why Prefer Max Life?

99.51%

Claims paid percentage

(Source : Individual Death Claim Paid Ratio as per audited financials for FY 2022-2023)

₹1,397,142 Cr.

Sum Assured

In force (individual) (Source : Max Life Public Disclosure, FY 2022-23)

₹122,857 Cr.

Assets Managed

(Source : Max Life Public Disclosure, FY 2022-23)

269 Offices

Max Life Presence

(Source : As reported to IRDAI, FY 2022-23)

Empathy

For our customers

Transparency

In all phases

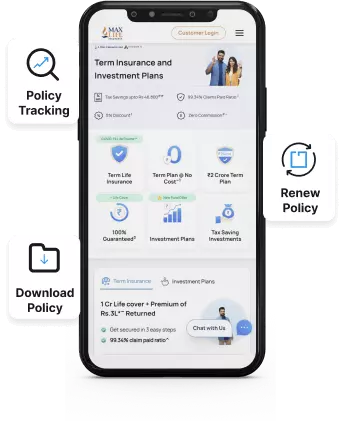

Download Max Life Insurance App

Super-fast way to answer all your life insurance needs

Track your updated policy status

Download your premium receipt for tax filling

Use a host of calculators to assess your financial needs

Get life insurance @ Zero Commission

Life Insurance

Life insurance refers to the legally binding contract between a policyholder and an insurance company that provides financial protection to his/her family. The insurer promises to offer the insurance benefit in exchange for regular premiums paid by the life insured. The ‘financial protection’ under life insurance is provided in the form of life cover, also known as sum assured. It is a pre-agreed amount that is payable in case of an untoward incident with the life insured.

For the life insurance contract to be enforceable and life insurance quotes to be accurate, your application must accurately disclose your current and past health conditions. Also, you need to pay a single premium or regular premiums as chosen when buying life insurance. You can estimate the life insurance quotes for your financial profile by using the insurance calculator.

Financial Security

Child’s Future Planning

Corpus Over Long Term

Disciplined Investments

Retirement Planning

Tax Savings

Life insurance purchase

You need to spend maximum time deciding on buying the most suitable life insurance plan at this stage. The life insurance quotes for your financial profile will help you make the decision. Although the best life insurance policies offer the flexibility to choose the benefits, the ultimate choice lies in your hands.

Hence, you must consider various factors, like plan tenure, premium, riders, and, most importantly, the reason to buy life insurance and find the life insurance quotes. You can then buy the plan online or offline as per your preference.

Premium Payment

As per the life insurance contract, the insurers promise to pay a pre-decided amount to the life insured or policy nominee provided the insured pays the premium without fail. In other words, all the benefits that you can get under a life insurance policy are based on the timely premium payment.

Hence, it is advisable to choose a premium that you can easily pay on time along with other financial liabilities. Your life insurance quotes will allow you to speculate on the premium costs in the coming years

Claim Filing

The last stage of a life insurance plan is related to filing for a claim to get the expected insurance benefits.

In case of your unfortunate demise, the nominee will receive the sum assured as defined in the contract. To receive it, the nominee has to submit a claim form along with various documents. Upon verification of claim, the insurance company releases the benefit to the nominee.

For life insurance plans with a return of premium option, the insured gets the total of all premiums paid back if insured person survives the policy term, which can be used to achieve several life goals.

Term Insurance

It is the simplest type of life insurance that provides financial safety to the life insureds family in case of the untimely demise. Depending on your income and liabilities, you can select an adequate sum assured under this type of life insurance plan to safeguard the financial interest of your loved ones.

ULIP

A Unit Linked Insurance Plan or ULIP is a unique form of life insurance. It provides life cover while also allowing you to invest money in market-linked instruments. By investing in ULIPs, you get the benefits of market linked returns over the long term, life cover, income tax savings, and flexibility to switch between funds. The life insurance quotes will enable you to determine the amount required for financial security and investment purposes, so that you can divide it efficiently.

Retirement Plans

These plans are life insurance products that provide financial security for your retirement days. These life insurance plans help you invest money during the working years and create a corpus that you can use as a whole or in parts to fund your retired life. You can think of investing in retirement plans as a disciplined way to plan for the golden years of life.

Child Plans

Child insurance plans, commonly known as saving life insurance plans, are designed to help you secure your child's future. Along with life cover, your child receives the benefit of pay-outs at different milestones during the educational journey under these life insurance plans. Investing in child plans shields your child's future against unfortunate events like death or critical illnesses

Savings and Income Plans

As life insurance products, these plans can help you instill the habit of disciplined savings to ensure steady returns in the form of monthly income or a lumpsum amount. Alongside, these life insurance plans provide various other benefits, including death benefits, tax benefits, terminal illness benefits, to name a few. Check the life insurance quotes and details before making investment decisions, so you can allocate your money in the right places

Group Insurance Plans

These life insurance plans are meant for organizations or groups to provide life cover to the employees or group members, respectively. Through group insurance plans, the employers tend to take care of the financial security of their employees’ family, thus motivating them to work harder to maintain high-performing businesses. Keeping this cover in mind, you can check the life insurance quotes for additional financial security for your loved ones.

Having life insurance gives you more than just a life cover. It also helps create wealth over the long term for you and your loved ones. Most importantly, life insurance gives peace of mind that your family will live life comfortably, should anything happen to you.

Buying life insurance is a good decision for people at different life stages.

For newly married people

After you have just tied the knot with a better half, you get the responsibility to plan for his/her well-being as well. Your life insurance quotes as a single person and married person will vary as you will have increased financial obligations. Along with the plans that you have already made for the life ahead, it always helps to prepare for the future with a life insurance plan.

For young parents

As a young parent, you can feel immense joy all around. Alongside your spouse, you now have another life to care for. With a life insurance plan, you can plan for your child's future in terms of education, marriage, and many others. The life insurance quotes when you buy a plan for your child's future will account for these factors. They will ensure that your kids’ dreams get fulfilled as planned.

For individuals with financial liabilities

Along with a growing family, the liabilities grow as well. To accommodate your loved ones, you buy a bigger home or buy a dream car that they all love, which gets added to your liabilities. Purchasing a life insurance plan for your loved ones ensures that your loved ones can shoulder these liabilities easily, if you have the right life insurance quotes.

For people nearing retiremen

Retirement planning is something that you should not take lightly, regardless of your current income. By investing in a life insurance plan, you can build a corpus for your twilight years and live life without facing financial dependence. You can also plan to receive a steady income during the retired life by getting reliable life insurance quotes, at the right stage in life.

At its core, life insurance is a financial benefit for possible contingencies linked to human life. These include death, disability, or retirement. When these contingencies occur, they result in loss of income for the household. It is where a life insurance plan works to benefit you and your family.

Under a life insurance plan, a monetary sum is offered as per life insurance plan opted to help cope up with the loss of income in the future years. Depending on your life insurance quotes, it can relieve a significant amount of financial burden. Hence, you should buy life insurance:

- To ensure financial support to your immediate family after you

- To finance your child's education plans

- To get a steady source of income in life

- To get insurance benefits in case your earnings are impacted due to a critical illness

As Indians, we put personal safety before everything else. Every day, before we leave for work, we check whether we have our wallets, cell phones, car keys, and house keys on us. We turn off all the lights, double-check if we have locked the doors securely, put on the seat belt, and only then start the car.

Even when we are shopping online, we put items in the cart that we like. Before making the payment, however, we make sure to check whether we can return them without any fee, in case the items are faulty.

When it comes to planning for life’s goals; therefore, it is imperative that you put contingency planning above all else.

When you get your life insurance, you can begin planning to ensure that your loved ones remain financially secure throughout their lives, even if something serious happens to you. At the same time, your life insurance plan helps you maximize your tax savings and work towards creating wealth and ensure financial protection in your absence. Like you cannot build your house without a firm foundation, you need life insurance to serve as the foundation to better and secure tomorrow for your family.

It would help if you prioritized buying life insurance quotes before making any other investments, for the simple reason that the insurance benefit will help you secure your family's financial future in case of your untimely demise.

Adding Life Insurance to your list of must-do's will not only get you additional benefits such as year-on-year tax savings up to Rs. 1.5 lakh under Section 80C as per prevailing tax laws and rider options to enhance your life cover against critical illnesses or a sudden loss of income due to accidents.

Moreover, getting the life insurance quotes helps increase your risk tolerance. The primary goal of any investor is to grow money over the long-term.

Determining your risk tolerance and, subsequently, going with the appropriate asset allocation (the blend of stocks, mutual funds, and cash) is crucial. With life insurance in your financial portfolio, you can take more risk with your investments.

The significance of putting life insurance at the top of the heap of your financial investments can be understood through a cricket test match.

A test match extends up to 5 days, and for each day, the playing strategy changes — similarly, your financial planning changes, too, as per your life stage and financial requirements, causing a variation in your life insurance quotes. Let us see how life insurance is crucial for long-term financial sustenance

Day 1: After winning the toss, you start the day’s play with caution, leaving or defending the good balls and punishing the bad deliveries for runs. Similarly, as soon as you start earning an income, the first thing that you need to do is to create a fool-proof strategy against life’s contingencies. This is where life insurance becomes a vital cog in your long term plans. With life insurance in your kitty, you can make sure that your loved ones do not have to depend on anyone else to support them, especially when you are no longer there to help them accomplish their dreams.

Day 2: Once you have the backing of a cautious yet emphatic start, and an imposing first day of cricket, you try to build upon your previous day score. In terms of financial planning, the next stage after purchasing life insurance is to build on your savings through a mix of traditional and market-linked investments. You can consider traditional savings instruments such as bank fixed deposits, recurring deposits, and provident funds while building up your tolerance for more aggressive market-linked investments.

Day 3: You invite the opposition to best your first inning total and create a game plan to put your opposition on the back foot. In life too, you prepare your finances against emergency medical situations and other unplanned expenditures with the help of health insurance. Together with life insurance and a health plan in your back pocket, you equip yourself and your loved ones against any crisis.

Day 4: Often, you have to second inning on this day – dig in deep to fortify your first-innings lead and work towards building a high total for the final day showdown. When it comes to creating a financial portfolio, it is now time for you to look for investment opportunities to help maximize your savings into wealth, so that you can effectively support your family's goals, be it your child's higher education, marriage or your spouse’s financial wellbeing. It is only through efficient financial planning and long-term capital appreciation of your savings that you can prepare yourself for your retirement.

Day 5: On the last day of the match, it is now time for you to put your total match score to test so that you can beat your opposition and put the crown of victory on your head. In life, too, the last stage of your financial planning is about bringing your savings and investment returns to fruition. You look to diversify your investment portfolio by including different equity and debt market instruments so that you can achieve maximal capital appreciation while minimizing the investment risks and ensure long-term financial sustenance

Many investors tend to make a common mistake of investing in instruments without factoring their entire financial picture – the equity they have built-in their home, existing loans, and other liabilities. Ideally, every asset and investment you own should factor into your risk-reward equation.

Getting your life insurance plan at an appropriate stage in life allows you to take more risk when it comes to securing your life and making sure that you provision a significantly large financial corpus (in the form of insurance coverage) as backup against contingencies, while continuing to invest for other life goals. Moreover, with a life insurance plan in your pocket, you can be sure that even if something happens to you, your family will not have to deal with a financial crisis at any time during their lives.

Planning with life insurance plans will help your family stay financially protected, serving as a safety net that will prove useful in case of an eventuality. Also, the insurance coverage will augment the total accumulated value of your investments, making sure that your loved ones continue to have a lifestyle that you intended for them, even if you are not there with them.

Customer Reviews

Real Folks with Real Stories!!

Got questions? We’d love to answer

ARN: PCP/HP/171023

Companies who’ve trusted Max Life Insurance

Being a member of the ever-evolving industry, Max Life Insurance is a trusted name among several companies and organizations. Let’s have a look at some of these companies that have laid their trust on our vision.

Become a Partner

Contact us

Got a question for us?

Connect with us on WhatsApp

+91 7428396005Customer Care

1860 120 5577