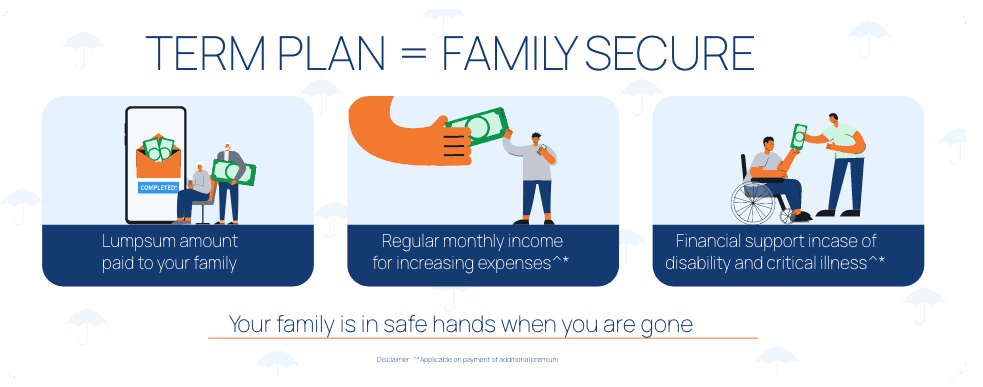

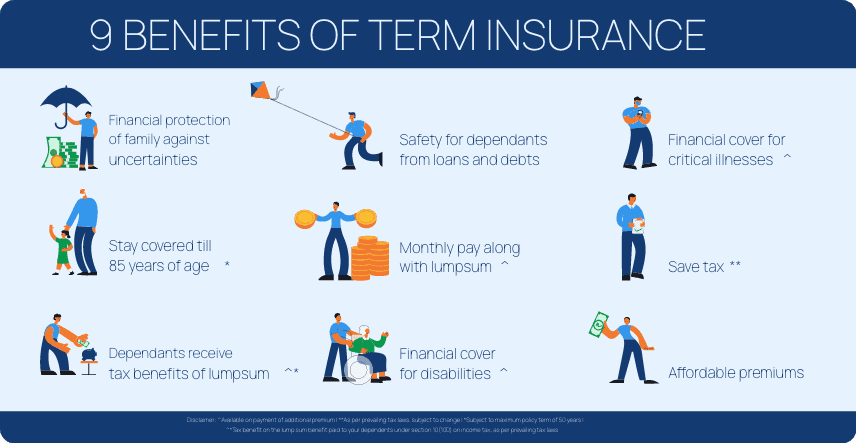

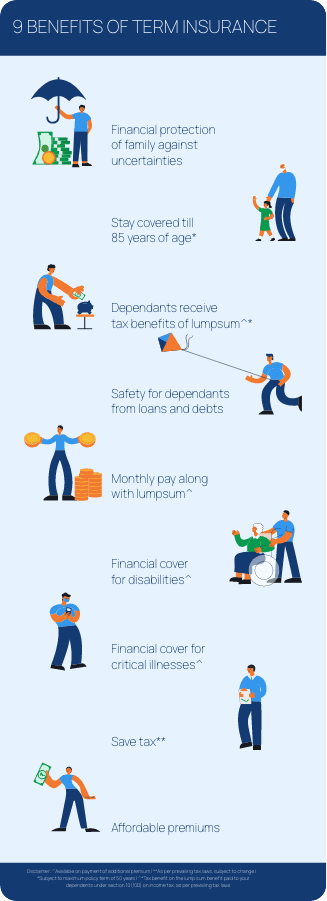

Term life insurance is one of the best ways to secure your family financially in case of your untimely demise. Term insurance coverage provides a fixed amount of sum as a death benefit if you meet with life’s eventuality during the policy period.

It is a good idea to buy a term insurance policy as you only need to pay small annual premiums against a considerable sum. Moreover, the term insurance premium is also subject to tax deductions, which adds the cherry on the cake.

For example- You bought an online term insurance coverage worth Rs. 1 Crore for a 30-yearpolicy term. In the event of your untimely demise (within the policy term), your family will receive the entire 1 crore Sum Assured as a death benefit, subject to terms and conditions.

The term insurance coverage amount, thus, enables the insured’s loved ones to lead a decent life and achieve all their goals even in the absence of the breadwinner.

Moreover,

buying riders like ”Accidental Death Benefit Rider” helps to make the term plan more comprehensive. These additional benefits are available on payment of additional premium.

Therefore, buying the term insurance plan is a good way to offer financial security toyour family, after you are no longer with them.

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Do you have any thoughts you’d like to share?