*Guaranteed monthly income for a period of 10, 20, or 30 years, immediately after the completion of Premium Payment Term. Life insurance coverage is available in this product.

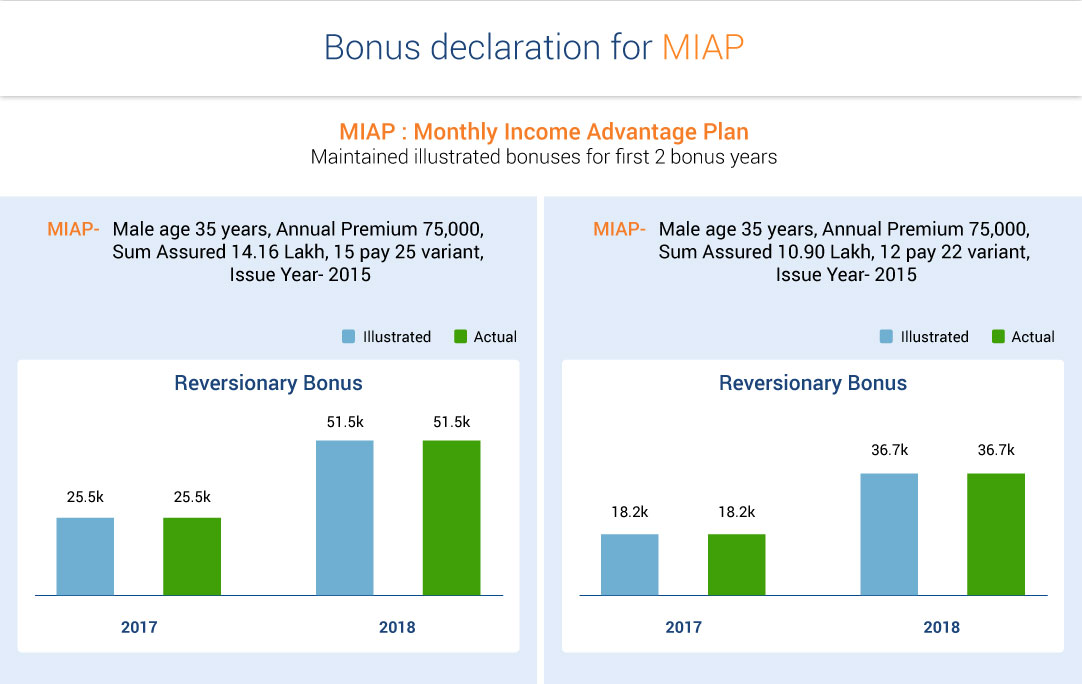

Max Life Monthly Income Advantage Plan

We all wish to lead a tension-free life with our loved ones. Vacations, weekend plans, festivals, and family functions give us occasions to rejoice with our family. At the same time, we must go through jobs, careers, and business hours to earn money to fulfil our family's financial needs.

Max Life Monthly Income Advantage Plan helps to ensure that you aren’t hard-pressed to meet these commitments in the future & your family remains financially secure, even in your absence. Under this plan, you can get life coverage of up to 45 years with a limited premium payment term.

3 Reasons Why You should Buy Max Life Monthly Income Advantage Plan

- Guaranteed Monthly Income for 10, 20, or 30 years after completing your premiums

- Get accrued bonuses along with a Terminal Bonus on the maturity of the policy

- In case of death, the policy continues as is and your family receives the policy benefits