Written by

Updated :

Reviewed by

Has it ever happen to you that you forgot the amount of money you spent last month? It is important to keep count of your hard-earned money. To manage it, you don’t have to be a math whiz, a basic knowledge of addition and subtraction is enough.

Life will be much easier for you if you know where your money is going. With good financial skills, you can maintain a good credit score and will end up carrying much less debt.

For instance,

Mr. X who is 35 years old earns Rs 1,00,000/month

Monthly Expenditure

Expenses |

Percentage of Your Income (%) |

House rent |

Rs 20,000 (20%) |

Groceries |

Rs 10,000 (10%) |

Child’s education |

Rs 10,000 (10%) |

Essential medicines |

Rs 3,000 (3%) |

EMIs |

Rs 10,000 (10%) |

Parties and trips |

Rs 15,000 (15%) |

Gym membership |

Rs 2,000 (2%) |

Eating at restaurants |

Rs 10,000 (10%) |

Miscellaneous |

Rs 5,000 (5%) |

Savings |

Rs 15,000 (15%) |

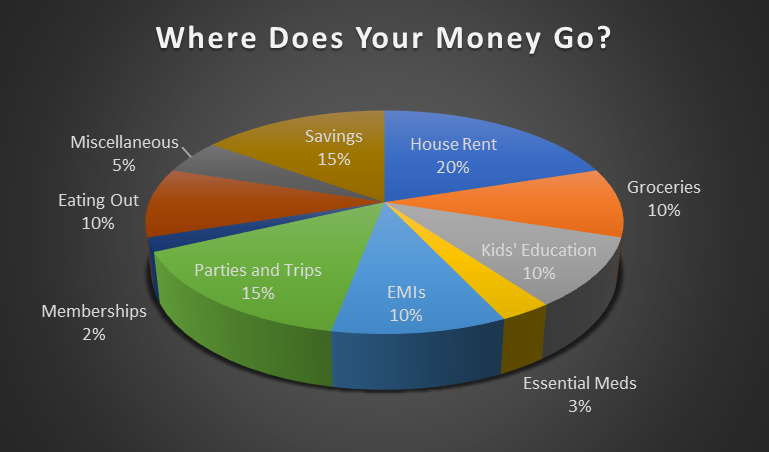

With the help of fig 1.1 and 1.2, you can see how a budget of average household looks like. You can see here that after monthly expenses, Mr. X is only able to save 15% of his salary. The rest of his salary is used either as an essential expenditure or on not so necessary expenses.

Following money management tips will help you arrange your money better:

1. Save First And Spend Later

From fig 1.1 you can see how Mr. X did unnecessary expenses such as going out on parties, eating at a restaurant and watching a movie in a theatre, which cost him loads of money. Instead, you should save that money by reducing these extra expenses and put to good use. Also, pay your bills on time to avoid late fees or penalty charges.

Save your hard-earned money when you can to spend it later where you can enjoy your life more.

2. Create a Comprehensive Budget

Many people ignore doing budget as they think it is time-consuming and tedious. If Mr. X had spent some time to budget his spending, he would have saved more than 15%. You have to spend only a few hours of your life to track your monthly budget. Instead of focusing on the process of creating a budget, you should focus more on the value it will bring to your life.

Cut off unnecessary expenses like going to parties weekly or going out to eat, instead reduce your outings. This will not only benefit you financially but your health also.

3. Limit Your Credit Card Purchase

Credit cards are your worst enemy if you are a lousy spender. When you run out of cash, you immediately switch to your credit cards without even considering whether you can afford to pay the debts. You can resist the urge to use credit cards by cutting off unnecessary purchases. Stop purchasing items that you can’t afford, especially those that you don’t need.

4. Set Your Goals

Firstly, set a goal that you want to achieve, it can be anything from going on a Europe trip to providing your child with top-class education. Pen it down and start planning towards achieving your goals.

You can make a habit of setting aside some money each month and pay it to yourself as if it is another bill.

5. Start Investing

(Image Credit: Shutterstock)

From fig 1.1, if Mr. X would have reduced his unnecessary expenses such as going out on parties (from 15% to 5%), eating at a restaurant (from 10% to 3%) and watching a movie in a theatre (from 5% to 2%), he could have saved 35% of his monthly salary i.e., Rs 35,000.

Don’t be like Mr. X; use these money management tips to reduce your extra expenses and increase your savings. Save 35 – 40% of your monthly salary and use it to invest in your and family’s future goals. Investments can also help you save tax and increase cash in hand for more investment and a better lifestyle.

6. Ensure Protection from Contingencies

Contingencies like sudden hospitalization, accident, job loss, etc. can result in a financial setback. Insurance plans like term insurance, health and critical illness insurance help you to secure a safety umbrella for your investments and family.

The term insurance plan will provide your family the financial security in case of your untimely demise while health insurance plans like cancer insurance plan and critical illnesses will help you receive better treatment in case of illnesses and accidental disabilities.

You can also enjoy additional tax benefits as per prevailing tax laws on your premium payments towards the life insurance and health insurance plans.

Disclaimer/Note: “These are general assumptions and Max Life does not accept responsibility for any decision taken by the readers on the basis of the information provided. The objective is to keep readers better informed and help them decide for themselves”

ARN:- Sep/Bg/28J