Written by

Updated :

Reviewed by

On this Page

Both individuals and businesses are liable to pay income tax based on the laws defined by the Income Tax department in India. Based on the tax liability and the type of entity they fall under for FY 2020-21, they need to file the Income Tax Return (ITR) using different forms, one of which is ITR 5 form.

What is ITR 5?

ITR 5 form is used by entities, such as firms, Limited Liability Partnerships (LLPs), Body of Individuals (BOIs) and Association of Persons (AOPs), and Artificial Judicial Person (AJP)[1]. Alongside, local authorities and cooperative societies can also use ITR 5 form to file their returns.

Also Read: How to File ITR Online & Offline?

As you can see here, the utility of ITR Form 5 is based more on the type of entity than the income. You must consult a tax professional to understand better what ITR 5 means to you and your business and how to file ITR 5.

Also Read: TDS Rates for FY 2019-20 & FY 2020-21

What is the Structure of ITR Form 5?

While knowing the meaning of ITR 5 in detail, you must know that ITR 5 form is divided into two parts and 31 schedules, as defined below:

Part A – General Information About the Taxpayer

1. Part A – BS: This part of ITR 5 form covers the balance sheet of the taxpayer as on March 31 of the FY 2019-20

2. Part A – P&L: It defines the profit and loss statement for the tax Assessee for the last fiscal year

3. Part A – QD: This section of ITR 5 form contains quantitative details about stock held or turnover details for the FY 2019-20.

4. Part A: Manufacturing account for the fiscal year 2019-20

5. Part A: Trading account for the financial year 2019-20

6. Part A – OI: This subpart of ITR 5 form includes other information related to the taxpayer

Part B

1. Part B – TI: This section of ITR 5 form includes the details of total income calculations

2. Part B – TTI: It contains details of tax calculated on the total income chargeable for tax

Schedules of ITR 5 Form

You can file ITR 5 form online with the Income Tax department in any of these two ways:

Here are some of the most critical schedules of ITR 5 form:

1)Schedule HP: This schedule of the ITR 5 form includes the computation of income from house property

Schedules of ITR 5 Form

Here are some of the most critical schedules of ITR 5 form:

1)Schedule HP: This schedule of the ITR 5 form includes the computation of income from house property

2) Schedule BP: This schedule covers the computation of income from profits and gains from business or profession

3) Schedule DOA: Under this schedule of ITR 5 form, comes the information on the depreciation of ‘other assets’ as defined under the Income Tax Act. The assets under this schedule of ITR 5 means the ones on which total capital expense exemption is no allowed

4) Schedule DCG: This schedule covers details of deemed capital gains when the depreciable assets are sold

5) Schedule CG: In this schedule, there are details of both short-term and long-term capital gains

6) Schedule DPM: This schedule of ITR 5 form covers the information about the depreciation on plant and machinery as covered under the Income Tax Act

7) Schedule CYLA: It covers the details of the income statement after setting off the losses of the current year

8) Schedule BFLA: This ITR 5 form schedule talks about the statement of income after setting off unabsorbed losses brought forward from the previous years

9) Schedule CFL: In this schedule of ITR 5 form, you get the details of the statement of losses to be carried forward to the financial years ahead

10) Schedule ICDS: This schedule gives information about the impact of income calculation disclosure standard on the earned profits

11) Schedule AMT: Under this schedule of ITR 5 form, comes the computation details of alternate minimum tax to be paid under Section 115JC

Also Read: Income Tax Filing Due Date Extension for AY 2020-21

See how the latest budget impacts your tax calculation. Updated as per latest budget on 1 February, 2020. No deductions will be allowed under the new tax regime.

How to Download ITR 5 Form?

To download ITR 5 form, here are the steps to be followed:

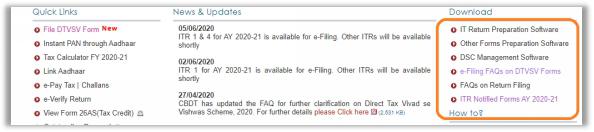

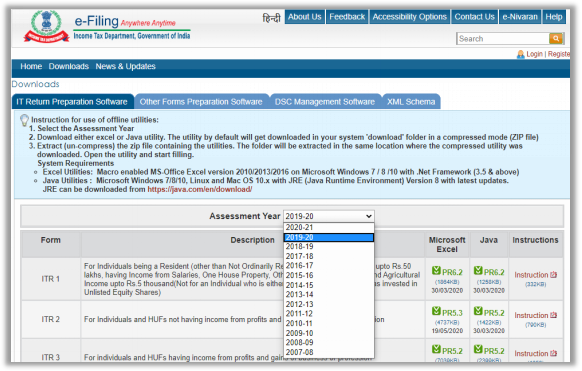

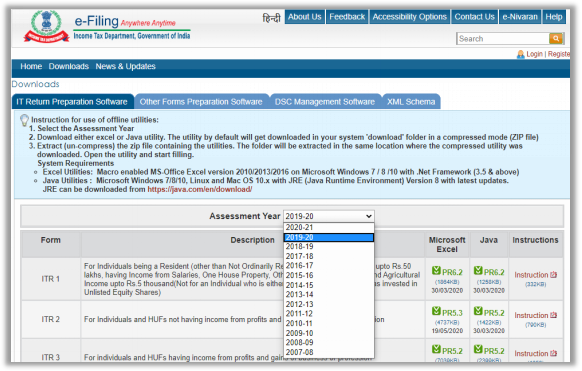

Step 1: Visit the Income Tax Department website- https://www.incometaxindiaefiling.gov.in/home.

Step 2: In the right-hand sidebar, you will find a ‘Download’ section.

Step 3: Click ‘ITR Notified Forms AY 2020-21’.

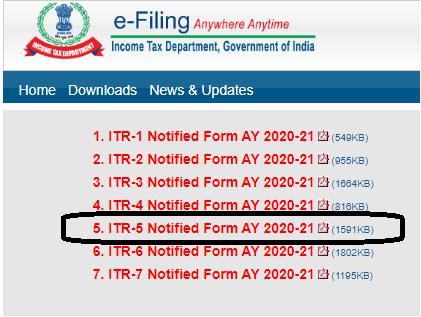

Step 4: Click on ‘ITR 5 Notified Form AY 2020-21’.

Step 5: Download the ITR Form 5 file and fill in the details.

Step 6: You can also download ITR 5 Form using this link: https://www.incometaxindiaefiling.gov.in/downloads/incomeTaxReturnUtilities

Step 7: Select the right assessment year from the dropdown, as shown below:

Step 8: Download the ITR 5 form file in the specified format.

Also Read: Income Tax Slab FY 2020-21 for Companies & Partnership Firms

How to File ITR 5 Form Online?

You can file ITR 5 form online with the Income Tax department in any of these two ways:

1.By filing the income tax return electronically using digital signature

2.By transmitting the return data online and then submitting the return verification in the return form ITR-5

Understanding Fixed Deposits TDS

You can file ITR 5 form online with the Income Tax department in any of these two ways:

1.By filing the income tax return electronically using digital signature

2.By transmitting the return data online and then submitting the return verification in the return form ITR-5

When you file the return online, you must get the two copies of ITR 5 form printed. You, as an Assessee, can keep one of the copies of the ITR 5 form for the record while the other copy needs to be duly signed and sent by ordinary post to the following address:

Post Bag No. 1, Electronic City Office, Bengaluru–560500 (Karnataka).

You must also know about the following things before filing ITR 5 form:

1. If your firm’s accounts are liable for audit as covered under Section 44AB, you must furnish the return electronically under digital signature

2. You need not attach any document while filing ITR 5 form as the return filed using this form is annexure-less

3. You are also advised to match the taxes, deducted or paid, with the details in Form 26AS

Eligibility Criteria

Who is Eligible to File ITR 5 Form?

You can file ITR 5 form online with the Income Tax department in any of these two ways:

The following entities are eligible for filing ITR 5 form: 1)Firm

2)BOI

3)AOP

4)AJP as referred to in Section 2 (31) (vii)

5)Local authority as referred to in Section 160 (1) (iii) or 160 (1) (iv)

What is ITR 5 Form Max Life Insurance

The following entities are eligible for filing ITR 5 form:

1)Firm

2)BOI

3)AOP

4)AJP as referred to in Section 2 (31) (vii)

5)Local authority as referred to in Section 160 (1) (iii) or 160 (1) (iv)

6) Cooperative society

7) Estate of the deceased or an insolvent

8) Societies registered under any state law or Societies Registration Act, 1860

9) Business trust as referred to in Section 139(4E)

Who is Not Eligible for Filing ITR Form 5?

A tax Assessee who is required to file the income tax return under Section 139 (4A) or 139 (4B) or 139(4C) or 139 (4D) need not submit ITR 5 form. Neither they need to check ITR 5 status.

What are the Key Changes Made in the ITR Form 5 in the Last Few Years?

For AY 2020-21:

1) Pertaining to the investments in unlisted equity shares, here are the details to be provided while filing ITR 5 form– name, company type, PAN, and movement in the investment throughout the financial year

2) Inclusion of a separate schedule 112A in ITR 5 form – It covers the calculation of Long Term Capital Gains (LTCG) with the sale of equity shares or units of a business trust liable to STT.

3) Details of tax on adjustments to transfer price as covered under Section 92CE(2A) to be provided

4) Details on deduction claims over investments or payments made from April 1, 2020, till June 30, 2020

For AY 2019-20:

The ITR 5 status was changed in AY 2019-20 with the following updates:

1) Information about recognition as a startup under the Department for Promotion of Industry and Internal Trade (DPIIT)

2) Details about the declaration filled in Form 2

3) Details about all the partnership firms in which the tax Assessee is a partner

4) Bifurcations of donations as per the payment mode – cash or non-cash

5) Information on the turnover/gross receipt as reported for GST

Before you learn how to file ITR 5 form, it is crucial to know about all such changes either online or with the help of a tax professional.

FAQs About ITR Form 5

Q. Can I file ITR 5 form Offline?

A. You can file ITR 5 form offline by either furnishing the bar-coded return or return in the form of physical paper. While submitting the return in physical paper form, you will receive an acknowledgement from the Income Tax Department.

Q. What will happen if I make any mistake while filing ITR 5 form?

A. Every taxpayer needs to file ITR 5 form with utmost precision. In case you need assistance, you are advised to contact tax professionals to know how to fill ITR 5 and avoid any possible mistake.

Q. How Can I Generate Audit Report for ITR 5 Form?

A. It is quite easy to generate an audit report online while you file the return. All that you need to do is to click on ‘Audit Report’, followed by ‘3CA – 3CD’ to generate the report.

Q. What is the due date to file ITR 5 form?

A. The due date for filing this form is August 31.

Q. What is covered in the Schedule-EI of the ITR form 5?

A. It covers the details of the statement of exempt income that is not included in the total income.

Sources:

[1]: https://www.incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/Instructions_ITR_5_AY_2019-20.pdf

[2]: https://archive.india.gov.in/images/banner/linktousbanner/itr/INS_ITR-5.pdf

[3]: https://www.incometaxindia.gov.in/Pages/tax-services/file-income-tax-return.aspx

ARN: Aug21/Bg/18PP