Case Study

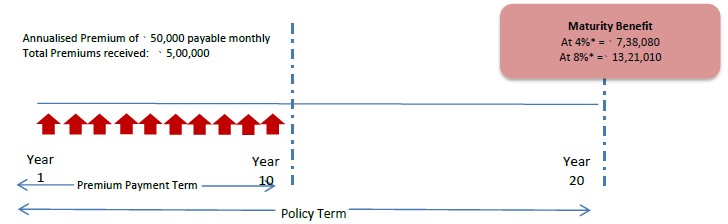

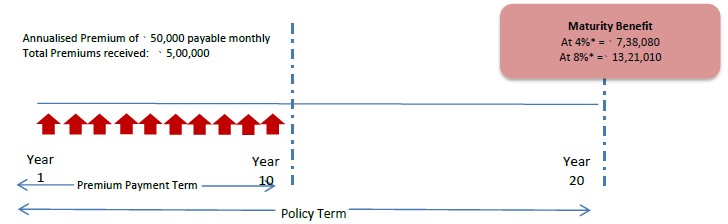

Mr. Gupta aged 35 years purchased Max Life Online Savings Plan (Variant 1) with the details as below:

Premium Payment Term = 10 years; Policy Term = 20 years; Mode of Payment = Monthly

Annualised Premium = 50, 000; Fund chosen: Balanced Fund; Cover Multiple: 10 times of Annualised Premium

*Please note that the above-assumed rates of return @ 4% and 8% p.a. respectively, for Balanced Fund, are only scenarios at these rates after recovering all applicable charges. Neither are they guaranteed nor are they the upper or lower limits of returns of the Funds selected in your policy. The performance of the Funds is dependent on a number of factors, including future investment performance. For more information, please request your policy-specific benefit illustration.

The charges specified below are guaranteed and shall not change during the policy lifetime.

1. Premium Allocation Charge

Nil

2. Policy Administration Charge (All Years)

Nil

3. Fund Management Charge

This is a charge levied as a percentage of the value of assets and shall be appropriated, usually daily, by adjusting the Net Asset Value of the Fund. The rate to be levied will be equal to the annual rate, as given below, divided by 365 and multiplied by the number of days that have elapsed since the previous unit valuation date. The charges specified below are guaranteed and shall not change during the policy lifetime. The annual rate of the Fund Management Charge is as below.

Name of Fund

|

Charge (per annum) as % of Fund Value

|

High Growth Fund (SFIN: ULIF01311/02/08LIFEHIGHGR104)

|

1.25%

|

Diversified Equity Fund (SFIN: ULIF02201/01/20LIFEDIVEQF104)

|

1.25%

|

Growth Super Fund (SFIN: ULIF01108/02/07LIFEGRWSUP104)

|

1.25%

|

Midcap Momentum Index Fund (SFIN: ULIF02801/01/24MIDMOMENTM104)

|

1.25%

|

Nifty Alpha 50 Fund (SFIN: ULIF02914/05/24ALPHAFIFTY104)

|

1.25%

|

Growth Fund (SFIN: ULIF00125/06/04LIFEGROWTH104)

|

1.25%

|

Balanced Fund (SFIN: ULIF00225/06/04LIFEBALANC104)

|

1.10%

|

NIFTY Smallcap Quality Index Fund (SFIN: ULIF02702/08/23NIFTYSMALL104)

|

1.00%

|

Dynamic Bond Fund (SFIN: ULIF02401/01/20LIFEDYNBOF104)

|

0.90%

|

Secure Fund (SFIN: ULIF00425/06/04LIFESECURE104)

|

0.90%

|

Money Market II Fund (SFIN: ULIF02301/01/20LIFEMONMK2104)

|

0.90%

|

Discontinuance Policy Fund

(SFIN: ULIF02021/06/13LIFEDISCON104)

-available only on surrender or discontinuance of policy in first five policy years

|

0.50%

|

4. Mortality Charge

The mortality charge will be levied on the basis of ‘Sum at Risk’ on every monthly anniversary by canceling units from the unit account starting from the date of commencement of the policy. The mortality charge will be on an attained age basis over the duration of the contract.

Variant 1:

Max (Max (Sum Assured, 105% of all premiums paid) – Total Fund Value, 0)

Please note that in the above definition Sum Assured reduced by applicable partial withdrawals, if any, shall be considered.

The mortality charges are unisex and are guaranteed for the entire Policy Term.

During Settlement Period:

Max (105% of total premiums paid – Total Fund Value, 0)

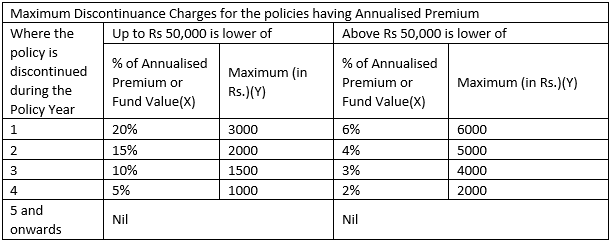

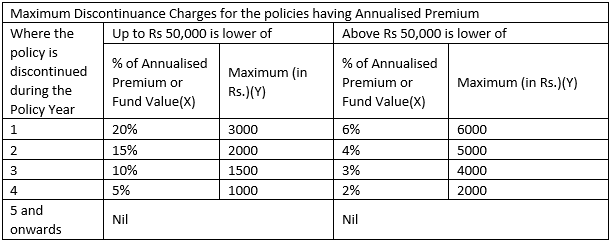

5. Surrender/Discontinuance Charge

This charge shall be levied on the Fund Value at the time of Discontinuance of Policy or effecting Complete Withdrawal (Surrender), whichever is earlier, as per the following table. This charge is expressed as the lower of (X% of Annualised Premium, X% of Fund Value, ‘Y’ fixed rupee amount) where X and Y vary according to the year of premium discontinuance/surrender.

No Surrender/Discontinuance charge shall be levied from the 5th Policy Year onwards.

For example: If the Annual Premium is ₹40,000 and the Fund Value at the end of the first year is ₹ 42,000, then the Discontinuance Charge will be lower of (20% of 40,000, 20% of 42,000, 3,000) which works out to be ₹ 3,000.

6. Switch Charge

All switches will be free of charge.

7. Premium Redirection Charge

There is no charge for premium redirection. A maximum of six premium redirections are allowed in any Policy year.

8. Partial Withdrawal

You can make up to two partial withdrawals in any policy year for free.

9. Miscellaneous Charges

There are no miscellaneous charges.

However, please note:

All applicable taxes, cesses, and levies as imposed by the Government from time to time will be levied on all charges as per the prevailing laws.

Any further taxes and cess shall be passed on to You.