Related Articles

Term Insurance Comparison

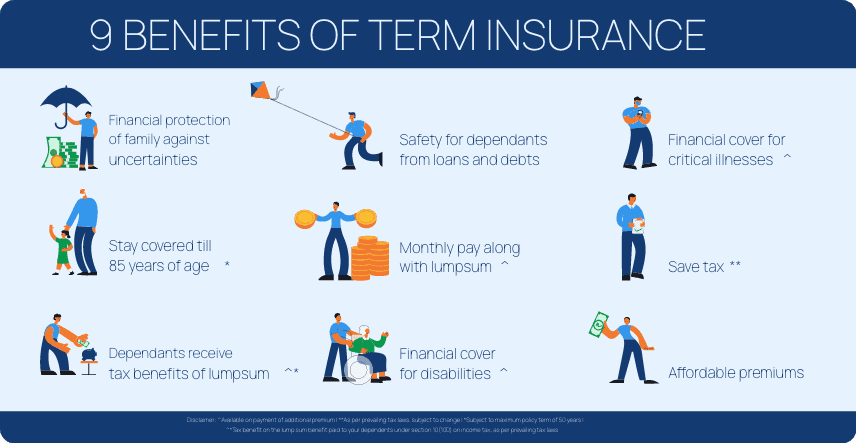

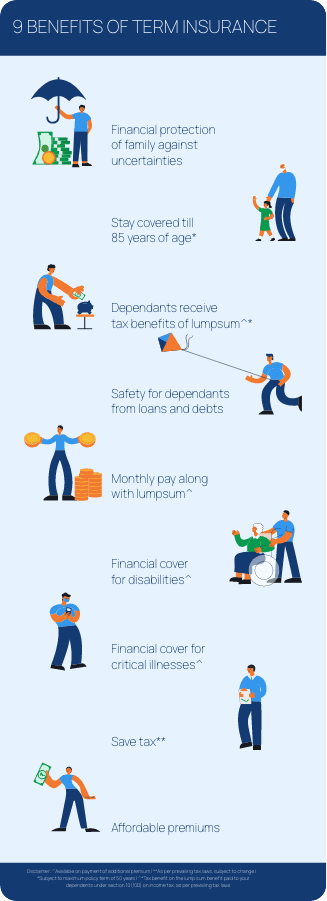

Term insurance provides your loved ones with the required financial security…

Read More

Is term insurance an investment or an expense ?

Term insurance covers natural, accidental death, or death due to some illness…

Read More

Difference between Term Insurance Plan and Whole Life Plan

If you are no longer around… how will your family cope with the bills?

Read More

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Do you have any thoughts you’d like to share?