Max Life Investment Plan

31.05%

5 yr Midcap Momentum Index

7.5%

Guaranteed Returns

Tax Saving Investments

Investment Plans for NRI

IN UNIT LINKED POLICIES, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER

*Disclaimer | Nifty Mid-cap 150 Momentum 50 Index was launched in Aug' 22. The past returns are back tested based on historical returns and formula (provided by NSE). These are returns of benchmark indices and are not indicative of return on Max Life Insurance' . Midcap Momentum Index fund. 5 year return of NIFTY Midcap 150 Momentum 50 Index as on 28/03/2024. Max Life Midcap Momentum Index Fund (SFIN: ULIF02802/01/24MIDMOMENTM104) is passively managed Index Fund that mirrors NIFTY Midcap 150 Momentum 50 Index.

Many prospective investors think saving and investing money are synonymous with each other, which is why they need an investment calculator and savings calculator. Saving money simply means keeping a certain amount aside for later use. On the other hand, investing money calls for selecting suitable financial instruments to get good investment returns.

The working of investment calculators and savings calculators is based on various factors, one of which is the expected rate of returns. While several investment calculators are available online, you need to pick the right one based on the instrument chosen to know how to calculate return on investment. For instance, use a ULIP calculator if you want to invest money in a ULIP to avail its benefits.

Let’s talk about savings and investment calculators in detail.

What is an Investment Calculator?

An investment calculator is an effective tool that allows individuals to get an idea of the investment returns generated through a specific instrument or plan. Most investment calculators show results based on the chosen invested amount, period of investment, and expected rate of return. This is one reason why they are also called Return on Investment calculators.

Investment calculators are designed to provide potential investors with an estimate of the returns they can expect. However, you should know that the actual returns may differ from those shown by an investment calculator.

For example, an investment calculator gives a rough idea of all the benefits you will receive under the plan you choose, the amount to be invested, payment tenure, and frequency. However, investment returns are not guaranteed by such an online tool.

How Does an Investment Calculator Work?

Before you dive deeper into how an investment calculator works, you must know that different calculators are designed to work differently. You can find investment calculators online on the official websites of insurance companies and many others. The working of an investment calculator may also differ based on the products being sold through it.

It is extremely easy to calculate investment returns with the help of an online investment calculator. You can use the investment calculator by following these simple steps:

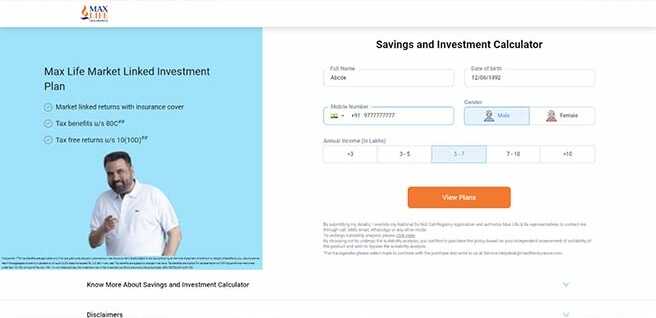

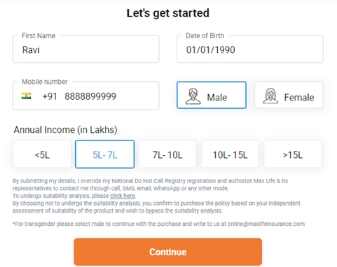

Step 1: Fill in your personal details like full name, date of birth, mobile number, gender, annual income and click on ‘View Plans’

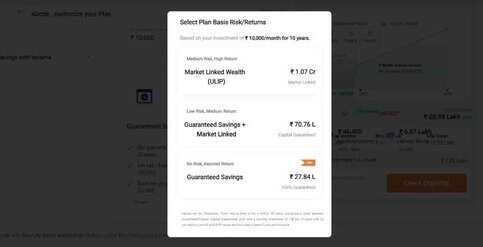

Step 2: Choose the right plan based on your requirements

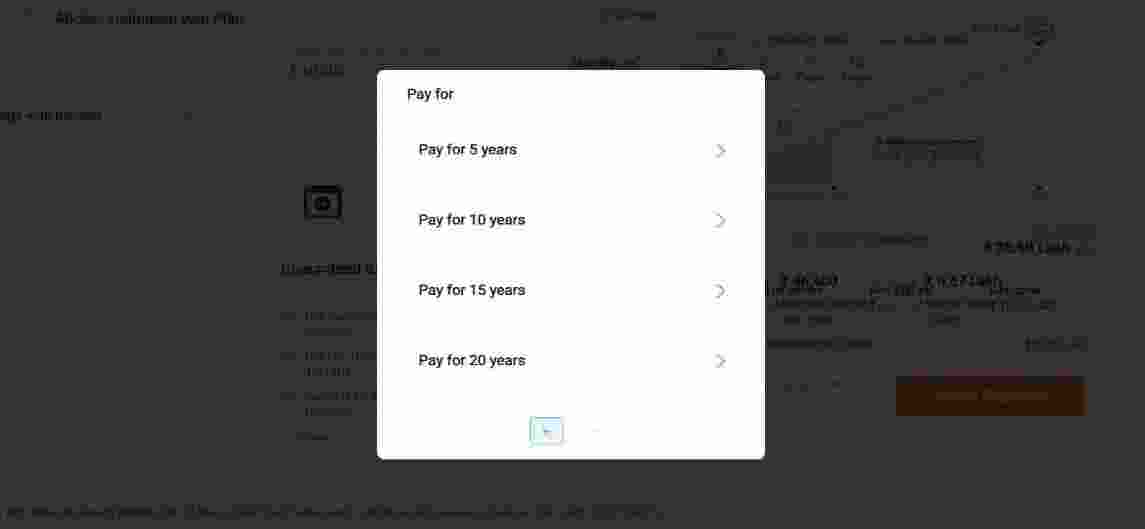

Step 3: The next step is to select the number of years for which you wish to invest

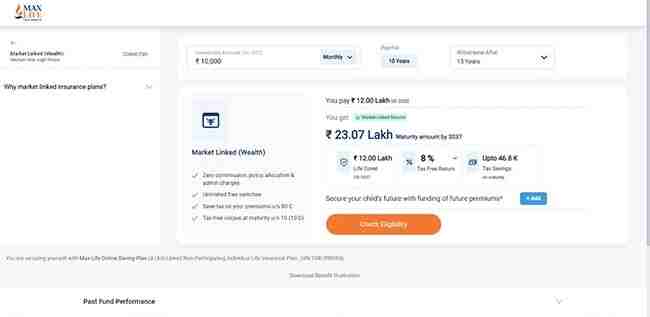

Step 4: Now you will be able to see the maturity amount at both 4% and 8% of investment returns.

The final screen also shows the total investment amount, standard rate of return as per your plan, some of the features of the plan you have selected and the maximum amount of tax you can save.

More About ULIP Calculator

A ULIP calculator is an online tool that allows insurance buyers to calculate the premium payable and the corresponding ULIP returns based on the assumed rate of returns . Based on the premium and policy period, a ULIP calculator gives an estimate of the returns offered by a specific plan. You may also find certain ULIP calculators that help compare different plans simultaneously, thus helping you zero in on the best plan.

With several ULIP plans available in the market, it often becomes challenging for many investors to select the one that suits their needs. A ULIP calculator helps in this regard, enabling them to compute the returns based on the amount they can invest to achieve various financial goals.

Using a ULIP calculator is quite easy once you have the crucial information like the amount to be invested, plan term, and premium payment tenure handy. After you enter all the details in different steps, using a ULIP calculator, you can get an idea of the amount you will accumulate under the plan.

Advantages of Using an Investment Calculator

A return on investment calculator shows an estimate of the returns you can receive on the investment. Knowing this is important as any investment decision impacts your overall financial planning in the big picture.

Investment calculators for different instruments also give you a better idea about their suitability for your financial goals. Particularly for risk-averse investors, an investment calculator holds significant value as it helps them find safe investment options. Also, the results shown by an online investment calculator are more accurate than manual calculations.

Steps to Use an Investment Calculator

The steps of using an investment returns calculator online may differ depending on the calculator you choose.

Typically, there are some common steps to use any investment calculator, including the following:

1.Select an investment plan from the options given in an investment calculator.2.Enter personal information like your name, gender, and date of birth.3.Enter the premium you would want to pay (monthly or annually) for a specific investment plan. For some plans, the investment calculator also shows a minimum limit for the premium you can select.4.Enter the premium payment tenure and policy period in the next step of using the investment calculator.5.Enter the benefit payout frequency, if asked.6.Add suitable riders to the chosen investment plan.7.Submit the details to get an estimate from the return on investment calculator.

Variables Involved in Investment Calculator

The variables involved in the investment calculator include:

Starting amount:

Sometimes referred to as the principal amount, the initial amount of the investment.

Return rate:

It is the rate at which your investment can grow. For purpose of illustration the rate of returns is standard at 4% and 8%Investment duration:

The duration of the investment refers to the time period of the investment.Maturity amount:

It refers to the amount at the maturity of an investment. It depends on the inputs of the other variables.Withdrawal duration:

It refers to the time period after which you wish to withdraw.What Does Investing Do?

Investing helps you grow your money that you have put into a particular investment scheme or option. Investing can help you multiply your wealth. However, it comes with some risks. An investor needs to be mindful and make investment decisions as per their risk appetite.

Types Of Investment Options Online in India

- Mutual Funds -Mutual Funds are investment schemes that are professionally managed by mutual fund manager. Investments from large number of investors are pooled and invested in multiple investment instruments under the specific mutual fund scheme. Mutual Funds in India are governed by SEBI (Securities Exchange Board of India) guidelines.

- SIP -SIP or Systematic Investment Plan allows investors to invest a small amount in regular intervals in a specific mutual fund. SIP comes in handy for investors who want to invest in a periodic fashion instead of lumpsum investments.

- ULIP -ULIP or Unit Linked Insurance Plans are a combination of an investment option and a life insurance. As the name ULIP suggests these are financial products that offer market-linked investment returns and life cover. If you want to take advantage of the benefits of both worlds of growth of wealth and life cover then you should go for ULIPs.Below are some of the funds available with Max Life Online Savings plan – Max Life UL Life Growth Super Fund Max Life High Growth Fund Max Life UL Life Growth Fund Max Life UL Life Balanced Fund Max Life UL Life Secure Fund Max Life Dynamic Opportunities Fund Max Life UL Money Market Fund

- Investment -Investment Plans are financial tools that help create wealth for future. There are a lot of investment plans which will help you to invest your money into different market-lined and money-market products in a periodic fashion to achieve your goals. Investment plans do provide the advantage of maximizing our investments through systematic, long-term investments and create wealth for the future. The first step towards having the investment plan in India is to understand your risk profile and needs, and then choose an investment plan that best suits you.

- Pension Plans -Pension plans are financial instrument that are designed to accumulate wealth throughout their working years so that you can cater to your restatement needs. Pension plans are crucial for creating a robust retirement plan for a stress-free retirement.

- Retirement Plans -Retirement Plans are a type of life/annuity plan that are made to help you pay for things like medical bills and living expenses after you retire. You would want to continue living the same way after retirement. Both benefits plan and retirement plans are a classification of life coverage designs that are extraordinarily intended to meet your post-retirement needs. These plans help cover your expenses and ensure your future so you can enjoy your golden years financially independent.

- Endowment -Uniquely, an endowment policy includes a savings or investment component in addition to providing insurance coverage in the event of the policyholder's death. An endowment policy, in contrast to standard life insurance, is designed to double as an investment vehicle and a protection plan at the same time.

- NRI Investment Plans -No matter where family members live, NRI investment plans are a smart way to protect their finances. NRIs can invest in savings plans, unit-linked insurance plans, child plans, and retirement plans, among others, in India in addition to pure protection policies like term life insurance.

- Fixed Deposit -If you have to deposit a specific amount in advance for the fixed duration, Fixed Deposit or FD can be an investment option. The banks offer a fixed interest rate on your deposit amount depending on the tenure and applicable FD interest rates. In order to help the achievement of financial objectives over a period of time, secured investments provide investors with assured returns.

- Tax Saving Investments -Tax saving investments are investments through which you can save tax in India. There are various sections under the India Tax Act through which you can save tax by investing in various instruments such as life insurance, ELSS (Equity Linked Savings Scheme), PPF (Public Provident Fund), Health Insurance etc.

Here is a list of tax saving investment options available in India–

| Investment options | Tax Benefit u/s |

|---|---|

| Life Insurance | Section 80C and Section 10(10D) |

| NPS Section | 80CCD |

| Health Insurance | Section 80D |

| ELSS (Equity Linked Savings Scheme) | Section 80C |

| PPF | Section 80C |

Types of Online Investments with Max Life Insurance

There are different types of investment options you can invest in.

Max Life Online Savings Plan - Variant 1

Max Life Online Savings plan – Variant 1(A Unit Linked Non Participating Individual Life Insurance Plan, UIN: 104L098V05) provides the dual benefit of lump sum payout for your goal along with protection from life's uncertainties. The ULIP gives the flexibility to choose from a wide range of funds to suit your investment style and choice of the policy term while enabling you to save taxes on your investments. Max Life Online Savings Plan – Variant 1 offers the following features and benefits:

1.Inbuilt Life Cover with Flexibility to Increase the Cover

2.Zero policy admin charge and Zero premium allocation charge

3.Flexibility to switch your money as many times you want

4.Flexibility to choose Policy Term from 5 years to 30 years

5.Flexibility to choose Investment Funds Basis Risk Profile

Max Life Online Savings Plan - Variant 2

Max Life Online Savings Plan – Variant 2 (A Unit Linked Non Participating Individual Life Insurance Plan, UIN: 104L098V05)provides a lump sum payout payable immediately on death, followed by regular payouts in the form of Family Income Benefit and the total Fund Value at the end of the Policy Term. Furthermore, all outstanding premiums after the date of death of the Life Insured will be funded by the Company. Max Life Online Savings Plan – Variant 2 offers comprises the following features:

1.Triple protection on parents demise through a Lump sum, Monthly Income and Auto Policy Continuation

2.Zero policy admin and premium allocation charge

3.Flexibility to switch money unlimited times

4.Flexibility to choose Policy Term - from 5 years to 30 years

5.Flexibility to choose Investment Funds basis Risk Profile

What is a Savings Calculator?

The savings calculator helps determine the rate at which your savings would grow over time. Most of the savings calculator online are related to certain savings and income plans. Based on the details you provide, a savings calculator will give you an estimation about the growth of your savings. It helps individuals in planning for different financial goals in life.

Whether your goal is to achieve guaranteed savings or guaranteed income, you can use a savings calculator online to determine the assured returns under a specific savings plan. Before you start using a savings calculator, make sure you assess your financial needs, and decide on an amount you can save regularly.

How Does a Savings Calculator Work?

When you plan to save a certain amount regularly, you want to know the interest rate or returns you can get. This is what a savings calculator does – it tells you about the expected returns for a specific amount saved under a plan over a certain tenure. Various online savings calculators also provide the details of life cover component associated with the chosen plan, if any.

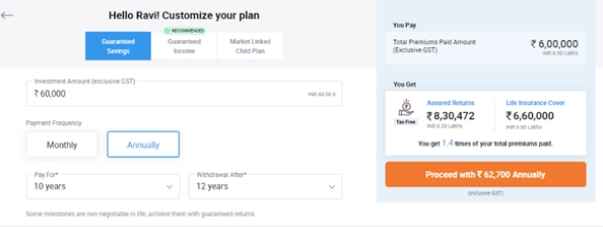

Let us consider how the savings calculator associated with Max Life Savings and Income Plans work –

1.Start using this savings calculator online by providing details, including your name, date of birth, gender, and annual income.

2.Choose from the options of guaranteed savings, guaranteed income, or market-linked child plan given in this savings calculator.

3.Enter the amount you can save monthly or annually under the plan selected.

4.Select the plan tenure and benefit period as given in the savings calculator.

5.You can see the details of assured investment returns and life insurance coverage, as shown below:

Tips for Invest Money Smartly

All the money-matters require careful consideration of diverse related aspects before you make any decision. Even the choice of a savings or investment calculator comes later than many other crucial steps. Here are a few tips for investing or saving money the right way:

1.Check your risk appetite and see if you can take the risk associated with investing money in different market-linked instruments. This is to be done even before you use an investment calculator.

2.Assess your financial goals to understand if saving money can fulfil them all. If not, then look for a suitable investment plan and estimate the benefits using an investment calculator.

3.Consider the benefits of various savings or investment plans before you zero in on any of them. Then calculate the premium payable using an investment calculator.

4.Select an extended investment period. You can easily check the impact of the investment period on returns using an investment returns calculator online.

FAQs

1.Why should I use an investment calculator?

An investment calculator helps in making an informed decision to invest money in the right instruments. It also tells you about the impact of invested amount and investment period over the expected returns.

2.When should I start investing money?

There is no specific age to begin investing money. You can start your investment journey based on your current financial profile and life goals. Begin with using an investment calculator to know how to calculate return on investments.

3.Should I invest or save money for the future?

Investing money comes with greater risk but higher returns. However, you can save money in a low or zero-risk savings plan to get assured investment returns. If you are risk-averse, use a savings calculator online to find a suitable plan based on your needs.

4.What will happen if I invest money without using any investment calculator?

The risk of capital loss may increase if you do not make informed investment decisions. You can lower this risk by gaining knowledge about the risk-to-return ratio of different investment plans using investment calculators.

5.Are online ULIP calculators paid or free?

Most of the online investment calculators, including ULIP calculators, are available for use at no cost. It means you can easily use these investment calculators without worrying about paying money to access them.

6.What is a ULIP Calculator?

A ULIP calculator is an easy-to-use calculation tool designed to help you determine the maturity amount from a ULIP.

7.What is a Savings Calculator?

The savings calculator is a type of tool is designed to help you determine the maturity amount from a Savings plan.

8.What Does investing do?

Investing can grow your money, helping you meet your savings and investment goals. In addition to that, investing can also help you outpace inflation to reduce your financial burden in the future.

9.Are returns guaranteed under ULIPs?

No, returns in ULIP are not guaranteed, given that a proportion of the deposit is used to invest in market assets.

10.What is ULIP NAV?

NAV stands for Net Asset Value. NAV in ULIP indicates the market value of stocks held by the investor in the ULIP plan.

11.What are the advantages of using a Returns on Investment Calculator?

A return on investment calculator can help you calculate your returns easily. It’s easy to use, saves time, and gives you accurate results without any errors. You can plan your financial future better using a return on investment calculator.

12.Is it possible to withdraw ULIP?

ULIP comes with a lock-in period of 5 years. Withdrawals are not permitted before this duration.

13.How do we calculate return on investment?

Return on investment can be calculated using a return on investment calculator. You just have to fill in basic details such as investment amount, return rate, and investment tenure to calculate your returns.

14.How is my money invested in ULIP plans?

Individuals who are investing in ULIP plans are required to make regular investments into the scheme. A portion of this investment is used to buy investment assets that can offer returns according to their NAV. These investment assets include equity, debentures, and government securities.

15.How are the returns calculated in ULIP?

As ULIP provides market returns; hence returns in ULIP are not guaranteed. However, you can calculate your returns based on standard rate of performance at 4% and 8% of the fund with the help of a ULIP calculator.

Arn - PCP/SIC/230822

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS

IRDAI Clarifies to public that:

· IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premium.

· Public receiving such phone calls are requested to lodge a police complaint.

IRDAI - Registration No. 104. ARN/Web/01/080719 Category: Life. Validity: Valid. Corporate Identity Number (CIN):U74899PB2000PLC04-5626. Trade logo displayed belongs to Max Financial Services Ltd. and Axis Bank Ltd. respectively and with their consents and are used by Max Life Insurance Co. Ltd under a license.

Copyright @2016 Max Life insurance Co. Ltd.

All Rights Reserved. An ISO 9001:2008 Certified Company.

Max Life Insurance Co. Ltd. is a Joint Venture between Max Financial Services Ltd. and Axis Bank Ltd. Registered Office: 419, Bhai Mohan Singh Nagar, Railmajra, Tehsil Balachaur, District Nawanshahr, Punjab -144 533.

Corporate Office :Max Life Insurance Co. Ltd. 11th Floor, DLF Square Building, Jacaranda Marg, DLF City Phase II, Gurugram (Haryana) - 122002.

Operation Center :Max Life Insurance Co. Ltd, Plot No. 90C, Udyog Vihar, Sector 18, Gurugram (Haryana) - 122015.

Helpline: 1860 120 5577 (9:00 A.M to 6:00 P.M Monday to Saturday) *Call charges apply.

Online Helpline - 0124 648 8900 (09:00 AM to 09:00 PM Monday to Saturday).

Fax Number:0124-4159397.

Email ids: service.helpdesk@maxlifeinsurance.com;

Life Insurance Coverage is available in this Product

THE LINKED INSURANCE PRODUCTS DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICYHOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF FIFTH YEAR.

Unit Linked Insurance Products (ULIPs) are different from the traditional insurance products and are subject to the risk factors. The premium paid in the Unit Linked Life Insurance Policies is subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. Max Life Insurance is only the name of the insurance company and Max Life Online Savings Plan (UIN: 104L098V05) is only the name of the unit linked life insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges from your Insurance agent or the Intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these funds, their future prospects or returns.

*#Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show different rates of assumed future investment returns. The assumed rates of return (4% p.a., 8% p.a. and 23.7% p.a.) are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including actual future investment performance.

Only for POS policies issued under Smart Fixed-return Digital plan, there is a waiting period of 90 days from the Date of Commencement of Risk (Waiting Period) during which period, on death of the life insured, no benefit is payable apart from refund of 100% of the premium paid since the date of commencement of policy excluding Goods and service tax, any other cess. Please note that if the customer dies due to accident then waiting period is not applicable and full lump sum Death Benefit' is payable. The waiting period is not applicable on the revival of a policy.

Standard Premium For 24-Year Old Male, Non-Smoker, 25 Years Policy Term, 25 Year Premium Payment Term (exclusive of GST).

‘Standard premium for 35-year old male, Non-smoker, 15 years policy term, 10 year premium payment term (exclusive of GST)'

7.2% return for for a monthly premium of 30k for a 12 year old male, non-smoker.

A Non-Linked Non-Participating Individual Pure Risk Premium Life Insurance Plan ^On payment of additional premium

Max Life Smart Wealth Plan is a Non-Linked Non-Participating Individual Life Insurance Savings Plan (UIN 104N116V12)

Max Life Smart Wealth Advantage Guarantee Plan is a Non-Linked Non-Participating Individual Life Insurance Savings Plan (UIN 104N124V07)

*Applicable for Titanium variant of Max Life Smart Fixed-return Digital plan (UIN: 104N123V04) (Premium payment of 5 years and Policy term of 10 years) and a healthy male of 18 years paying Rs. 20,000/- per month (exclusive of all applicable taxes) with 7.50% return. Life Insurance is available with this product|1Save 46,800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are a Regular Individual, Fall under 30% income tax slab having taxable income less than Rs. 50 lakh and Opt for Old tax regime| 2Tax benefits are eligible for tax exemption on fulfilling conditions mentioned under Section 10(10D) of income tax act 1961. Tax exemptions are as per our understanding of law and as per prevailing provisions of income tax at 1961 . Policy holders are advised to consult tax expert for better clarification /interpretation. Please note that all the tax benefits are subject to tax laws at the time of payment of premium or receipt of policy benefits by you. Tax benefits are subject to changes in tax laws.

*^Total premiums paid inclusive of any extra premium but exclusive of all applicable taxes, cesses or levies and modal extra. Return of premium option is available on payment of additional premium.

~The percentage saving computed is purely in terms of premium paid over the term (Difference between Limited and Regular pay) of the policy and does not account for time & other factors that may happen during this period. It is one of the many variants that the product offers and you can opt for it based on your individual needs. The percentage savings is for Online Term Plan Plus- Life Option for 1 Crore life cover for a 28-year-old healthy male for a policy term of 40 years with regular income pay-out option. The total premium will be 3,20,640 (in case of regular pay) and 1,79,520 (in case of 10 pay) excluding taxes.

^^*^^Free look period conditions:

The policyholder has a free look period of 15 days from the date of receipt of the policy document and period of 30 days in case of electronic policies and policies obtained through distance mode, to renew the terms and conditions of the policy, where if the policyholder disagrees to any of those terms and conditions, he/she has the option to return the policy stating the reasons for his objections. The policyholder shall be entitled to a refund of the premiums paid, subject only to deduction of a proportionate risk premium for the period of cover and the expenses occurred by the company on medical examination of the lives insured and stamp duty charges. In case of a unit linked insurance product, in addition to the deductions under sub-regulation above, the insurer shall also be entitled to repurchase the units at the price of the units on the date of cancellation. A request received by insurer for free look cancellation of the policy shall be processed and premium refunded within 15 days of receipt of the request, as stated at sub clause above.

^ As per Annual Audited Financials, FY' 20-21

^*Claims for policies completed 3 continuous years. All mandatory documents should be submitted before 3:00 pm on a working day.

Claim amount on all eligible policies 4 is less than Rs. 1 Crore. The claim does not warrant any field verification.

^^ – “Total premiums paid” means the total of all Premiums received, excluding Underwriting Extra Premium, loading of modal premium, Rider Premiums, and applicable taxes, cesses, or levies, if any.

#– Terminal Benefit is the money back which is paid at the end of income pay-out period and amount is equal to “Total premiums paid”1

##

Sum of all guaranteed income payouts, payable at the end of the period (monthly or annual income frequency as chosen), post completion of the Policy Term, for the pay-out period as per the variant selected by you.

Terminal Benefit (only for long term income variant) is the money-back which is paid at the end of the income pay-out period and the amount is equal to “Total premiums paid”1

Mandatory Documents :

· Original policy document

· Original/attested copy of death certificate issued by the local municipal authority

· Death claim application form (Form A)

· NEFT mandate form attested by bank authorities along with a canceled cheque or bank account passbook along with nominee's photo identity proof • Discharge/Death summary attested by hospi

*^^ To take care of your family's lifestyle, a recurring income benefit, equal to 1% of the Sum Assured, will be paid each month till the end of the policy term.

#The guaranteed benefits are applicable only if all due premiums are paid. | ##All tax benefits are applicable only if all due premiums are paid. customer survives the policy term & are subject to tax laws prevailing at the time of payment of premium or receipt of benefits by you. Tax benefits are subject to change in tax laws. Tax benefits are eligible For tax exemption on fulfilling conditions mentioned under Sec 10(10D) of Income Tax Act, 1961 | ^Applicable for the Titanium variant of Max Life Smart Fixed-Return Digital (Premium payment term of 5 years| Policy Term of 10 years) and a healthy female of 18 years old paying Rs.3,60,000/- annually (exclusive of all applicable taxes). The Net Rate of Return has been calculated based on the total maturity benefit, assuming that all premiums have been paid as and when due (excluding applicable taxes, cesses and levies and rider premiums, if any). | ARN: 151222/LP/Savings/SFRD/V3

^ subject to fulfilling underwriting criteria and document validation.

*+The policyholder can surrender the policy anytime during the policy term, after it has acquired a surrender value.

ARN : ARN/200424/Savings/CG-SWP-SWAG/RC

Mandatory Documents :

· Original policy document

· Original/attested copy of death certificate issued by the local municipal authority

· Death claim application form (Form A)

· NEFT mandate form attested by bank authorities along with a canceled cheque or bank account passbook along with the nominee's photo identity proof

· Discharge/Death summary attested by hospital authorities or FIR & Post Mortem Report/viscera report (in case of accidental death).

THE LINKED INSURANCE PRODUCTS DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICYHOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF FIFTH YEAR.

Insurance is the subject matter of solicitation. For more details on the risk factors, Terms and Conditions, please read the sales and rider prospectus carefully before concluding a sale. Tax benefits are eligible for tax exemption on fulfilling conditions mentioned under Section 10(10D) of the income tax act 1961. Tax exemptions are as per our understanding of law and as per prevailing provisions of income tax at 1961 . Policyholders are advised to consult tax expert for better clarification /interpretation. Please note that all the tax benefits are subject to tax laws at the time of payment of premium or receipt of policy benefits by you. Tax benefits are subject to changes in tax laws. The monthly Income Benefit and Terminal Benefit may be taxable subject to extra premium being loaded at underwriting stage.

~ 5 year return (CAGR – compounded annualized growth rate) from high growth fund as 09/03/2022 (Source: Morningstar.in) Max Life Online Savings Plan, A Unit Linked Non Participating Individual Life Insurance. 100% of the investment money will be allocated in High Growth Fund| Life insurance is available in this product

#Please note that the above assumed market-linked rates of returns, 4% and 8%, are only scenarios at these rates after recovering all applicable charges. These are not guaranteed and they are not the upper or lower limits of returns of the Funds selected in your policy, as the performance of the Funds is dependent on number of factors including future investment performance.

1Risk commencement is subject to validation of documents and total life insurance benefit not exceeding Rs. 25 lakhs for all POS policies with Max Life.

^Capital Guarantee Solution 1 is a life insurance solution that provides life cover and helps you earn market linked returns through Max Life Online Saving Plan and the promise of guarantee returns with Max Life Smart Wealth Advantage Guarantee Plan.

^#All tax benefits are applicable only if all due premiums are paid. customer survives the policy term & are subject to tax laws prevailing at the time of payment of premium or receipt of benefits by you. Returns are tax free if the aggregate of premium payable on all such ULIPs does not exceed Rs. 2.5 lakh in any year. Tax benefits are subject to change in tax laws. Tax benefits are eligible For tax exemption on fulfilling conditions mentioned under Sec 10(10D) of Income Tax Act, 1961

^1The Net Rate of Return has been calculated based on the total maturity benefit, assuming that all premiums have been paid as and when due (excluding applicable taxes, cesses and levies and rider premiums, if any).

*1The market linked benefits are applicable only if all due premiums are paid.

~1Capital Guarantee Solution 1 is a life insurance solution that provides life cover & helps you earn market linked returns through Max Life Online Savings Plan & the promise of guaranteed returns with Max Life Smart Wealth Advantage Guarantee Plan.

^2Lumpsum benefit paid immediately on the death of the Life Insured, higher of Sum Assured, or 105% of Total premiums received upto the date of death.

*2Family Income Benefit equal to 1% of the Sum Assured will be paid each month starting from the Policy anniversary date of every month following or coinciding with the date of death of the Life Insured till the end of the Policy Term, subject to a minimum of 36 monthly payments and a maximum of 120 monthly payments. Please note in case of death of Life Insured with less than 36 months left till the end of Policy Term, there will be a Lump Sum payment of remaining instalments (36 less monthly instalments already paid) with the last monthly payout at end of the Policy Term.

^#Tax benefits as per prevailing tax laws subject to change.

~2The guaranteed benefits are applicable only if all due premiums are paid.

*##Applicable for the Titanium variant of Max Life Smart Fixed-Return Digital (Premium payment term of 5 years| Policy Term of 10 years) and a healthy male of 18 years old paying Rs.3,60,000/- annually (exclusive of all applicable taxes) in Max Life Smart Fixed-return Digital Plan (UIN- 104N123V04). The Net Rate of Return has been calculated based on the total maturity benefit, assuming that all premiums have been paid as and when due (excluding applicable taxes, cesses and levies and rider premiums, if any).