Related Articles

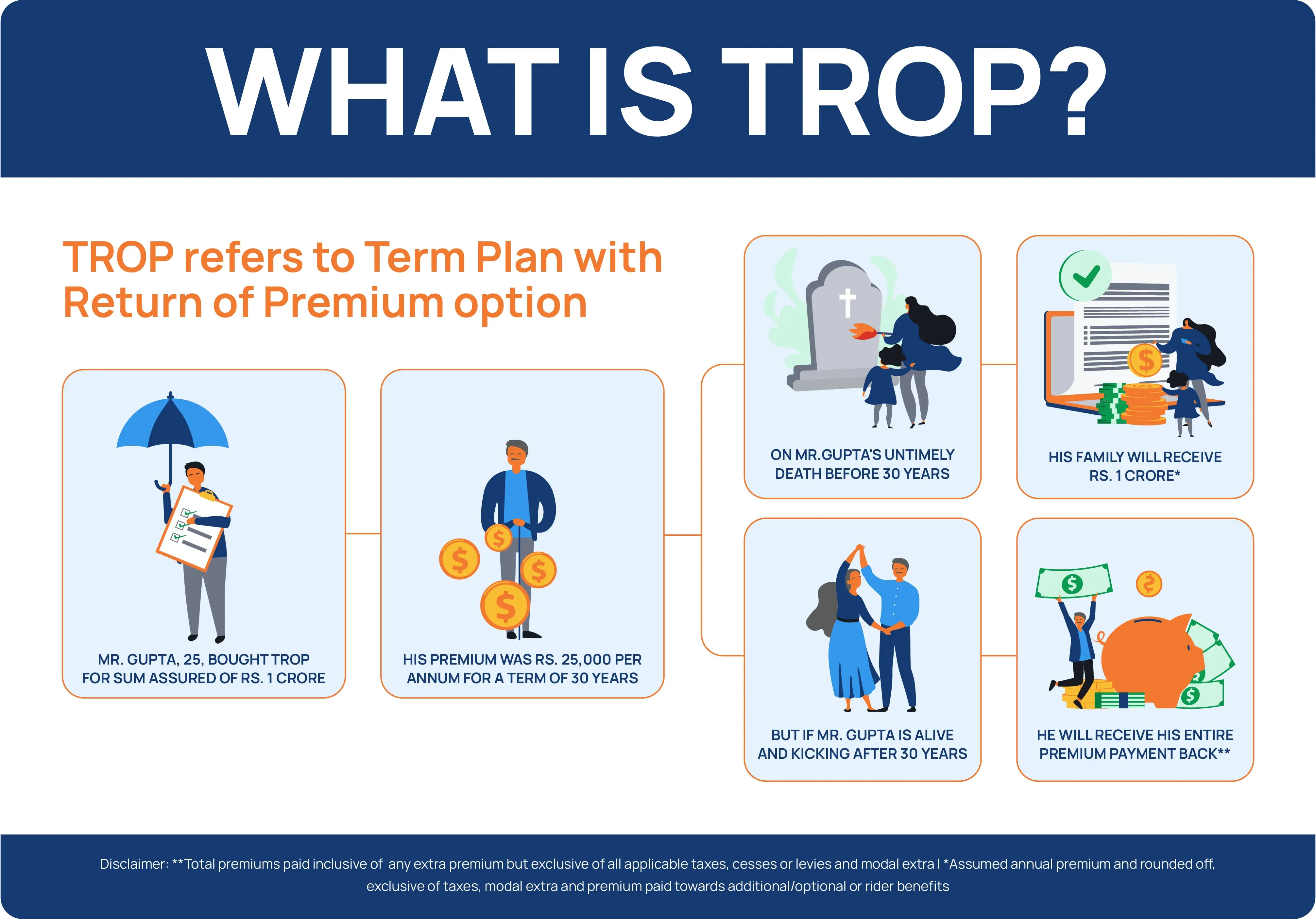

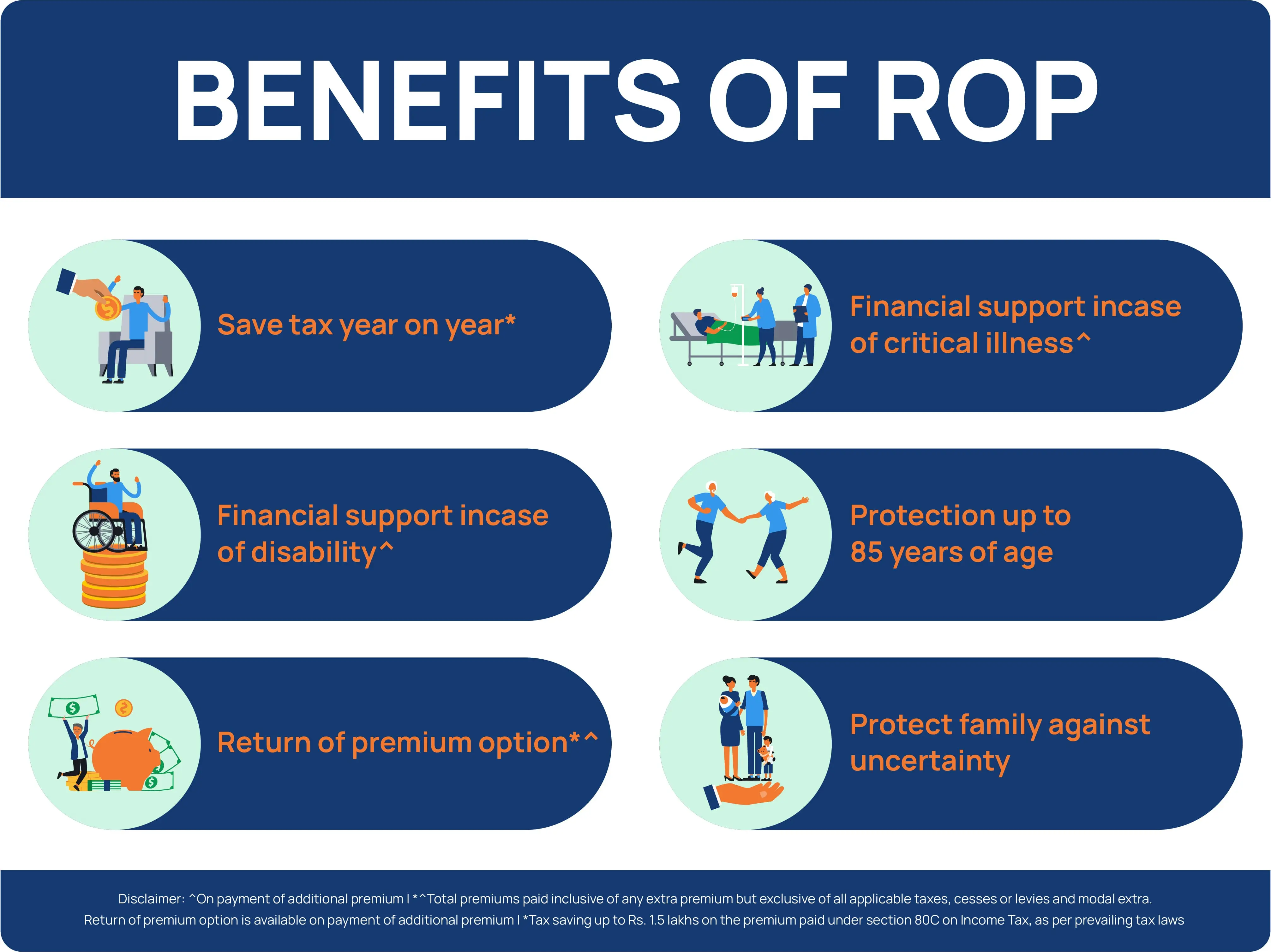

Features & Benefits of Max Life’s TROP

The secret to a long and eventful life is to live in the presence of family and friends. To prolong our happiness, we invest not only in healthier…

Read More

Max Life Smart Secure Plus Plan | Benefits & Features

As a breadwinner of your family, there are several responsibilities on your shoulders to ensure your loved ones live a comfortable life. Hence, it is crucial to make…

Read More

Limited Pay vs Regular Pay: Which One To Choose?

Life insurance plans are in place to help you create a sound financial plan to deal with unforeseen circumstances. The contract between the insured…

Read More

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Do you have any thoughts you’d like to share?