Written by

Updated :

Reviewed by

A courageous outlook, albeit seldom seen. Generally, cancer patients struggle with issues of diagnosis and treatment. Shock and disbelief are usually immediate reactions to the diagnosis. Mixed emotions of anxiety, anger and depression follow as it sinks in. As options and treatment plans are discussed, the patient starts to adjust and prepare for the next steps.

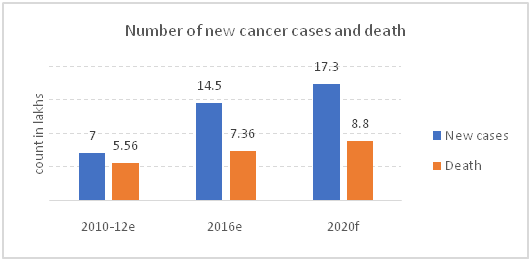

The problem with cancer is its constantly increasing incidence rates. The statistics from the Indian Council of Medical Research (ICMR) show that cancer cases in India are rising[i] at an alarming rate and the situation isn’t going to improve going by ICMR projections for 2020[ii].

Source: Use of tobacco accounts for about 30% of all cancers in India: ICMR, May 19 2016, Livemint

The International Institute of Health Management Research (IIHMR) estimates that by 2021, over 7 crore Indians will likely suffer from cancer[iii]. That is even more than the population of Rajasthan, Gujarat or Tamil Nadu. According to NICPR, the current estimate of people living with cancer is about 25 lakhs, which is more than the population of Goa.[iv]

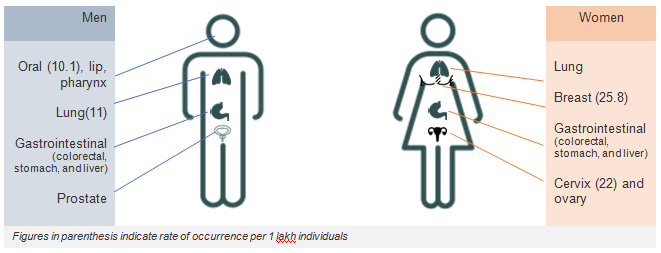

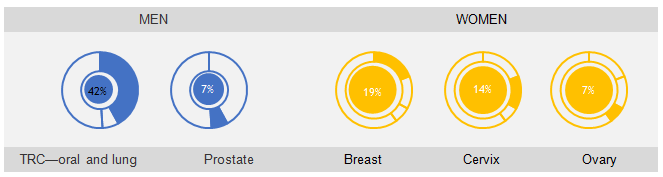

Tobacco-Related Cancer (TRC) is a major culprit and accounts for 30 – 40% of cancer cases[v]. Among all TRCs, oesophagus, lung, hypopharynx, and mouth are the leading sites for both males and females[vi].

Cancer affects men and women differently. According to NICPR, the death toll from cancer in men is 3.56 lakhs and in women, 3.26 lakhs[vii]. According to the EY report, by 2020 men will account for 2.25 lakh TRC cases, while breast cancer cases in women will be 1.23 lakh[viii].

Out of the total cancer cases, nearly 45% of males and 20% of females are due to tobacco consumption. According to EY report, TRC cases are estimated at 2.25 lakhs for males and 3,563 for females[ix].

The top five cancers in men and women account for more than 40% of all cancers

How to contain cancer- Early screening, detection, and treatment

According to NICPR, 71% of cancer deaths occur in the age-group of 30 – 69iv. This demographic represents the economically active and productive age-group, thus having an adverse socio-economic impact on the patient, their families and the country.

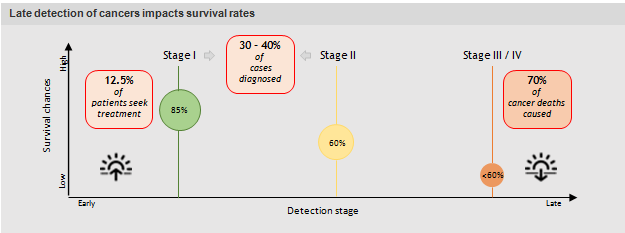

The death toll from the top five types of cancers can be reduced by timely screening, early detection, and affordable treatment. This calls for attention to issues of low awareness about cancer that leads to late detection and consequently high costs of treatment. It doesn’t help that there aren’t enough treatment facilities and well-equipped centres.

Source: https://www.thebetterindia.com/86527/did-you-know-late-detection-cause-70-cancer-deaths/; http://www.business-standard.com/article/news-ians/70-cancer-patients-in-india-consult-doctor-at-terminal-stage-february-4-is-world-cancer-day-117020301268_1.html

Challenges India faces in dealing with cancer

1. Low Awareness: What is unknown goes undetected and untreated

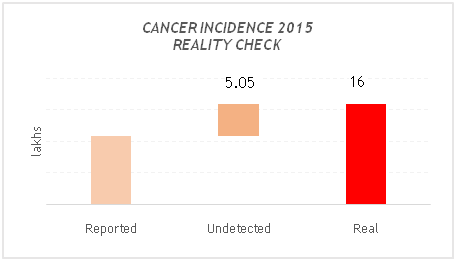

Many cancer cases are not reported, which means there are several people living with the disease, undiagnosed because it remains undetected.

Cancer, if genetic, cannot be prevented despite maintaining a healthy diet and lifestyle that includes no tobacco and alcohol. However, early detection and diagnosis can prevent an untimely death due to the disease.

Source: Call for Action: Expanding cancer care in India, EY

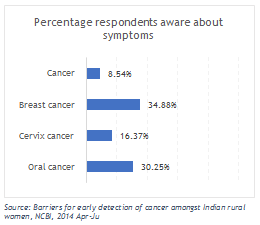

Ask anyone “What is cancer?” ”How does it happen?” or “What are the symptoms of cancer?” and you will likely be met with a blank stare. Very few people notice the occurrence of the symptoms in order to act on it sooner rather than later.

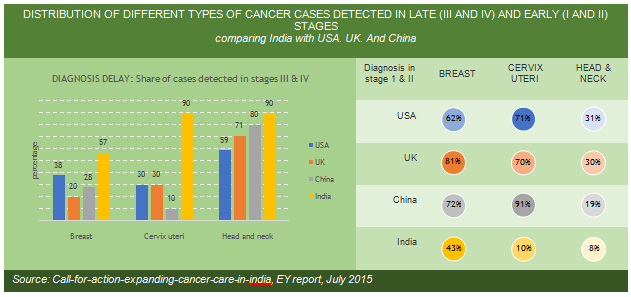

In the context of breast and cervix uteri cancer cases, awareness amongst women is low — symptoms, the possibility of early detection, available tests and the possibility of a cure for the disease is low.

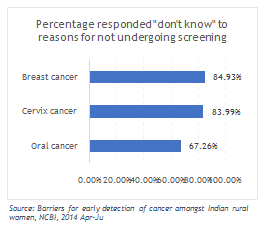

According to a 2014 study published in the South Asian Journal of Cancer, the main barrier to screening was lack of information. The study, comprising 281 women showed the following results:

1. Only 8.54% of women knew correctly what cancer means.

2. And 30.96% knew that cancer is curable while 27.76% were under the impression that it wasn’t. However, 41.28% had no answer.

3. Only 4.59% of women knew that cancer is curable upon both, early diagnosis and right treatment.

4. 66% of women thought only early diagnosis could cure cancer, while 51.72% thought only the right treatment could help.

The results show that people need to be more aware of cancer, what it is, the causes, symptoms, and screening tests. Unless the common man has this information, there can be no immediate contact by way of consultation with a doctor. The consultation could trigger the process of detection and diagnosis that not only reduce treatment costs but provide better chances of recovery too.

On the other hand, late detection of cancer impacts survival rates and cost of treatment.

|

|

2. High Treatment Costs: Late detection = higher treatment costs

The cost of treating cancer is high. Upon early detection, costs can be as low as Rs.3 – 4 lakhs in India, provided the victim can continue with their job. However, based on various factors, costs can rise as high as Rs.20 – 50 lakhs, leading to borrowing or distress selling off possessions. Single chemotherapy can cost between Rs.16,000 – 45,000 per session, in top Indian hospitals.

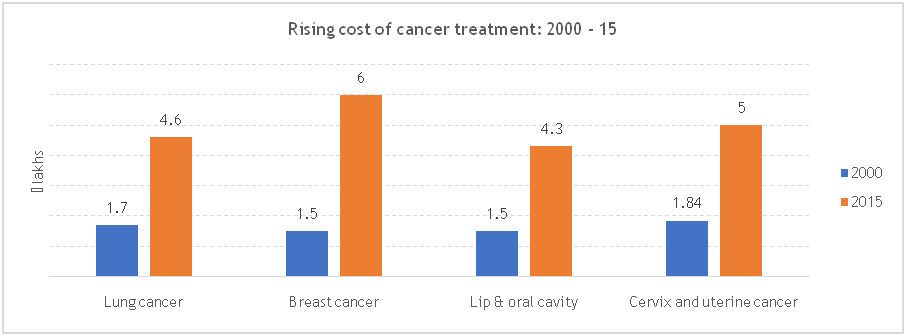

As per a report in The Economic Times newspaper, costs have increased by over 300% between 2000 and 2015 for different cancer types[x]:

Source: Can you bear the cost of cancer treatment? ET, Jun 22, 2015

3. Facility Shortage: Lack of medical infrastructure for cancer treatment

When it comes to actual treatment, India has serious constraints in terms of hospitals, staff, equipment and number of medical seats for oncology courses. For instance, only 30% of the available cancer centres have advanced imaging technologies such as PET-CT, which is essential for accurate diagnosis, staging and response monitoring of cancer.

In addition, access to multi-modal treatment options is inadequate and 40-60% of facilities and oncologists are concentrated in the top 7 to 8 metropolitan cities.

As the EY report (Call for Action: Expanding cancer care in India July 2015) states, lack of adequate infrastructure and absence of mass screening programmes still remain key barriers to timely and accurate diagnosis in India. There are an estimated 2,700 mammograms installed in India, representing less than 5% of that in the US. Additionally, the majority of the estimated 120 PET-CT scanners are in metros.

Source: Call for Action: Expanding cancer care in India, EY, July 2015

There is an option – Fight the battle against cancer with a cancer insurance plan

Given the high costs of treatment, an insurance plan can be a resourceful weapon in the battle against cancer. Not only can it equip you with the necessary funds to seek the best treatment, but it can also prevent your savings from being wiped out.

Ensure to insure. It is essential to protect yourself and your family from the heavy financial burden of this disease. Hence, make sure you buy a cancer insurance policy at the earliest.

Health insurance policies generally pay only for inpatient hospitalisation and treatment in India. They do not cover the entire cost of treatment, especially because many don’t buy coverage that exceeds Rs.5 lakh[xii]. A comprehensive medical insurance (usually floater policies covering entire family) that covers a wide range of medical problems comes with sub-limits on the amount payable in different situations. However, this problem can be addressed with a Critical Illness Rider.

A critical illness rider helps pay for expensive treatments required for specific diseases at premiums lower than comprehensive medical insurance plans. However, critical illness insurance plans also have some limitations. For instance, they only cover cancer at an advanced stage, i.e. when a malignant tumour is growing uncontrollably, invading and destroying normal tissues. Also, a regular critical illness plan provides only a lump-sum benefit and does not waive future premiums payable by the insured.

A cancer insurance plan covers costs incurred for diagnosis and treatment for most cancer types and at any stage (early or advanced), irrespective of gender. Typically, the insured has to be aged between 18 and 65 years; the sum assured can be in the range of Rs.5 – 50 lakh and the terms of policy renewal after 65 years of age varies from policy to policy.

Given the comprehensive scope of coverage, cancer insurance plans basically provide:

1. Financial and mental security as they have lump-sum payouts at various stages of diagnosis, treatment and surgery.

2. Payouts depending on previous claims and different stages of severity.

3. Free regular cancer check-ups during the policy term.

4. The option to choose a waiver in premium for the remaining policy term when a claim under the major stage cancer benefit clause is approved and there are no outstanding premiums.

Cancer insurance is reasonably priced compared to other types of health plans. Just like any medical insurance, the premium paid is also eligible for tax benefits as per prevailing tax laws. And there is no death, maturity or surrender benefit payable under such plans. Here is a basic comparison of a regular health insurance plan and a cancer insurance plan:

Regular health insurance |

Cancer insurance plan |

Cancer-specific exclusions like pre-malignant tumour, non-invasive cancer (cancer in situ), prostate cancer stage 1 (T1a, 1b, 1c), etc. |

Covers all stages and forms of cancer through diagnosis to treatment |

Generally, pays only for inpatient hospitalisation and treatment in India |

A fixed benefit is paid irrespective of the cost incurred based on early or major stage Cancer |

No benefits for a premium waiver |

Provision for a premium waiver for the policy term |

Higher premiums for large sum assured |

Reasonably priced premium across the range of sum assured |

Remember, cancer insurance plans do not usually cover skin cancer and cancer caused by sexually transmitted infections, congenital or pre-existing conditions, and nuclear, biological or chemical contamination. However, cancer insurance is a secure option to ensure you are covered when facing this critical condition. Get a Quote today!

2. In India, 10 lakh new cases of cancer detected every year, Sep 18, 2017, Times of India

3. Cancer to be a major disease in India: change in lifestyle main culprit, MIO hospital, March 1, 2017

4. Tobacco use accounts for 40 per cent of all cancers in India, says report, The Hindu, JULY 21, 2016

6. Cancer Hits More Women In India Than Men, But More Men Die Of It, NICPR, January 20, 2018

8. Call for action: Expanding cancer care in India, EY, July 2015

10. 'Orphan Drugs Act' a crying need in India - ACCI 2017, Sep 28, 2017, ACCI

11. Why you should consider a cancer insurance policy, Aug 05, 2015, ET

ARN:-Jan/Bg/142