Related Articles

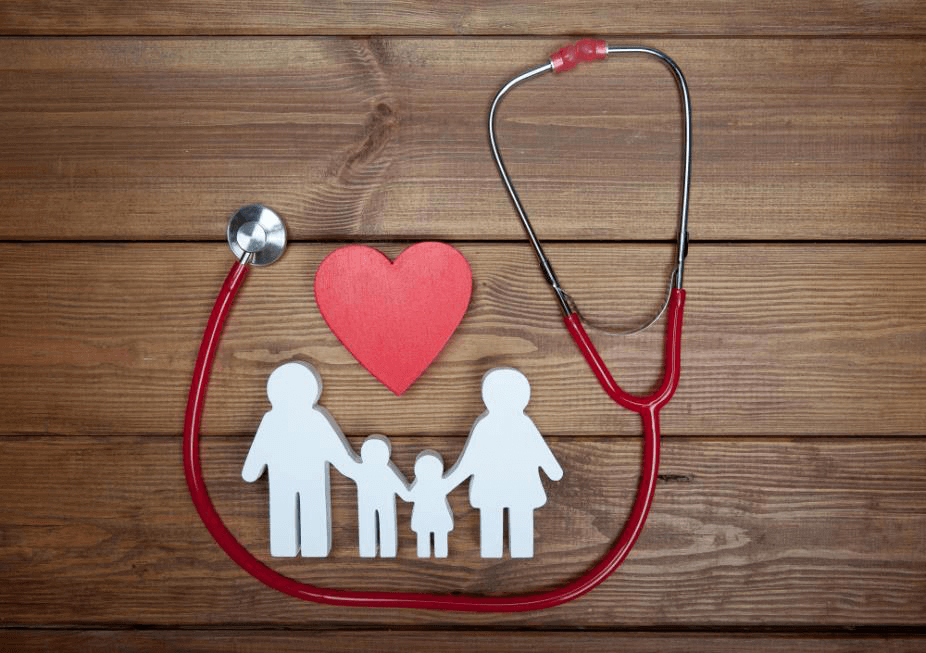

Features & Benefits of Max Life Cancer Insurance Plan

The unfortunate reality of today is that we are prone to several critical illnesses. Among them, cancer is a life-threatening disease…

Read More

Difference between Health, Critical Illness & Cancer Insurance Plan

According to a cancer research paper published in The Lancet Oncology Journal, about 10 lakh people in India are diagnosed with cancer…

Read More

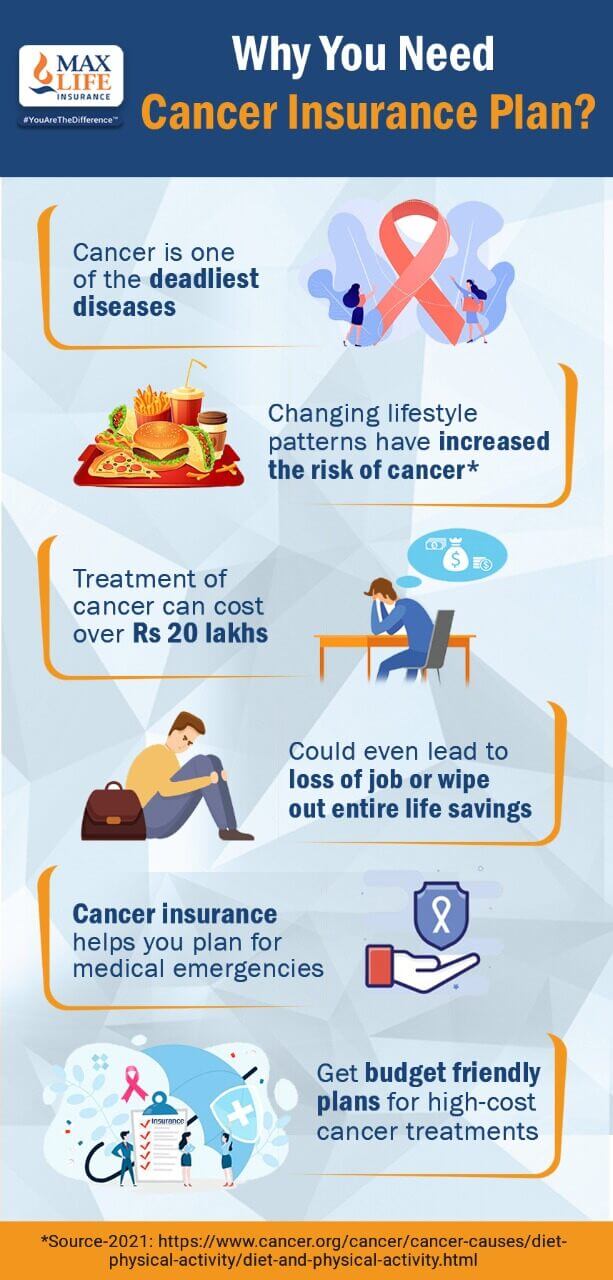

Why is Cancer Insurance Important?

A courageous outlook, albeit seldom seen. Generally, cancer patients struggle with issues of diagnosis and treatment…

Read More