Life Insurance Coverage is available in this Product

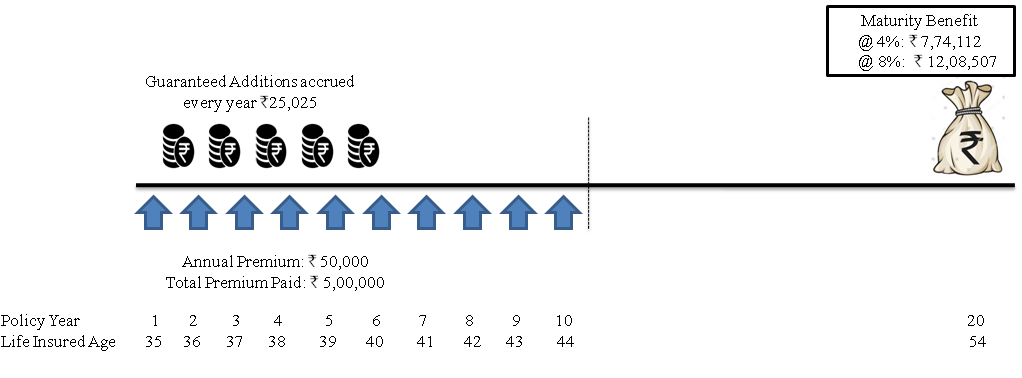

Max Life Savings Advantage Plan

You may have many goals in life for which you save money. These may be short-term goals, or long-term goals, such as buying a sedan, planning for children’s education in an ivy college, and planning for your daughter’s destination wedding. To ensure that you meet these goals, you need a financial instrument that can systematically grow your savings.

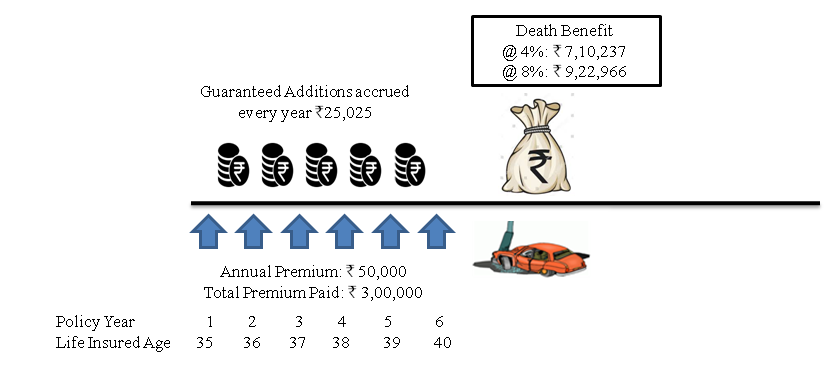

Presenting Max Life Savings Advantage Plan that accelerates the growth in your systematic savings and helps you build a corpus to address all your life goals while providing insurance coverage to take care of your loved ones in case of an unfortunate event.

Top Reasons Why You should Buy Max Life Savings Advantage Plan

- Flexibility to choose Premium Payment Term and Policy Term that matches your life goals

- Get lumpsum amount on maturity that is partly guaranteed

- Save tax under section 80C and Section 10(10D) as per prevailing tax laws

- Protection for your family through life insurance cover