Single Premium Variants

1. Immediate Annuity: Following sub-variants are available under this variant:

a. Single Life without Death Benefit: This variant provides annuity for life till death of the annuitant. Death benefit is not applicable under this variant.

b. Joint Life without Death Benefit: This variant provides annuity for life till death of last survivor. Death benefit is not applicable under this variant.

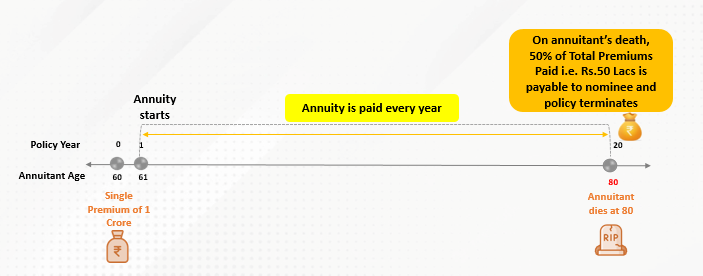

c. Single Life with Death Benefit: This variant provides annuity for life till death of the annuitant with return of proportion of Total Premiums Paid on death. The proportion can vary from 25% to 100% (in multiples of 25%) and has to be chosen at inception only.

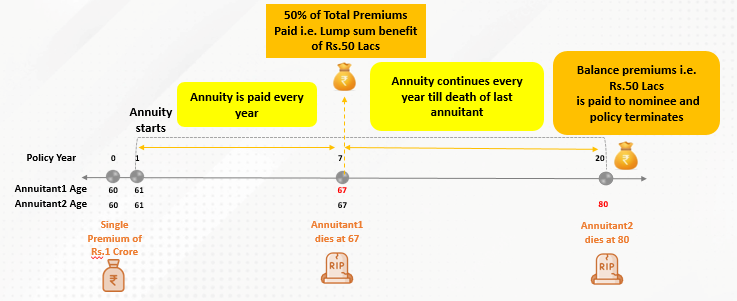

d. Joint Life with Death Benefit: This variant provides annuity for life till death of last survivor with return of proportion of Total Premiums Paid on first death and the remaining Total Premiums Paid shall be payable upon second death. The proportion can vary from 0% to 100% (in multiples of 25%) and has to be chosen at inception only.

It shall be noted that in case of first death during the first five policy years, the annuity shall continue till death of the last survivor, thereafter, 100% of the Total Premiums Paid shall be payable upon second death and policy terminates.

2. Immediate Annuity with chosen proportion of Annuity to Last Survivor: Following sub-variants are available under this variant:

a. Joint Life without Death Benefit: A fixed annuity amount, guaranteed at policy inception, shall be payable in arrears till both the annuitants are alive. On first death of either of the annuitants, annuity payable to the last survivor shall be revised to the chosen annuity multiple times (either 50% or 110%) the annuity payable at inception. No death benefit shall be payable.

b. Joint Life with Death Benefit: A fixed annuity amount, guaranteed at policy inception, shall be payable in arrears till both the annuitants are alive. On first death of either of the annuitants, annuity payable to the last survivor shall be revised to the chosen annuity multiple times (either 50% or 110%) the annuity payable at inception. On death of the last survivor, 100% of the Total Premiums Paid shall be payable and policy will terminate.

3. Immediate Annuity with Early Return of Premium: This variant is available for Single Life with Death Benefit Only. In this variant, the policyholder has a flexibility to take early return of either 50% or 100% of Total Premiums Paid upon survival till the chosen milestone age and 100% of Total Premiums Paid less benefit already paid at the milestone age, if any, shall be payable to the nominee on death of the annuitant. The milestone age can be opted amongst 70/75/80/85 years of Age (last birthday). The proportion of Total Premiums Paid (i.e.50% or 100%) and milestone age has to be chosen at inception of the policy.

4. Immediate Annuity for Guaranteed Period and Life thereafter: This option is available for

Single Life without Death Benefit only. In this variant, policyholder can choose the guaranteed period of 5/10/15/20 years at inception of the policy. The annuity under the policy shall continue till the end of guaranteed period or till the death of the annuitant, whichever is later.

On death of the annuitant after the guaranteed period (as opted at inception), the policy will terminate without any further benefit payout.

5. Increasing Immediate Annuity: Following sub-variants are available under this variant:

a. Single Life Increasing Annuity Each Year with Death Benefit: In this variant, the policyholder can choose the % of increase in annuity from 1% to 6% (in multiples of 1) at inception of the policy.

b. Single Life Increasing Annuity Every 3 Years with Death Benefit: In this variant, the annuity at inception is guaranteed to increase @15% (Simple Increase) in every 3 years. Upon death of the annuitant, 100% of the Total Premiums Paid shall be payable and policy will terminate.

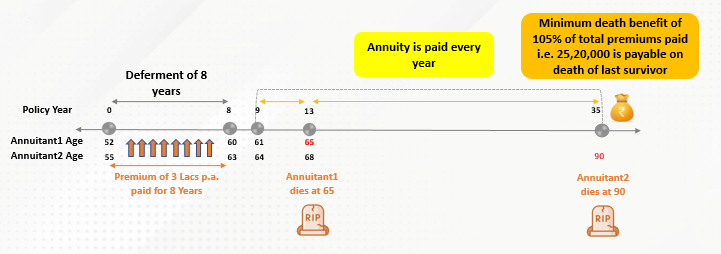

6. Deferred Annuity: In this variant, policyholder has to opt deferment period and premium payment term at the inception of the policy. The annuity payment starts after the end of deferment period based upon the chosen annuity payment frequency. The Deferment period should always be equal or greater than premium payment term. Following sub-variants are available under this variant:

a. Single Life with Death Benefit till Deferment Period - Single Premium: Under this variant, a fixed annuity amount, guaranteed at policy inception, shall be payable in arrears after the expiry of the deferment period till death of the annuitant. On death of the annuitant during deferment period, minimum 105% of the total premium, shall be payable to the nominee(s) as death benefit.

b. Joint Life with Death Benefit till Deferment Period - Single Premium: Under this variant, a fixed annuity amount, guaranteed at policy inception, shall be payable in arrears after the expiry of the deferment period till death of the last annuitant. On death of the last annuitant during deferment period, minimum 105% of the total premium, shall be payable to the nominee(s) as death benefit.

c. Single Life with Death Benefit for Life - Single Premium: Under this variant, a fixed annuity amount, guaranteed at policy inception, shall be payable in arrears after the expiry of the deferment period till death of the annuitant. Annuity payout will cease on the death of the annuitant and minimum 105% of the total premium, shall be payable to the nominee(s) as death benefit.

d. Joint Life with Death Benefit for Life - Single Premium: Under this variant, a fixed annuity amount, guaranteed at policy inception, shall be payable in arrears after the expiry of the deferment period till death of the last annuitant. Annuity payout will cease on the death of the last annuitant and minimum 105% of the total premium, shall be payable to the nominee(s) as death benefit.

Note: For policies sold through Point Of Sales (POS) persons, currently, only “Immediate Annuity – Single Life with Death Benefit and Immediate Annuity – Joint Life with Death Benefit” is available. Only, upon death of the annuitant in case of single life and upon death of Last Survivor in case of joint life, 100% of the Total Premiums Paid shall be payable.

Limited Premium Variants

e. Single Life with Death Benefit till Deferment Period - Limited Premium: Under this variant, a fixed annuity amount, guaranteed at policy inception, shall be payable in arrears after the expiry of the deferment period till death of the annuitant. On death of the annuitant during deferment period, minimum 105% of the total premium, shall be payable to the nominee(s) as death benefit.

Where, Fixed Annuity Amount = Base Annuity + Loyalty Annuity

f. Joint Life with Death Benefit till Deferment Period - Limited Premium: Under this variant, a fixed annuity amount, guaranteed at policy inception, shall be payable in arrears after the expiry of the deferment period till death of the last annuitant. On death of the annuitants during deferment period, minimum 105% of the total premium, shall be payable to the nominee(s) as death benefit.

Where, Fixed Annuity Amount = Base Annuity + Loyalty Annuity

g. Single Life with Death Benefit for Life - Limited Premium: Under this variant, a fixed annuity amount, guaranteed at policy inception, shall be payable in arrears after the expiry of the deferment period till death of the annuitant. Annuity payout will cease on the death of the annuitant and minimum 105% of the total premium, shall be payable to the nominee(s) as death benefit.

Where, Fixed Annuity Amount = Base Annuity + Loyalty Annuity

h. Joint Life with Death Benefit for Life - Limited Premium: Under this variant, a fixed annuity amount, guaranteed at policy inception, shall be payable in arrears after the expiry of the deferment period till death of the last annuitant. Annuity payout will cease on the death of the last annuitant and minimum 105% of the total premium, shall be payable to the nominee(s) as death benefit.

Where, Fixed Annuity Amount = Base Annuity + Loyalty Annuity

Loyalty Annuity is 20% of the Base Annuity and shall accrue on completion of deferment period. Loyalty Annuity shall be payable in arrears along with the Base Annuity payout as per chosen Annuity payment mode.

Annuity Payout Modes: The payout shall happen at the end of the modal period and the following Modal Factors will be applicable:

· Monthly: 0.08,

· Quarterly: 0.24 and

· Semi-Annually: 0.49.

This means, an annuity plan which provides a single annual payout of Rs.1,00,000, will convert into 12 monthly payouts of Rs. 8,000 each (Rs.1,00,000 x Monthly Modal Factor).