Max Life Smart Wealth Plan

Disclaimer : In Unit Linked Policies, the investment Risk in the investment portfolio is borne by the policyholder.

Written by

:Reviewed by

What is Max Life Smart Wealth Plan?

At Max Life Insurance, we understand the significance of such milestones in your Life. Thus, presenting Max Life Smart Wealth Plan (a Non-Linked, Non-Participating, Individual, Life Insurance Savings plan, UIN: 104N116V12), which is designed to help secure your financial future through guaranteed returns. This plan will help you pursue your dreams and accomplish all milestones that you set your heart on, with certainty.

How to Save with Max Life Smart Wealth Plan?

Guaranteed Maturity Benefits

Max Life Smart Wealth Plan provides guaranteed benefits on your savings, to help you meet your savings goal

Flexibility

You have the flexibility to choose from four plan options- Lumpsum, Short Term Income, Long Term Income, and Whole Life Income

Guaranteed Additions

Accrued Guaranteed Additions that boost your corpus under Lumpsum Option of Max Life Smart Wealth Plan

Financial Security in Case of Death

Max Life Smart Wealth Plan offers comprehensive death benefit in case of your demise (as Life Insured) during the policy term

Who Should Invest in Max Life Smart Wealth Plan?

Max Life Smart Wealth Plan is suitable for the following categories:

1) Salaried individuals

2) Self-employed individuals

3) People with dependents who seek a long-term financial plan

4) People who have less risk appetite

5) People who seek guaranteed returns on savings

6) People who look for dual benefits of life insurance and savings

You can buy Max Life Smart Wealth Plan to secure your retirement, for your children's education, your spouse's financial independence in your absence, or any other financial goals. Furthermore, this savings plan is also suitable for those investors who wish to put their money into a financial instrument, which provides long term capital appreciation, but with less risk than pure equity market investments.

Why Save with Max Life Smart Wealth Plan?

This product is eligible for tax benefits under section 10(10D) of the Income Tax Act, 1961 as the condition of "premium payable for any of the years during the term of policy not exceeding ten percent of the sum assured" is satisfied considering total sum assured during the policy term is 11.25 times for single premium policy and 17 times for regular premium policy. Further, in our interpretation, for a joint life policy, as premium paid is not separately identifiable for each life insured, the aggregate annual premium vs aggregate sum assured ratio will be considered to check the eligibility under tax laws.

You are advised to independently consult your tax advisors on income tax implications and tax benefits. The above understanding is subject to any changes made to tax laws in future.

How does Max Life Smart Wealth Plan Work?

Max Life Smart Wealth Plan comes in four variants and you can choose the one which best suits your savings need. Here is how you can invest in Max Life Smart Wealth Plan:

Step 1: Choose a suitable variant

Max Life Smart Wealth Plan offers the following plan variants:

1) Lumpsum

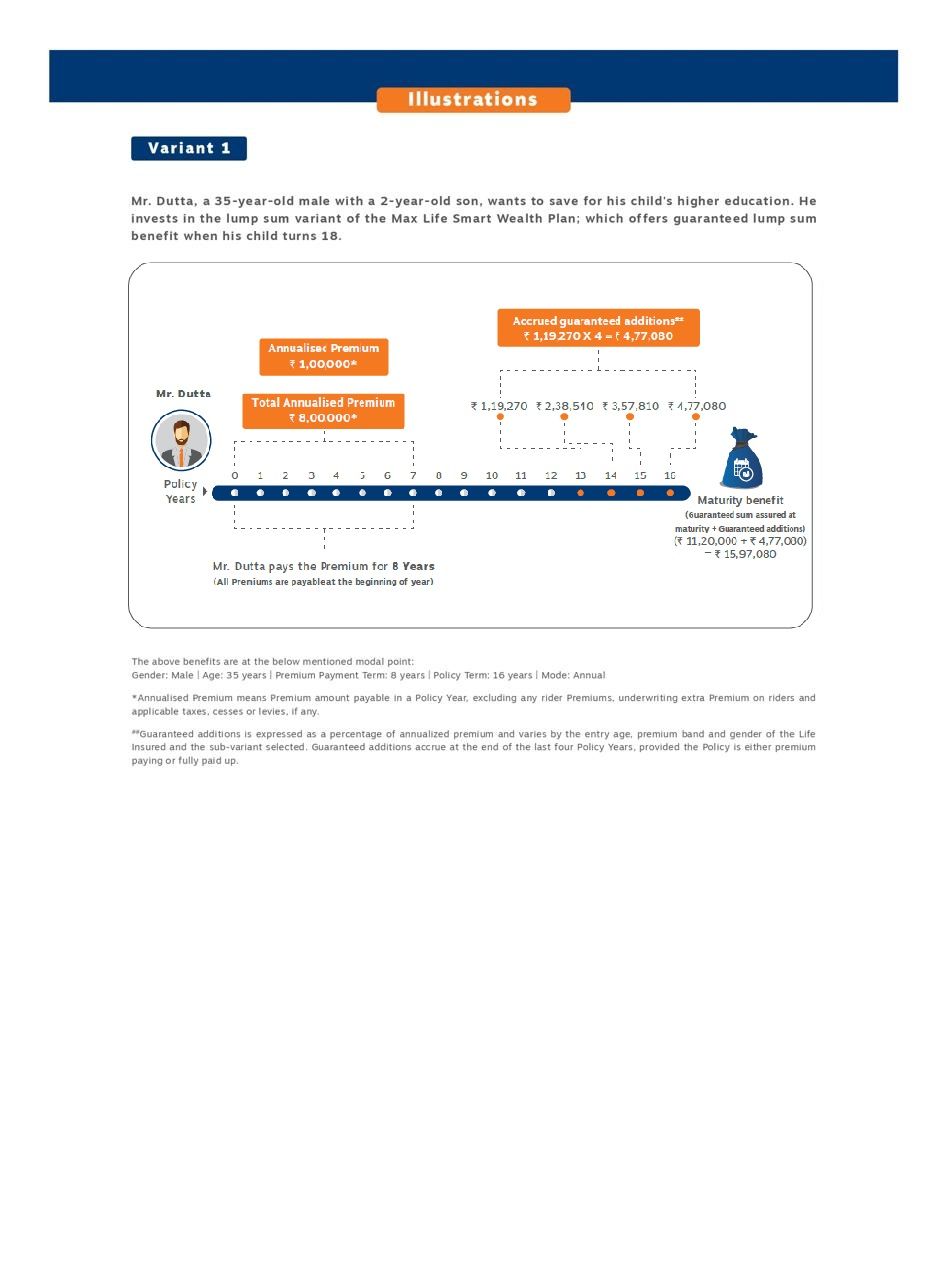

This variant offers to pay maturity benefit as a lump sum at the end of the policy term. The maturity benefit paid comprises both guaranteed sum assured on maturity and the accrued guaranteed additions (if any). Under this variant, the Guaranteed Additions are expressed as a percentage of annualized premiums, and they may vary based on the entry age, premium band, and gender of the Life insured and the sub-variant selected.

2) Short Term Income

This variant of Max Life Smart Wealth Plan offers to pay guaranteed 'income benefit' at the end of the period (monthly, quarterly, half yearly or annually) as per the frequency chosen, for the pay-out Period as per the sub-variant selected by you, post completion of the Policy Term. The income benefit is expressed as a percentage of the annualized premium. It varies by the entry age, premium band, and gender of the Life insured and the sub-variant selected.

3) Long Term Income

Under this variant, you receive a guaranteed 'income benefit' at the end of the period (monthly, quarterly, half yearly or annually) as per the frequency chosen, for the pay-out Period as per the sub-variant selected by you, post completion of the Policy Term. Moreover, after the pay-out period, you will also receive a 'terminal benefit,' which equals the Total Premiums Paid. Here, the income benefit is expressed as a percentage of annualized premium, and its value depends on the entry age, premium band, and gender of the Life insured and the sub-variant selected. Also, you can also choose the income pay-out frequency, other than annual.

4) Whole Life Income

Under the Whole Life Income variant of Max Life Smart Wealth Plan, a guaranteed 'income benefit' is payable at the end of the period (monthly, quarterly, Half yearly or annually as per the frequency chosen, post the policy term, until the death of the last surviving life. Here, the income benefit is expressed as a percentage of the Single premium and varies by the entry age, gender, and premium band.

Step 2: Choose your Premium/Income Pay-out

Step 3: Choose your sub-variant, i.e. "Policy term and Premium payment term" from the available options

Variant | PPT | PT | Maturity Benefit | Single Life/Joint Life |

Lumpsum | 5 | 10,12,15,20 | Lump sum at the end of policy term | Single Life |

8 | 10,12,16,20 | |||

10 | 10,12,15,20 | |||

12 | 12,15,20 | |||

Short Term Income | 6 | 7 | Guaranteed income benefit for 6 years (from 8th year to 13th year in arrears) | |

8 | 9 | Guaranteed income benefit for 8 years (from 10th year to 17th year in arrears) | ||

10 | 11 | Guaranteed income benefit for 10 years (from 12th year to 21st year in arrears) | ||

12 | 13 | Guaranteed income benefit for 12 years (from 14th year to 25th year in arrears) | ||

Long Term Income

| 6 | 6 | Guaranteed income benefit for 25/30 years (from 7th year to 31st/36th year in arrears plus Terminal Benefit) | |

6 | 7 | Guaranteed income benefit for 30 years (from 8th year to 37th year in arrears plus Terminal Benefit) | ||

6 | 8 | Guaranteed income benefit for 25/30 years (from 9th year to 33rd/38th year in arrears plus Terminal Benefit) | ||

8 | 8 | Guaranteed income benefit for 25/30 years (from 9th year to 33rd/38th year in arrears plus Terminal Benefit) | ||

8 | 9 | Guaranteed income benefit for 25/30 years (from 10th year to 34th/39th year in arrears plus Terminal Benefit) | ||

8 | 10 | Guaranteed income benefit for 30 years (from 11th year to 40th year in arrears plus Terminal Benefit) | ||

10 | 10 | Guaranteed income benefit for 25/30 years (from 11th year to 35th/40th year in arrears plus Terminal Benefit) | ||

10 | 11 | Guaranteed income benefit for 25 years (from 12th year to 36th year in arrears plus Terminal Benefit) | ||

10 | 12 | Guaranteed income benefit for 25/30 years (from 13th year to 37th/42nd year in arrears plus Terminal Benefit) | ||

12 | 12 | Guaranteed income benefit for 25/30 years (from 13th year to 37th/42nd year in arrears plus Terminal Benefit) | ||

12 | 13 | Guaranteed income benefit for 25/30 years (from 14th year to 38th/43rd year in arrears plus Terminal Benefit) | ||

12 | 14 | Guaranteed income benefit for 25 years (from 15th year to 39th year in arrears plus Terminal Benefit) | ||

Whole Life Income | Single Pay | 5 | Guaranteed income benefit until the death of last survivor from 6th year in arrears | Joint Life |

6 | 6 | Guaranteed income benefit until the death of last survivor from 7th year in arrears |

What does Max Life Smart Wealth Plan Offer?

- 11 times the sum of Annualised Premium* and underwriting extra premiums***, (if any),

- 105% of all sum of Total Premiums Paid**, underwriting extra premiums*** and loadings for modal premiums, (if any) as on the date of death of life insured,

- Any absolute amount assured to be payable on death #

- In case of Single Pay- 1.25 times the Single Premium* plus underwriting extra premiums (if any),

- In case of regular pay- 7 times the Annualised Premium* plus underwriting extra premiums (if any),

- 105% of sum of Total Premiums Paid**, underwriting extra premiums and loadings for modal premiums, (if any) as on the date of death of life insured,

- Any absolute amount assured to be payable on death #

Variant 1, 2 and 3:

A lump sum guaranteed ‘Death Benefit’ is payable immediately on the death of the life insured during the policy term and is defined as higher of:

*“Annualised Premium” means Premium amount payable during a Policy Year chosen by Policyholder, excluding Underwriting Extra Premium, loading for modal premium, Rider Premiums and applicable taxes, cesses or levies if any;

**“Total Premiums Paid” means the total of all Premiums received, excluding Underwriting Extra Premium, loading for modal premium, Rider Premiums, and applicable taxes, cesses or levies, if any.

***“Underwriting Extra Premium” means an additional amount charged by Us, as per Underwriting Policy, which is determined on the basis of disclosures made by Policyholder in the Proposal Form or any other information received by Us including medical examination report of the Life Insured

#The absolute amount assured to be payable on death under these variants is equal to the Total Premiums Paid accumulated monthly at an interest rate of 8% p.a.

Variant 4:

A lump sum guaranteed ‘Death Benefit’ is payable immediately on the death of the life insured(s) during the term of the policy and is defined as the higher of:

*“Single Premium” means the lump sum premium amount paid by the policyholder at the inception of the policy excluding the taxes if any.

#The absolute amount assured to be payable on death under the Variant 4 on event of first death is equal to 1.25 times the Single Premium plus underwriting extra premiums (if any) in case of single pay and 7 times the Annualized Premium plus underwriting extra premiums (if any) in case of regular pay , and 10 times the Single Premium (Single Pay)/Annualised Premium (Regular pay) plus underwriting extra premiums (if any) on the event of the second death during the policy term.

The policy shall continue until the death of the last surviving policyholder.

On death of the last surviving policyholder post expiry of the policy Term, Single Premium plus underwriting extra premiums (if any) in case of single pay and total premiums paid plus underwriting extra premiums (if any) in case of regular pay shall be payable to the beneficiary.

The policy shall terminate on payment of the death benefit for the last surviving policyholder and no further benefits will be payable

How do Max Life Smart Wealth Plan Variants Work?

Various Online Insurance Plan by Max Life

What are the Rider Options Available with Max Life Smart Wealth Plan?

Max Life Smart Wealth Plan offers the following rider options with its Lumpsum (Variant 1), Short Term Income (Variant 2) and Long-Term Income (Variant 3) options.

Max Life Waiver of Premium Plus Rider (UIN: 104B029V04)

As the name suggests, this rider offers to waive off all future premiums in case you are diagnosed with a life threatening ailment such as cancer or suffer dismemberment or your demise (only when the Life Insured and the Policyholder are different individuals). Under Max Life Smart Wealth Plan, there is no inbuilt Waiver of Premium benefit, and thus, you would have to avail of this rider benefit as an additional benefit.

Downloads

Max Life Accidental Death and Dismemberment Rider (UIN: 104B027V04)

Under this plan with guaranteed returns, you can opt for this rider to avail of additional financial benefits in case of death or dismemberment of the Life Insured because of an accident.

Downloads

Max Life Critical Illness and Disability Rider (UIN: 104B033V01)

Max Life brings a comprehensive insurance plan that covers up to 64 critical illnesses along with total and permanent disability coverage. You can choose the best variant for you from the five available variants. You will be also be eligible for a discounted renewal premium based on the number of steps monitored on Max fit app. You can even choose to get a cover up to age 85 years. (For further details, please refer to Max Life Critical Illness and Disability Rider, UIN – 104B033V01, prospectus/brochure

Downloads

Max Life Term Plus Rider (UIN: 104B026V03)

Using this rider add-on, available under Max Life Smart Wealth Plan, you can provide for an additional lump sum benefit in case of death of the Life Insured.

Downloads

Remember, there are no rider options available with the Whole Life Income (Variant 4) of the smart wealth plan and the policies sold through POS persons.

ARN: PCP/SWP/020823

Create Wealth for Your Family’s Future Goals

With Max Life Investment Plans100% Guaranteed returns*#

Save tax up to Rs. 46,800##

Popular Searches

- 0124 648 8900(09:00 AM to 09:00 PM Monday to Saturday)

- service.helpdesk@maxlifeinsurance.comEmail

- SMS ‘LIFE’ to 5616188Message

- Let us call you back

- 1860 120 5577(9:00 AM to 6:00 PM Monday to Saturday)

- Chat with us

- Write to usPlease write to us incase of any escalation/feedback/queries.

- 011-71025900, 011-61329950(9:00 AM to 6:00 PM Monday to Saturday)

- nri.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Do you have any thoughts you’d like to share?