Written by

Updated :

Reviewed by

On this Page

In India, Income Tax Return Filing is a mandatory prerequisite for claiming income tax or TDS refund. To request TDS refund, you need to provide written proof of income and other deductions to the Income Tax department for a given assessment year. After that, you can check your TDS refund status online any time before you receive the TDS refund in your bank account.

What is Income Tax Refund or TDS Refund Status?

Income Tax Refund or TDS refund implies that when you pay more taxes (in the form of either Tax Deducted at Source (TDS) or Self-Assessment Tax, or Advance Tax) than what you are supposed to, you can ask the Income Tax department to refund the excess amount.

In other words, when the Income Tax paid is more than Income Tax payable for a given assessment year, the excess amount is referred to as Income Tax or TDS refund.

TDS refund is calculated after considering all the deductions and exemptions applicable, after processing of Income Tax Return, and refunded to you. To claim Income tax refund or TDS refund, you will be required to file your ITR.

Also Read: How to File ITR Online?

How to Claim an Income Tax Refund/TDS Refund?

To claim your TDS refund or income tax refund for FY 2019-20 & AY 2020-21, you must provide written proof of about Income and deduction details to the Income Tax department, by filing your Income Tax Return.

Make sure that you provide accurate details of all your income and tax paid/deducted/collected/ during the relevant assessment year.

Doing so will help ensure that the TDS refund component and status gets reflected in your income tax return.

Here are the steps to claim your income Tax or TDS Refund –

Step1: Enter your PAN number to check whether you are already registered on

Related Articles

https://portal.incometaxindiaefiling.gov.in/e-Filing/Registration/RegistrationControl.html

Step 2: Register or login on the portal.

Step 3: Download the relevant ITR form, fill the required details, upload, and submit the form.

Step 4: E-verify the ITR submission through an Aadhaar-based OTP, digital signature, or your net banking account.

Step 5: You will receive an Acknowledgement and TDS refund processing email (if you are eligible to receive a TDS refund) from the Income Tax Department.

How is TDS Refund Issued by the IT Department?

As per the revised process for claiming TDS refund, it is now compulsory that you pre-validate your bank account, in which you want to receive the refund amount.

Along with pre-validation of the bank account, you also need to link your PAN with your bank account (effective from March 1, 2019)

TDS refund is issued by the Income Tax Department in two ways –

1. RTGS/ECS

Related Articles

Under this facility, you receive the TDS refund directly in your registered bank account. TDS refund through RTGS/ECS is the fastest facility provided by the IT department.

2. Paper Cheque

You receive an account payee cheque from the Income Tax department. To receive the cheque, you must provide your bank account number along with your address.

Under this facility, you receive the TDS refund directly in your registered bank account. TDS refund through RTGS/ECS is the fastest facility provided by the IT department.

2. Paper Cheque

You receive an account payee cheque from the Income Tax department. To receive the cheque, you must provide your bank account number along with your address.

How to Verify TDS Refund Status?

If you have not received your TDS refund, you can verify the status online by downloading your Form 26AS. You can also verify your Form 26AS (or Annual TDS summary statement) with your income and TDS details.

You can contact your jurisdictional Income Tax office to check your TDS refund status. You can raise a complaint through your income tax e-filing account or contact Ombudsman Income Tax Department to check your TDS refund status.

See how the latest budget impacts your tax calculation. Updated as per latest budget on 1 February, 2020. No deductions will be allowed under the new tax regime.

What is the Meaning of Different TDS Refund Status?

Different TDS Refund Status and their meaning are described below –

1. Not determined

This TDS Refund Status implies that your Income tax refund is still not processed. In such cases, you must confirm if your income tax return is filed and duly verified.

Here are different ITR-Vor 'Income Tax Refund – Verification' Receipt Status for your reference –

a. ITR-V Received – ITR-V form is duly received at CPC-Bangalore and is successfully verified

b. ITR-V e-verified – Your income tax return is e-verified

c. E-return for this Assessment Year has been Digitally signed – Your Income tax return has been filed and verified with Digital Signature

d. ITR-V not received – ITR-V form is yet to be e-verified or received by CPC (you must send a signed copy of ITR-V to CPC Bangalore or opt for e-verification process

2. Refund Paid

This TDS Refund Status means that the Income Tax Department has processed the refund and sent it to you by either paper cheque or direct debit to your Bank Account Number (registered at the time of filing your return).

You can contact your bank in case you have opted to 'Direct debit to your bank account' and still not received your TDS refund.

You can check your TDS refund status by tracking the Speed Post reference number, in case you have opted for TDS refund by paper cheque.

3 Assessment Year Not Displayed in Refund / Demand Status

This TDS Refund status implies that no income tax e-return has been filed for this PAN. In other words, it means that you may have missed the deadline to e-file your return. If this is the case, then you must proceed to file your Income-tax Return immediately.

Also Read: Why Should You File Your ITR on Time?

4. No Demand No Refund

In case of this TDS refund status, you may have filed for a refund, but you are not eligible for any refund, as per the calculations of the Income-tax department.

Usually, this happens when there is a mismatch in your and their TDS details calculations.

Subsequently, the IT department may issue an intimation under Section 143(1)(a), depicting a comparison between the details submitted and those considered by the Income-tax Department.

If you find any errors in the return, you can seek correction of the same by filing rectification return.

In case of this TDS refund status, you may have filed for a refund, but you are not eligible for any refund, as per the calculations of the Income-tax department.

Usually, this happens when there is a mismatch in your and their TDS details calculations.

Subsequently, the IT department may issue an intimation under Section 143(1)(a), depicting a comparison between the details submitted and those considered by the Income-tax Department.

If you find any errors in the return, you can seek correction of the same by filing rectification return.

5. Refund Unpaid

This online TDS return status implies that the Income Tax department has processed and released the refund; however, either your bank details or your address is incorrect

In this case, you must visit your Refund Banker's website and enter your PAN details and Assessment year to check the status of the TDS refund.

Later, you can update the details on the Income Tax Department's website and raise a refund re-issue request.

6. ITR Processed Refund Determined and Sent Out to Refund Banker

This online TDS refund status implies that the Income Tax department has completed the process of calculating your return and generated a Refund request.

The details of the TDS refund have been forwarded to your refund banker for further processing and disbursal.

Your Refund Banker service will provide the latest status of the TDS refund such as speed post tracking and error messages if you have provided incorrect bank details. You can recheck the TDS refund status after a few days for any updates by your refund banker.

7. Demand Determined

The meaning of this TDS refund status is that the Income Tax department has rejected your request for refund. Instead, the department had raised a demand for outstanding taxes that you need to pay.

You would receive a notice from the IT department, containing information about the reason and the exact amount of outstanding demand. You can check the notice to understand and clarify the reason behind the difference in the two tax amounts.

It is advisable that you verify your e-Filing records and if you find that you have raised an erroneous request for TDS refund, you must pay the outstanding the tax amount. In case you find that the intimation was mistakenly sent by the IT department, you can update your e-filing details, if needed and file a Rectification Return to support your TDS return claim.

8. Contact Jurisdictional Assessing Officer

This TDS refund status means that the Income Tax department requires some clarification or additional information related to your Income-tax Return.

You can contact the AO (also known as the Jurisdictional Assessing Officer) for your region via telephone, email, or post to provide the required details.

Also Read: What is TDS Challan?

How to Apply for TDS Refund Reissue?

Before applying for a TDS refund re-issue, you must first verify that your Income Tax Return is correct. Also, track the status of your TDS refund online with the Income Tax department.

If you have still not received the TDS refund, you can check whether your address or bank account details are incorrect.

Subsequently, if you receive an Intimation from the IT department, you can request for a TDS refund re-issue for FY 2019-20 & AY 2020-21 via the following steps:

Step 1: Go to http://incometaxindiaefiling.gov.in

Step 2: Login to your e-filing account using your PAN card details and password.

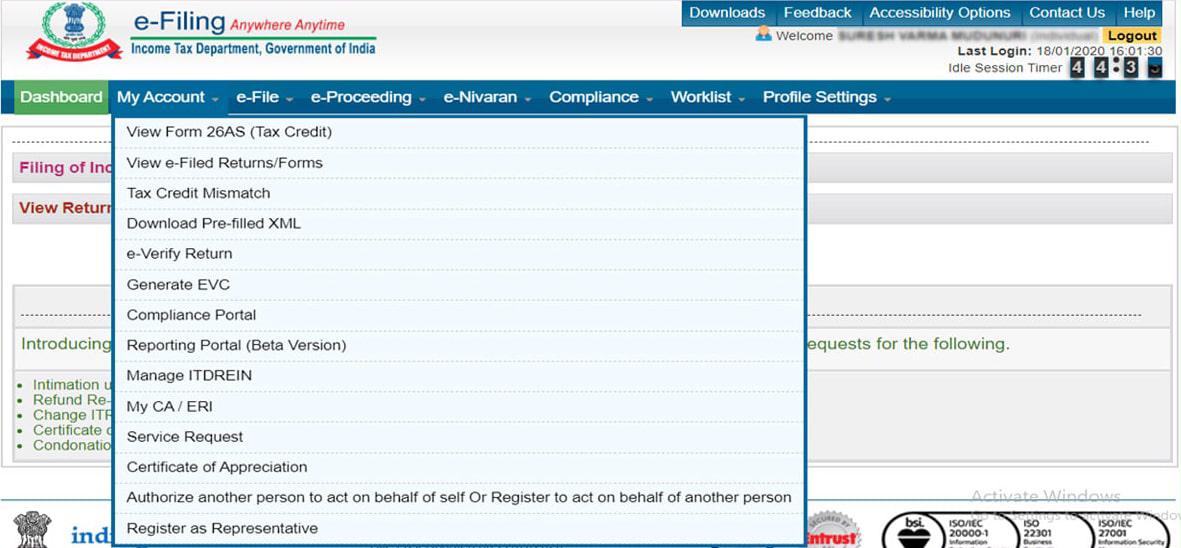

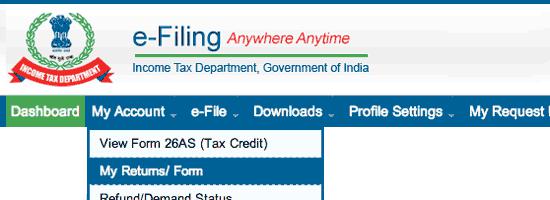

Step 3: Click the my "My Account" tab.

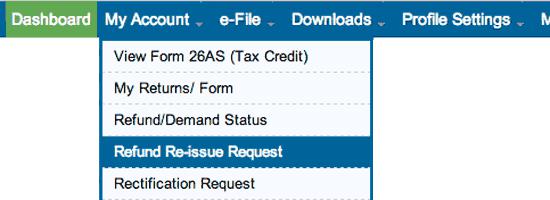

Step 4: Select' Service Request' from the 'My Account' drop-down menu.

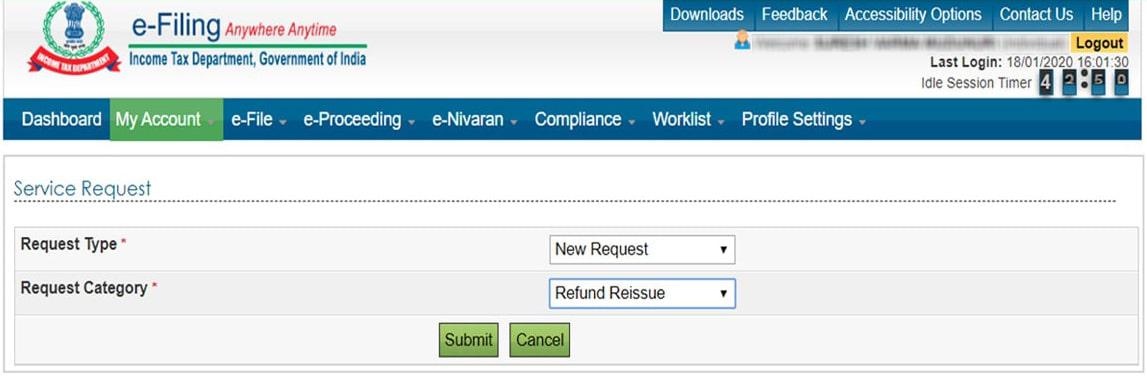

Step 5: Select' New Request' under Request Type.

Step 6: Select 'Refund Re-issue' under the Request Category.

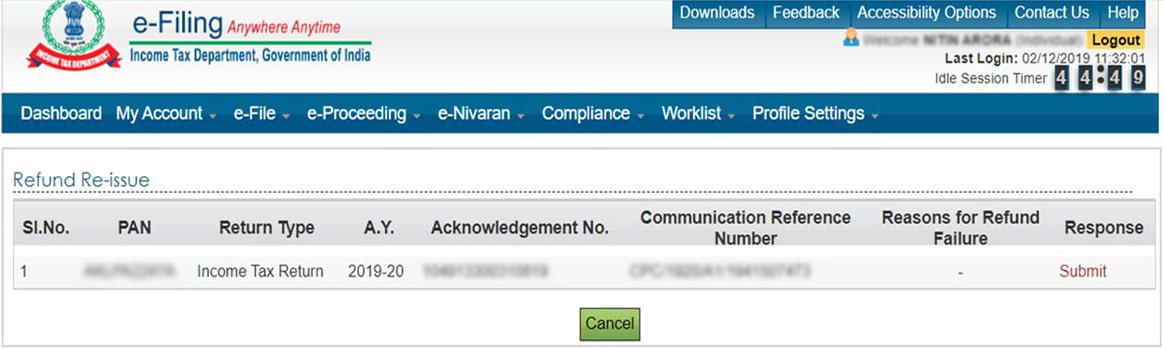

Step 7: Click on the 'Submit' button under the Response column.

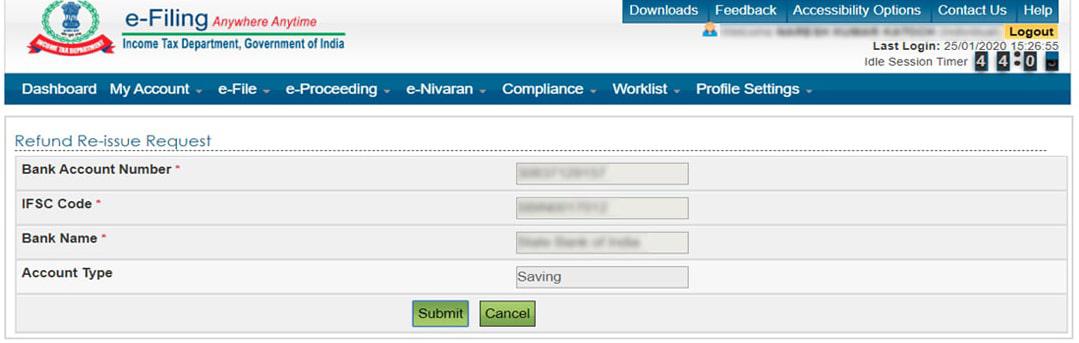

Step 8: Fill additional details such as Account Type, Bank Account number, IFSC Code.

Step 9: Click on 'Submit.' after filling all the details.

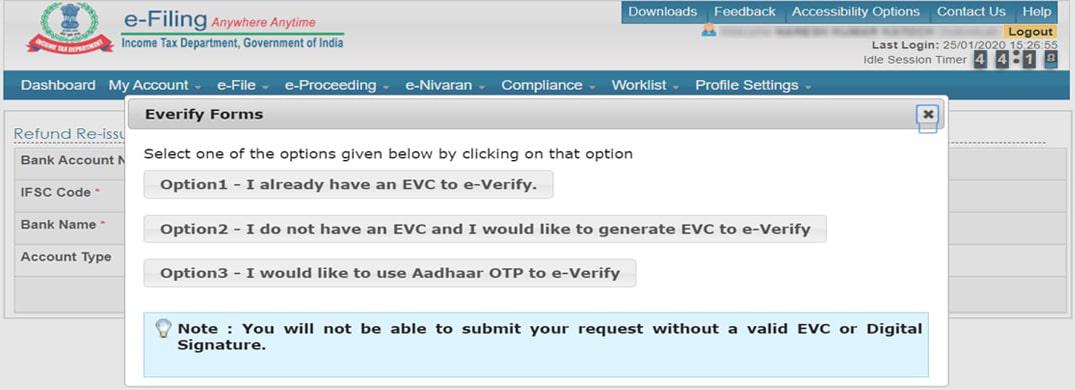

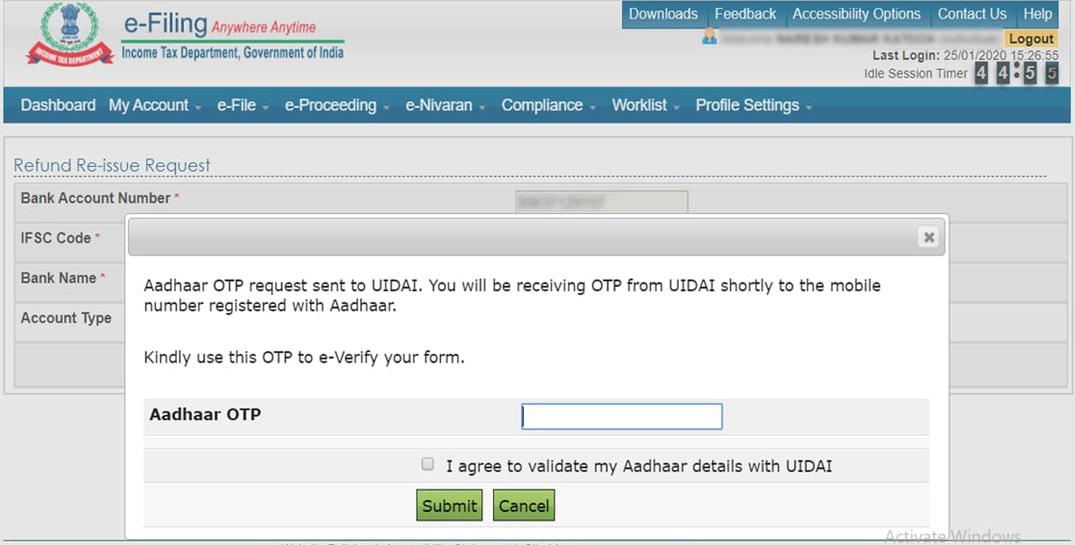

Step 10: You must authenticate the TDS refund re-issue request through EVC code and Aadhaar OTP.

Step 11: Click on 'Submit'.

Any changes related to your bank or address details that you make here will be updated automatically in the centralized TIN database. Subsequently, your TDS refund amount will be re-issued based on your updated records.

How to Check Income Tax or TDS Refund Status?

You can review your TDS refund status ten days after the refund has been sent by the Assessing Officer to your bank – by entering your 'PAN' details and 'Assessment Year' on www.tin-nsdl.com

The TDS Refund Paid status also reflects under the 'Tax Credit Statements' section in your Form 26AS.

Here is how you can check the TDS refund status online for the FY 2019-20 –

With Income Tax Login

Step 1: Go to http://incometaxindiaefiling.gov.in

Step 2: Enter your PAN, e-filing password, and captcha code to login.

Step 3: Click on 'View returns/forms' on the dashboard.

Step 4: Select income tax return in the drop-down menu.

Step 5: Click on the acknowledgement number to check the details of the TDS refund payment mode, amount of TDS refund and the date of credit (if your TDS refund has been processed and released.

Without Income Tax Login

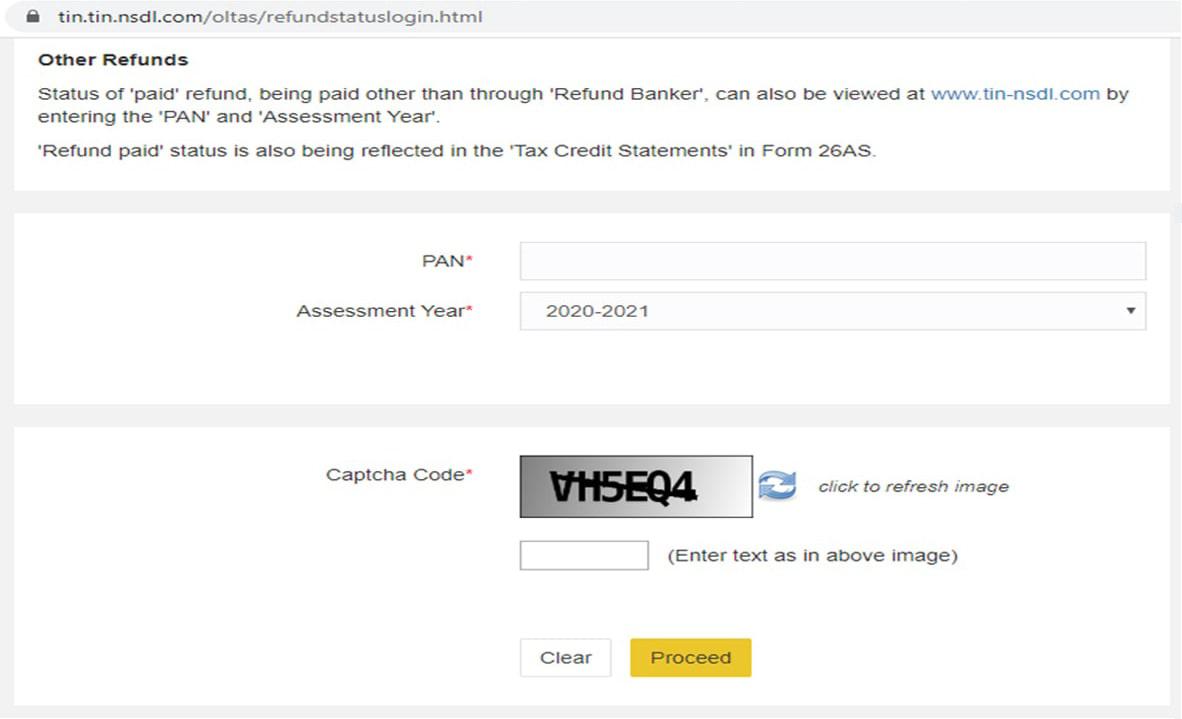

Step 1: Go to TIN NSDL website

Step 2: Enter your PAN number.

Step 3: Choose the assessment year for the TDS refund.

Step 4: Enter the Captcha Code to proceed.

FAQs About TDS Refund Status

Q. I have e-Filed my Income Tax Return but have not received TDS refund yet?

A. If you have not received your TDS refund till date, it might be due to the following reasons –

· Your Income Tax or TDS Return has not been processed – You can check the status of your TDS refund and e-filed IT Return online by logging to the Income Tax e-Filing website and going to 'My Returns/Forms' under 'My Account' section

· Your TDS Return has been processed by the Income Tax department, but they have not determined any refund

· Your TDS Return has been processed, after which a refund has been initiated, but your ECS credit/Cheque could not reach you due to incorrect address or bank account number

Q. My Bank Account Number has changed. Can I change it to the Bank Account Number mentioned in my Income Tax Return?

A. You can change your Bank Account Number only in case there is a TDS refund failure, i.e., your TDS refund is processed, and generated, but you have not received it

To change the Bank Account Number in case of Refund failure, you must login to your Income Tax e-Filing account and go to 'Refund re-issue request' under 'My Account'.

Choose the mode – ECS or paper cheque, enter the new Bank Account Number and address details, before submitting the. TDS refund re-issue request.

Q. How can I change my Address /Email ID/Mobile Number mentioned in my Income Tax Return?

A. You can update your address, email id or mobile number by logging in the Income Tax e-Filing website.

· Go to 'My Profile Settings' and click on 'Update Contact details'

· Enter the new address/email/mobile number and submit

· Once submitted, your details are updated in your profile and also sent to the Central Processing Center (CPC)

Q. Why Have I not Received Any TDS Refund if it is Already Verified?

A. You may not have received your TDS refund due to the following reasons –

a) Your Income Tax Return (ITR) status is still under processing

b) The IT department has issued a notice regarding your filed ITR such as a Defective notice under Section 139(9) or Proposed Adjustments notice under Section 143(1)(a)

c) The IT Department has processed your ITR but has determined there is 'No Refund Due.'

d) The TDS refund has been processed and released but has not reached you due to incorrect bank account and postal address details

e) The IT department has processed and adjusted your ITR with an outstanding demand (if any)

Sources:

https://www.allindiaitr.com/income-tax-refund-status

https://www.tin-nsdl.com/services/status-tax-refunds/refundstatuslogin.html

Disclaimer:

Save 46800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are:

- Regular Individual

- Fall under 30% income tax slab having taxable income less than Rs. 50 lakh

- Opt for Old tax regime

ARN: Aug21/Bg/18NN