Written by

Updated :

Reviewed by

How to Choose the Right Sum Assured Under a Term Plan?

In the race to achieve everything in life, we often make our health and wellness suffer. This is one reason why an uncertainty like COVID-19 disease has made people more anxious about their jobs, financial security, and medical expenses during emergencies.

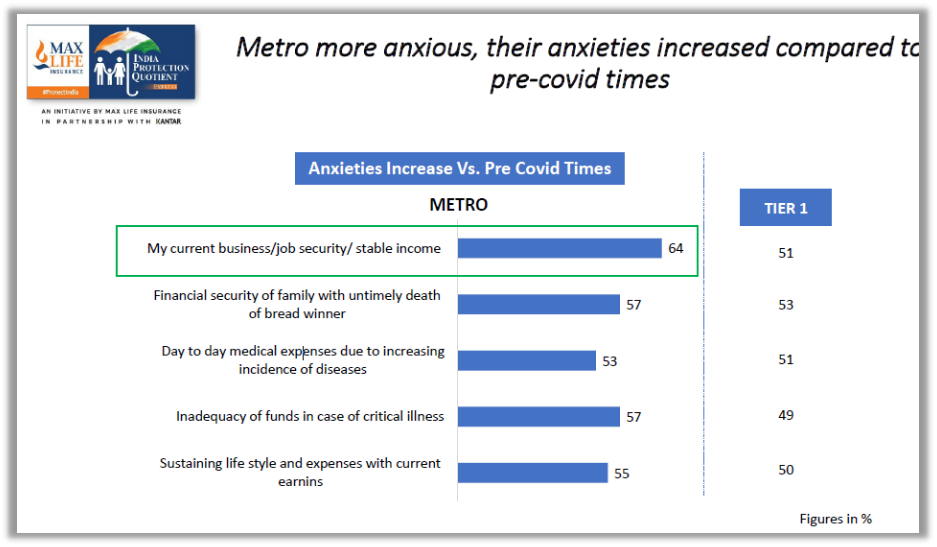

The following data shows that people in metro cities are more anxious about their jobs, business, and income, compared to the pre-COVID times:

Along with rising health concerns, the cost of availing quality medical treatments is also on a high, making people worried about inadequacy of funds (as shown above). It calls for planning for our secure financial future, considering the shift in lifestyles and the related health conditions.

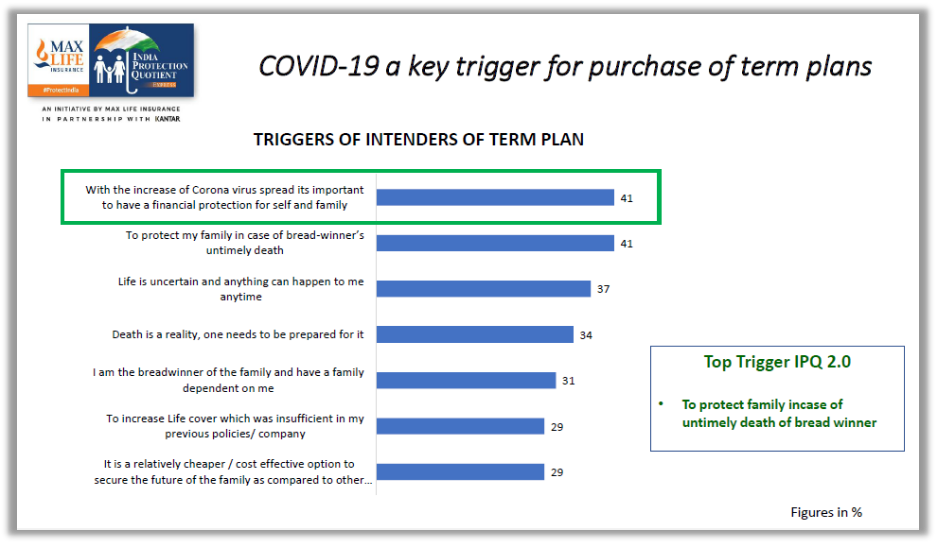

A term plan purchase is an easy way to build a financial safety net around your loved ones. The need for comprehensive term plans is stressed upon even more in the current COVID times in which more people are realizing the importance of a guaranteed returns and life cover to deal with uncertainties.

Besides choosing the right term insurance plan, having adequate coverage is a must. Without the right sum assured in life insurance, the whole concept of it is negated. If you already have a term plan, you might have chosen an inadequate life cover because of its low premium, not knowing about parameters to consider at that time.

In general, selection of adequate sum assured must be based on several crucial factors, including medical history, number of dependents, and sum assured premium, to name a few.

To avail maximum coverage and benefits while you are alive as well as after you, you can also add suitable riders in return of extra sum assured premium.

Let us know more about how to choose the right sum assured while buying a term plan.

1. Steps to Be Followed to Choose Right Sum Assured

2. What Else Should You Consider While Buying a Term Plan?

3. Conclusion

Steps to Be Followed to Choose Right Sum Assured

Analyze Future Working Years

While buying a term plan, you should realize that you are not buying it only to complete a checklist of financial protection. Inadequate life cover bought on a very low premium may not be sufficient for you and your loved ones. Since you will pay a sum assured premium from your income, it is crucial to assess your work life.

Consider the number of years you expect yourself to earn an income. Since a term life insurance policy also acts as an income replacement tool, you need to ask yourself when you wish to retire. It will help you determine an adequate cover and sum assured premium.

For instance, if your 30 right now and you expect to be retired at 55, your future earning years are 25. It is likely to impact the choice of insurance coverage as well as the sum assured premium.

While buying a term plan, you should realize that you are not buying it only to complete a checklist of financial protection. Inadequate life cover bought on a very low premium may not be sufficient for you and your loved ones. Since you will pay a sum assured premium from your income, it is crucial to assess your work life.

Consider the number of years you expect yourself to earn an income. Since a term life insurance policy also acts as an income replacement tool, you need to ask yourself when you wish to retire. It will help you determine an adequate cover and sum assured premium.

For instance, if your 30 right now and you expect to be retired at 55, your future earning years are 25. It is likely to impact the choice of insurance coverage as well as the sum assured premium.

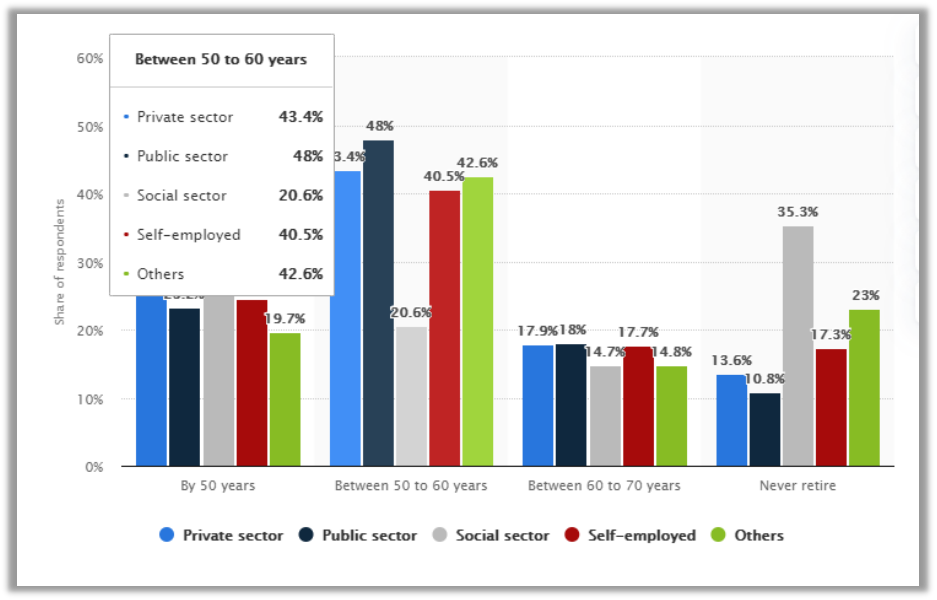

You can also go by the data that shows the preferred retirement age amongst millennials in India in different sectors.

Source: Satista

If you already have a term plan, you can also ask the insurer for provisions to increase the sum assured at different life stages

Chart Out Regular Annual Expenses

The idea behind buying a term plan is to ensure that your family gets the financial backup they need after you. That is what, you should have a clear idea of you and your family’s lifestyle expenses. Since you will pay a premium for the chosen life cover, you must know analyse how much money you can afford to pay for it.

To ascertain the coverage amount and sum assured premium, take note of your monthly expenses, and see how much money you can set aside for insurance needs. It is one of the main steps for financial planning, says an article by Deloitte.

The objective here is to estimate the financial cover that you and your family needs for a comfortable living, along with keeping inflation rates in mind. Also, take into account all ongoing and recurring expenses like education fees, healthcare bills, utility bills, and other miscellaneous expenditures for optimal coverage.

Next to the current insurance premiums you are paying, you need to check if you can pay more to get a higher sum assured with the same plan or buy another term plan to get sufficient life cover.

Consider Major Life Goals

Certain life phases like marriage, higher education abroad, and retirement, are special and need additional financial assistance. The choice of sum assured under a term plan should be made accordingly.

For instance, if you are planning for an early retirement, you can invest in a term plan with Return of Premium option. This way, you will get the life cover till you reach your retirement age and then avail maturity benefits to enjoy financial independence during the retired life.

These are various landmarks in life for which you need to prepare yourselves from a young age itself financially. You need to calculate and add these expected savings to meet your life goals, which may even increase with every passing year.

Assess Your Investments, Savings, and Liabilities

To select adequate sum assured under term insurance, you need to calculate your liabilities, savings, and investments. For this, you can also use human life value calculators available online. Make sure that all your loved ones are covered, and their lifestyle needs and dreams are met without any compromises.

The correct assessment of your financial situation is a must as the last thing you want is your family bearing the burden of your debts after your untimely demise.

What Else Should You Consider While Buying a Term Plan?

When buying a term insurance plan for you and your family, you need to understand the concept of adequate sum assured. The reason why it is often stress upon is because it lays the foundation of financial security in your life. Purchasing a term plan is also vital to your financial portfolio, which is why it requires you to make a well-informed decision.

There are certain things you need to look at before making the final decision. These include the insurer’s reputation, online reviews, claim filing process, and the list goes on.

You can also add various riders by paying additional premium, including critical illness cover, disability cover, accidental death benefit, waiver of premium, and many others in return of an extra sum assured premium.

Remember that the sum assured premium should not be the sole guiding factor when buying a term plan. If you already have a term plan but unsure if it provides sufficient life cover, you can balance it up by buying a new term plan from a renowned insurer. Similarly, you can look for term plans with gives option of return of premium receive additional benefits in the form of Critical Illness cover and Return of Premium under your term plan through riders.

Along with sufficient life cover and affordable sum assured premium, here are a few more thing you must check before investing in a policy:

Insurer’s Claim Settlement Ratio

The claim settlement ratio, also known as CSR or claims paid ratio, is a metric that reveals the percentage of life insurance claims an insurer has settled (paid out) during a financial year. In other words, the settlement ratio is defined as the percentage of the total number of insurance claims paid out by an insurance company compared to the total number of received claims.

It signifies the capacity of the insurer to fulfil the claims filed by its customers. Higher the CSR, the higher the reputation of the insurer amongst the masses in general.

Max Life Insurance has a claim settlement ratio of 99.51% for FY 22-23 (source: Individual Death Claim Paid Ratio as per audited financials for FY 2022-2023).

Inclusions and Exclusions of Chosen Term Plan

While investing in term insurance, it is advisable to understand how it works and what it specifically covers. While choosing a term plan, make sure to compare different insurers based on the sum assured premium and the coverage they provide against it.

Full knowledge of the life insurance plan’s inclusions and exclusions is of utmost importance to avoid further confusion and rejection of claims.

Medical process and filling proposal form

Every insurance provider asks a set of questions about your health, profession and lifestyle. It is very important that you answer these questions correctly as these questions decide if you would be eligible for a telemedical or a physical medical. Both these medicals (either of the one you have undergone) hold equal weightage when it comes to your claims process.

Steps to File a Term Insurance Claim

Every insurance provider has a specific claim application and settlement procedure. For both the insured and the policy nominee, it is crucial to keep themselves abreast of this procedure. It helps in minimizing hassles at the time of filing a claim.

We, at Max Life Insurance, guarantee a hassle-free death claim process. Your nominee can either download the claim form or visit the nearest branch of our office, and the advisor will help you fill the claim form.

You can call our 24X7 customer support service and clear all your doubts regarding the claim procedure. It is advised to submit all required documents within 30 days and complete information for faster and efficient claim processing.

Choose the Right Term Plan with Affordable Sum Assured Premium

For every individual, the financial implication of safeguarding their family’s future along with taking care of all the present needs is different. If you are the sole bread earner in your family, you need to consider every possible scenario and prepare well for it. Choosing the right and adequate term insurance coverage will help you lead a stress-free life.

Insufficient life cover can cause financial problems to you and your loved ones. So, make sure you invest in a term plan by carefully assessing every aspect of it and how it related to your life.

So, select the right sum assured in life insurance for a secure financial future.

FAQs

1. How will I get a term insurance sum assured premium under my budget?

With a wide variety of term insurance policies available online, you have a lot of options to compare and find the best plan that suits your financial needs. Make sure you do extensive research and use sum assured premium calculators.

It is advisable to buy an adequate sum assured that can cater to your needs, considering inflation in every sector. Assess your income and expenditures to buy a policy with a sum assured premium within your budget.

2. Is it essential to add riders with a basic term plan?

Apart from the basic death benefit, term insurance plans also offer additional covers in the form of riders. You can add these riders to your term plan based on your specific needs

For instance, in case there is a family history of a particular life-threatening disease, then you can choose critical illness rider to provide for the treatment charges. Similarly, you can opt for return of premium rider to receive survival benefits on outliving the policy period.

So, consider your family needs and extend your basic life cover for optimal protection.

3. Is it more beneficial to buy term plans online?

Buying anything online gets you great offers and discounts. Insurance is no exception. With the online market expanding its reach, many insurers provide comprehensive policies online.

Since there is no involvement of middlemen, the sum assured premium is also lower as compared to buying from offline modes.

4. Till when can we submit the claim form after the incident?

As per the guidelines, all valid term insurance claims are to be settled within 30 days after you submit all the necessary documents and clarifications. To avoid any rejection, you must follow the insurer’s claim settlement procedure without much delay.

5. Who is entitled to receive term insurance claim amount?

At the time of buying the term plan, you are required to nominate your family members who will receive the claim amount in case of your unfortunate demise. It is therefore advisable to carefully choose your nominees.

If you have bought a term plan with return of premium option, you will receive the survival benefits on surviving the chosen policy period.

ARN: Bg/RSA/120623