Max Life Flexi Wealth Plus

In today’s day and age, you work hard to fulfil your responsibilities towards your family. You spare no efforts in making sure that your loved ones work towards accomplishing their goals without any worries.

Choosing Max Life Flexi Wealth Plus (A Unit-Linked Non-Participating Individual Life Insurance Plan | UIN: 104L115V03) enables you to take care of your loved ones while protecting them from the uncertainties of life. Max Life Flexi Wealth Plus helps you create wealth through systematic savings into various equity and debt fund options. With Max Life Flexi Wealth Plus, you can accomplish your goals of wealth accumulation for both long term and a planned time frame.

At the same time, this flexible ULIP plan extends the much-needed life insurance coverage to your family and yourself.

What is Max Life Wealth Plus?

Max Life Flexi Wealth Plus is a ULIP (Unit Linked Insurance Plan), which combines protection and savings benefits into a flexible and straightforward solution. Whether it is accumulating wealth for supporting your child’s higher education or protecting their future financially from life’s uncertainties, this plan will help you fulfil all requirements.

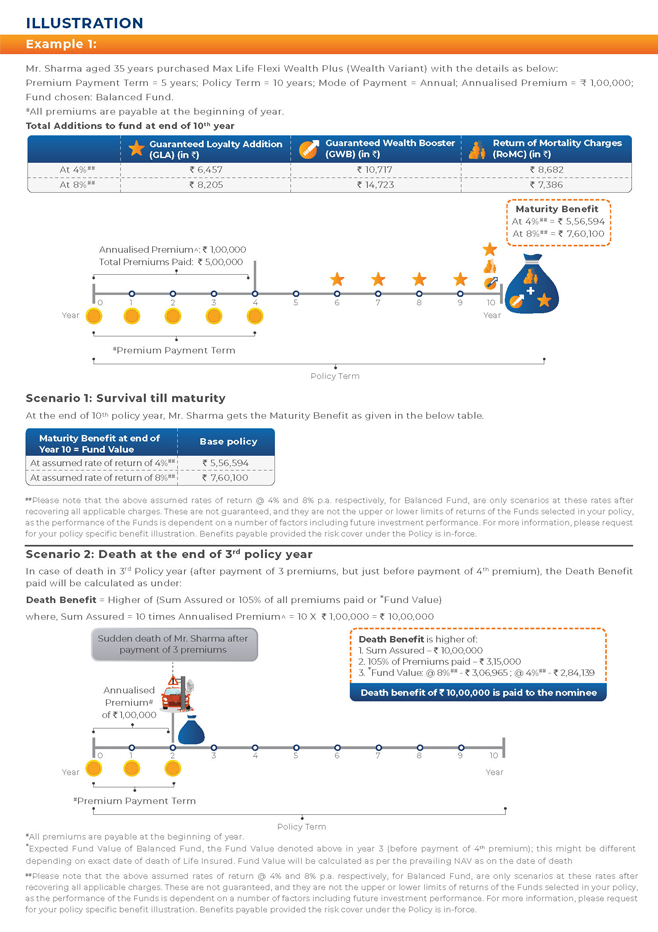

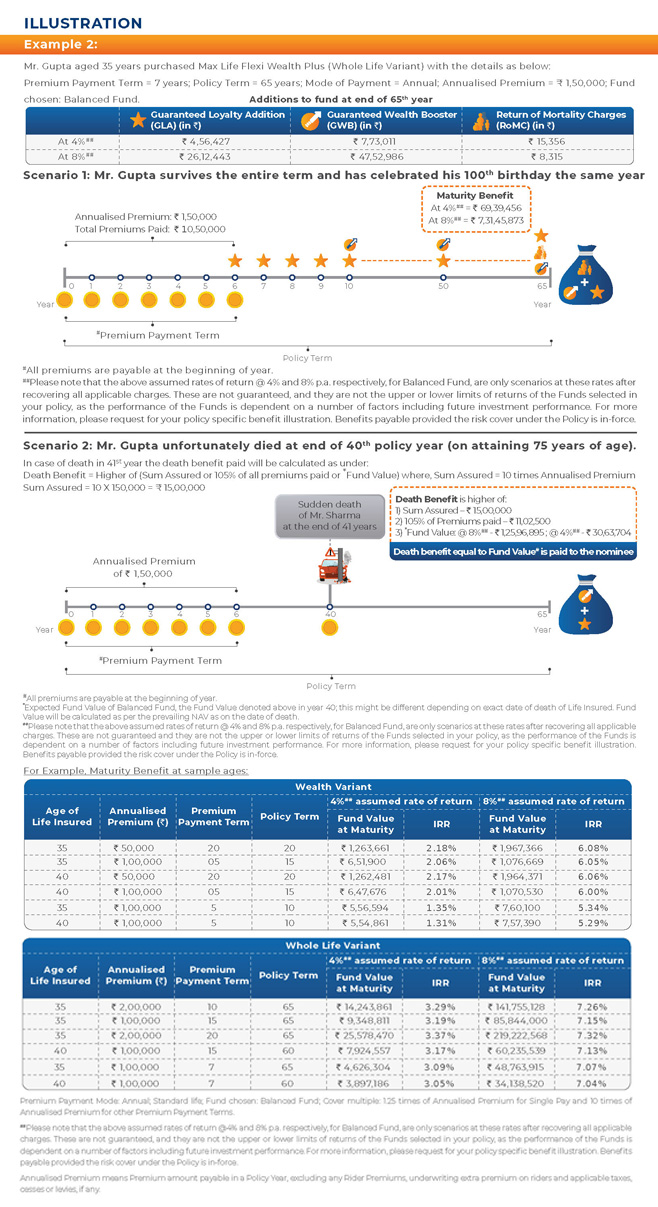

The ULIP allows you to utilize different investment strategies and various market-linked fund options, so that you can avail returns as per your risk appetite. Furthermore, this flexible ULIP plan offers 3 types of additions - Guaranteed Loyalty Additions and Guaranteed Wealth Boosters and Return of Mortality Charges to help maximize your accumulated fund value that you receive upon surviving the policy tenure.

Max Life Flexi Wealth Plus also allows you to make partial withdrawals from your accumulated fund value once the initial lock-in period of five years is over. The ULIP comes with additional tax benefits on the premiums paid and received benefits, as per the applicable tax laws.

6 Reasons to Buy Max Life Flexi Wealth Plus

6 Reasons to Buy Max Life Flexi Wealth Plus

- Guaranteed Loyalty Additions and Guaranteed Wealth Boosters

- Return of Mortality Charges upon surviving the plan tenure

- Option to avail policy benefits till 100 years under Whole life variant

- Inbuilt Life Cover with wealth growth

- Power to Personalize your investments based on your risk appetite

- Full flexibility with unlimited free switching throughout the term