Written by

Updated :

Reviewed by

When it comes to securing your financial future, the National Pension System (NPS) is undoubtedly one of the safer or next-to-nil risk investment options. As the name suggests, NPS or National Pension System primarily provides for the subscriber’s retirement benefits. That said, the NPS Tier II account (a voluntary option) offers a combination of liquidity, flexibility, and the potential for growth, making it an attractive avenue for those who seek.

In this article, we delve into the benefits of investing in an NPS Tier 2 account, unpacking its features and the advantages it holds over other investment vehicles.

What is NPS Tier II Account?

An NPS Tier II account is a voluntary account under the National Pension System which is offered to those who have an active NPS Tier I account. This account can be opened with a minimum investment amount of Rs 1,000 with no mandatory continued contribution required.

Now, there are 4 asset classes that you can choose from when investing in NPS Tier II account, namely, Equity, Government Securities, Bonds (corporate) and Other investment funds.

The money you invest is then put into one of these asset classes to be earned returns from. Also, you get the option to choose your fund manager (e.g. Max Life Pension Management Fund, HDFC Pension Management Fund, Aditya Birla Sun Life Pension Management Fund, etc.)

While NPS Tier I is a retirement benefit account from which fund withdrawal is not allowed till a specified period of time, NPS Tier II is an investment account which helps in growing your wealth. Also, you can transfer your NPS Tier II funds anytime to Tier I without any restrictions.

Benefits of Investing in NPS Tier 2 Account

NPS Tier II is a voluntary account that can be chosen by the accountholder to reap benefits of investing in different funds, like a mutual fund. Here are some of the key investment benefits related to NPS Tier II:

Low-cost structure: The NPS is known for its cost-effective management fees, and the Tier II account is no exception. It comes with zero added annual maintenance charges. This ensures that a larger portion of your investment goes towards growing your wealth.

No exit-load: There is no barricading on the exit of this account. You can transfer your funds from NPS Tier 2 to 1 anytime, without having to pay any exit fee.

Performance tracking: The performance of NPS funds is regularly monitored and publicly available, providing transparency and helping investors make informed decisions. Also, your investment pattern doesn’t have to be replicated with a Tier 1 account. You are at liberty to choose a different type of Tier 2 account (for e.g.: choosing percentage of allocation in different asset classes other than Tier 1)

Nomination: Apart from appointing a nominee for your Tier 1 account, you can name another person as your nominee separately for the NPS Tier 2 account.

NPS Tier 2 Account: Features

The NPS Tier 2 account is a voluntary savings-cum-investment option available to individuals who are already subscribed to the Tier 1 account of the National Pension System. It's designed to offer greater flexibility and liquidity compared to the Tier I account, which is more retirement-focused. Here are some of the standout features of the NPS Tier II account:

Flexibility in contributions: Investors have the freedom to contribute to their Tier 2 account at their convenience, with no upper limit on contributions and a low minimum requirement, making it accessible to a wide range of investors.

Wide range of investment choices: Subscribers can choose from a variety of investment options, including government securities, corporate bonds, and equity markets, allowing for a tailored investment approach based on risk appetite and financial goals.

Liquidity: Unlike the Tier 1 account, the Tier 2 account allows for withdrawals at any time, making it akin to a regular investment account but with the added benefits of the NPS framework.

Who can open an NPS Tier 2 Account?

The eligibility criteria for opening a Tier 2 Account under NPS are listed below:

Participant should be a resident of India (NRIs not allowed to opt for it)

Aged between 18 and 55 years of age

Must have an active NPS Tier 1 Account

That said, All Government Subscribers who are compulsorily covered under the National Pension System with an active Tier I account, can activate their NPS Tier II account as well.

Related Articles

- Benefits of ULIP Investment Plan

- Types of ULIPs

- How to Save Tax with ULIPs

- Maximize Returns With ULIPs

- Best Short Term Investments for Tax Saving

- What is Power of Compounding

- What is Investment

- Types of Investment in India

- 80C Investment Options

- Fixed Deposit Interest Rates

- Voluntary Provident Fund

- Difference Between Saving And Investing

- What is Fixed Deposit

- What is Term Deposit

- What is Recurring Deposit

- Fixed Deposit vs Recurring Deposit

- What is KYC

- Max Life Guranteed Income Plan

- What is ULIP

How to Open NPS Tier II Account?

There are two ways of opening Tier II NPS account, viz. offline and online. To open NPS tier II offline, you need to download the Annexure 1: Tier II Details Form from NPS official website. Fill this form, sign the same and send it to POP-SP. When sending, please make sure to provide your bank account details.

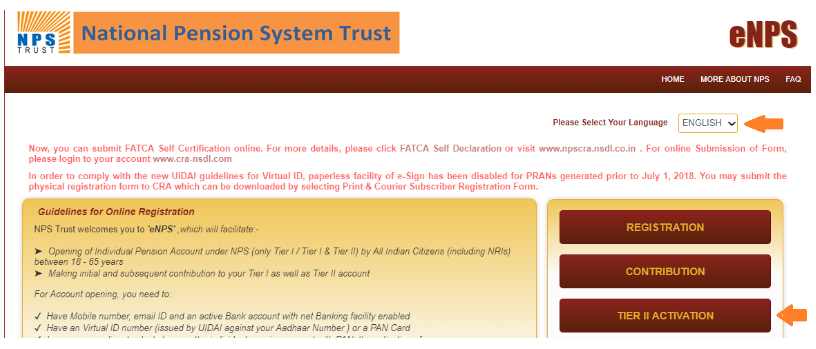

Follow the steps given below in order to open an NPS Tier II account online (Here we are giving steps for ePNS but Tier II can be opened via Protean and other ways too):

Go to eNPS website and click on ‘Tier II Activation’.

Enter the details asked in the form thus opened (PRAN, Date of Birth, PAN and captcha).

Click on ‘Verify PRAN’ after filling the form.

You will receive an OTP on your registered mobile number. Enter that in the space provided.

Next, fill in your bank account details and click on ‘Validate Aadhaar’ option.

Note the acknowledgement number displayed on the screen indicating successful validation. Click on ‘OK’.

Next, select a PFM (Pension Fund Manager) and choose from ‘Auto’ or ‘Active’ investment options.

Click on ‘Save and Proceed’.

Next step involves entering nominee details and then hit the ‘Save and Proceed’ button.

Pay the amount (minimum investment for NPS Tier II account is Rs 1,000).

Validate with the OTP to complete the process.

NPS Tier 1 vs. NPS Tier 2

The following table draws a crisp comparison between the two types of accounts under NPS, i.e., Tier I and Tier II viz.:

Basis of Difference |

NPS Tier I |

NPS Tier II |

Participation |

Mandatory for participating in NPS |

Voluntary |

Purpose |

For pension generation |

For investment |

Withdrawal |

Restricted |

No restrictions |

Annual contribution |

Rs 1,000 each year |

No annual investment required except one-time opening investment of Rs 1,000 |

Tax Benefits |

Tax benefits up to Rs 1.5 lakhs/FY {+Rs 50,000 u/s 80 CCD (1B)} |

No tax benefit (only for government employees) |

Related Articles

- Benefits of ULIP Investment Plan

- Types of ULIPs

- How to Save Tax with ULIPs

- Maximize Returns With ULIPs

- Best Short Term Investments for Tax Saving

- What is Power of Compounding

- What is Investment

- Types of Investment in India

- 80C Investment Options

- Fixed Deposit Interest Rates

- Voluntary Provident Fund

- Difference Between Saving And Investing

- What is Fixed Deposit

- What is Term Deposit

- What is Recurring Deposit

- Fixed Deposit vs Recurring Deposit

- What is KYC

- Max Life Guranteed Income Plan

- What is ULIP

Practical Benefits of NPS Tier 2 Account Investments

The tangible benefits of investing in NPS Tier 2 account come to light when we scrutinize the historical performance data. The NPS schemes, managed by professional fund managers appointed by the PFRDA, have consistently delivered competitive returns. This is particularly evident when compared to traditional savings options, which often cannot keep pace with inflation or provide substantial growth over time.

Active Management Benefits

The active management of the NPS Tier 2 account by seasoned fund managers allows for timely rebalancing of portfolios in response to market dynamics, which is a key factor in the account's ability to potentially outperform passive savings instruments. Investors benefit from the expertise of these managers who navigate the complexities of the market, aiming to maximize returns while mitigating risks.

Diverse Investment Choices

The NPS Tier 2 account features a wide array of investment choices, enabling subscribers to diversify across asset classes such as equities, corporate bonds, and government securities. This diversification is not just a hedge against volatility but also an avenue to tap into different market segments for balanced growth.

Risk and Return Profile

The NPS Tier 2 account is suitable for investors who are willing to assume a moderate level of risk for the possibility of higher returns. The account's structure allows for a personalized risk-return profile, enabling investors to align their Tier 2 account investment benefits with their individual financial goals and risk tolerance.

The practical advantages of the NPS Tier 2 account are not limited to potential returns. The account's liquidity feature stands out, as it allows investors to withdraw their funds if necessary, which is not an option with the Tier 1 account. This liquidity, coupled with the potential for higher returns and the ability to tailor an investment portfolio, makes the NPS Tier 2 account a compelling option for those looking to optimise their investment strategy.

Maximizing Financial Potential with NPS Tier 2 Account

The NPS Tier 2 account is more than just a savings tool; it's a versatile investment option that can be strategically used to enhance one's financial portfolio. This section will explore various ways in which the Tier 2 account can be optimised to meet different financial objectives, from tax planning to achieve short-term goals.

Strategic Tax Planning with NPS Tier 2 Account

While the NPS Tier 2 account does not inherently offer the same tax benefits as the Tier 1 account, it can still play a strategic role in tax planning. Investors can leverage the flexibility of the Tier 2 account to time their investments and withdrawals in a manner that optimizes their tax liability, especially when combined with other tax-saving instruments.

Role of NPS Tier 2 in Retirement Planning

Even though the NPS Tier 2 account is not strictly for retirement, it can be a valuable component of a broader retirement strategy. This section explores how Tier 2 account investment benefits can complement other retirement savings and pension plans, providing additional liquidity and investment options in an investor's golden years.

NPS Tier 2 Account for Short-Term Financial Goals

Unlike its Tier 1 counterpart, the NPS Tier 2 account can be suitable for short-term financial goals due to its liquidity. This section can delve into how investors can use the Tier 2 account to save for goals that are a few years away, such as a child's education or a down payment on a home.

Frequently Asked Questions (FAQs)

Q. Who can open an NPS Tier II account?

An individual of 18 years of age, living in India with an active PAN card and NPS Tier I account can open an NPS Tier II account.

Q. Who manages my money in NPS Tier II?

There are 11 pension fund managers (e.g. Aditya Birla Sun Life Pension Management Fund, Max Life Pension Fund Management etc.) that you can choose from to manage your investments in Tier II account of the National Pension System.

Q. What is the minimum investment amount for opening NPS Tier II account?

You need to invest minimum amount of Rs 1,000 to open an NPS Tier I account.

Q. Can NRIs open NPS Tier II account?

No, NRIs are not permitted to open an NPS Tier II account.

Q. Can I transfer money from Tier II to NPS Tier I account?

Yes, you can anytime transfer your money in NPS Tier II to NPS Tier I account easily without paying any exit load or other fee.

ARN No : April24/Bg/02A