Max Life Smart Fixed-return Digital Plan

Disclaimer

: In Unit Linked Policies, the investment Risk in the investment portfolio is borne by the policyholder. *+Nifty Mid-cap 150 Momentum 50 Index was launched in Aug’22. These are returns of benchmark indices and are not indicative of return on Max Life Insurance’s Midcap Momentum Index fund. 5 year return of NIFTY Midcap 150 Momentum 50 Index as on 31/12/2023. Max Life Midcap Momentum Index Fund (SFIN: ULIF02802/01/24MIDMOMENTM104) is passively managed Index Fund that mirrors NIFTY Midcap 150 Momentum 50 Index.

Disclaimer: Applicable for Titanium variant of Max Life Smart Fixed-return Digital plan (Premium payment of 5 years and Policy term of 10 years) and a healthy male of 18 years paying Rs. 30,000/- per month (exclusive of all applicable taxes) with 7.50% return. Life Insurance is available with this product

Written by

:Reviewed by

Features and Benefits of Max Life Smart Fixed-return Digital Plan

Max Life Smart Fixed-return Digital Plan is an all-rounder plan having an array of features and benefits to offer to the customers:

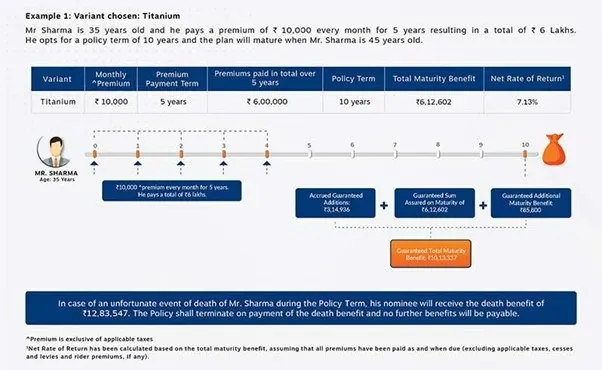

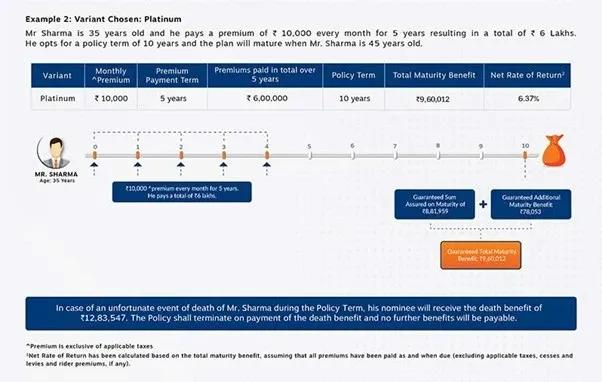

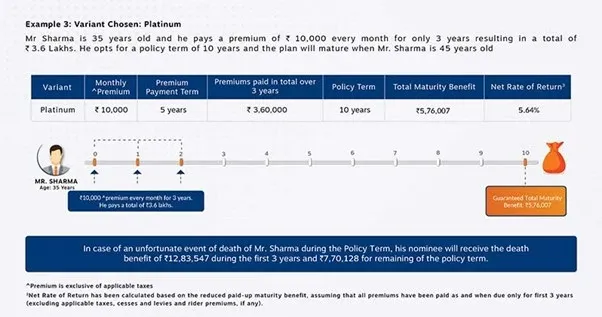

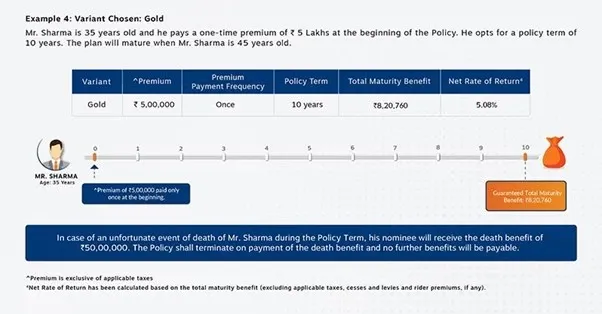

1. Maturity Benefit:

A guaranteed*# corpus is given as maturity benefit once the policyholder survives the policy tenure (policy term). The maturity benefit is the sum total of the following components.

- Sum Assured on Maturity

- Accrued Guaranteed Additions applicable only for Titanium variant

- Additional Maturity Benefit on account of paying higher premiums

- Additional Maturity Benefit available specially for female customers

For all variants, Maturity Benefit includes the additional benefit payable on account of paying higher premiums. For Titanium variant, Maturity Benefit also includes the guaranteed additions which get accrued on payment of all due premiums.

2. Tax Benefits:

Max Life Smart Fixed-return Digital Plan offers tax benefits to its policyholders. The tax benefits are applicable on premium payments, as well as maturity benefits. Policyholders can get a tax deduction of up to INR 1,50,000 under Section 80C of the Income Tax Act. In addition to that, the maturity benefit is also tax-free, as per the provisions of Section 10(10D)for all variants except for Gold wherein a life insurance coverage of 1.25 times the single premium is opted on a single life basis.

3. Facility to Take Loans:

Getting a loan can get easier with Max Life Smart Fixed-return Digital Plan. In case of any emergency, you can secure a loan against the policy.

Why Should you Choose Max Life Smart Fixed-return Digital Plan?

With Max Life Smart Fixed-return Digital Plan, you don’t need to worry about how the market is functioning as this plan offers you guaranteed returns at the time of maturity.

1. Offers Guaranteed*# Returns:

2. Life cover:

As the plan acts as a life insurance product, you also have the option to choose suitable riders to get the maximum benefits possible. The death benefit payable to the nominee would be at least 11 times of the annualized premium for Platinum and Titanium variants. For Gold variant, you can choose to get covered for 1.25 times or 10 times of the single premium when single life is covered.

3. Builds Savings:

Special Benefits for Women with Max Life Smart Fixed-return Digital Plan

In order to encourage women to buy insurance cum savings products, Max Life has introduced special benefits for women. This includes offering additional maturity benefits to females as compared to male customers of the same age.

- 0.25% of additional maturity benefit for a policy term of 5 years and

- 0.5% of additional maturity benefit for a policy term of 10 years

How to Buy Max Life Smart Fixed-return Digital Plan?

Buying Max Life Smart Fixed-return Digital Plan is not at all a hassle. The purchase journey is short, quick hassle-free. Here’s how you can buy Max Life Smart Fixed-return Digital Plan:

There are three variants of the plan available:

The variant also offers a life-insurance feature wherein the life insurance benefit of 1.25 times or 10 times of the Single Premium as chosen by you. The customer also has the option of opting for a joint cover.

A life insurance benefit is also an exciting feature of the variant wherein the life insurance benefit is equal to 11 times the annualized premium.

An attractive feature of this variant of the plan is that apart from the lump-sum benefit guaranteed, policyholders also get guaranteed additions which accrue once you have paid all the premiums due to be paid by you.

Who can Buy this Max Life Smart Fixed-return Digital Plan?

Max Life Smart Fixed-return Digital Plan is ideal for anyone who is looking to build a savings corpus as well as desires financial protection through life insurance. The plan gives the best of both worlds, a maturity benefit if you survive the term, and a death benefit that can act as a financial net for your family in case the worse happens. On top of it, the Max Life Smart Fixed-return Digital Plan offers you the sum more than you invested.

In addition to that, Max Life Smart Fixed-return Digital Plan is also ideal for risk-conservative investors. Investment in this plan is completely safe and unaffected by market fluctuations. It means, that even if the market is crashing down, you will get the return you were promised.

Lastly, the plan is also ideal for women as they can get special benefits specially curated for them. Women policyholders can get additional maturity benefits than men of the same age. These additional benefits include a 0.25% of additional maturity benefit for a policy term of 5 years and a 0.5% of additional maturity benefit for a policy term of 10 years.

Married couples who are looking to start a family or have a family can also get the gold variant of the Max Life Smart Fixed-return Digital Plan. The gold variant of the plan offers joint life insurance.

Conclusion

Max Life Smart Fixed-return Digital Plan is your go-to way of meeting your savings goal and providing a safety net for your family. It offers you the dual benefits of maturity benefit and life insurance benefit. So, if you are someone who is excited by these benefits, Max Life Smart Fixed-return Digital Plan is ideal for you.

Downloads

Frequently Asked Questions

ARN: PCP/SFRD/010524

*#Guaranteed benefits are applicable if all due premiums are paid.

1Risk commencement is subject to validation of documents and total life insurance benefit not exceeding Rs. 25 lakhs for all POS policies with Max Life.

Why Choose Max Life

Get Tax-Free##

Fixed Returns

up to 7.5%*

Popular Searches

- 0124 648 8900(09:00 AM to 09:00 PM Monday to Saturday)

- service.helpdesk@maxlifeinsurance.comEmail

- SMS ‘LIFE’ to 5616188Message

- Let us call you back

- 1860 120 5577(9:00 AM to 6:00 PM Monday to Saturday)

- Chat with us

- Write to usPlease write to us incase of any escalation/feedback/queries.

- 011-71025900, 011-61329950(9:00 AM to 6:00 PM Monday to Saturday)

- nri.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.