Written by

Updated :

Reviewed by

Importance of Critical Illness Cover

Many lucky individuals in the world rarely hear the term ‘critical illness,’ while it is a part of life for many others. The major prevalence of unhealthy lifestyles paired up with the degrading environment has led to the occurrence of life-threatening diseases among Indian citizens.

Data suggest that the cases of many lifestyle and critical diseases have doubled in India in the last two decades, leading to the increased burden of diseases in India.

Sadly, in the event of a healthcare emergency resulting from a critical illness, health is not the only concern in mind for many. The exorbitant costs of critical illness treatment can lead anyone towards financial ruin unless things have been planned right.

Paying medical bills from your pocket can be easily avoided with a health insurance policy. However, the loss of a breadwinner next to such a health crisis can further add more load to the financial worries. Many standard health insurance plans do not cover critical illnesses. This is where critical illness coverage with life insurance comes to your rescue.

A big health emergency can happen to anyone. A critical illness cover is something that can protect you and your family from facing a financial burden.

What is Critical Illness Cover?

Critical illness cover refers to the insurance coverage provided against various life-threatening diseases. Here, ‘critical illness’ refers to the health condition or disease that is dangerous to life and thus, requires regular check-ups and ongoing treatment.

When paired with a life insurance policy, it provides additional coverage for specific critical illnesses above the base plan benefits. Since illnesses like a heart attack or cancer often incur above-the-average medical expenses, critical illness payouts under this cover help deal with the overruns.

The list of critical illnesses covered under such insurance add-ons may vary from one insurer to the other. Hence, it is important to check it before making any final decision.

Need for Critical Illness Coverage in India

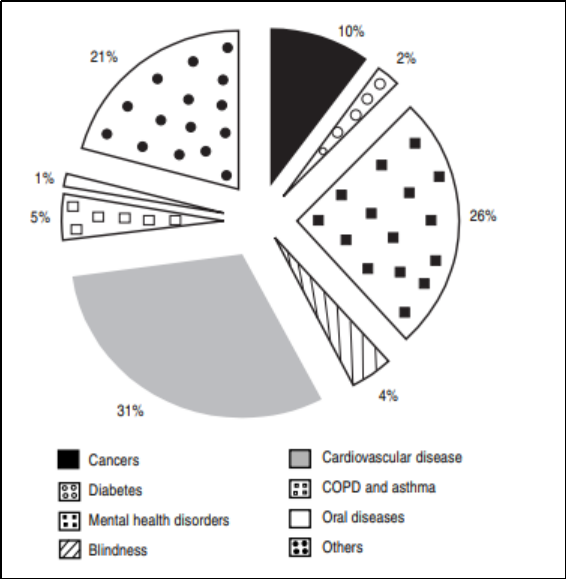

Various health diseases have plagued India in the last few decades. Heart diseases, kidney failures, strokes, and paralysis have become common in our nation. Various statistics related to these diseases provide a dull picture.

- As per the Global Burden of Disease in 2016, more than one million Indians died due to heart diseases.

- The studies have also reported an increased prevalence of Coronary Heart Disease (CHD) in India over the last 60 years, ranging from 1%-10% in urban regions. The risk factors associated with this disease are diabetes, hypertension, obesity, to name a few.

- As per data from ICMR, diabetes cases have risen to 7.1%, which is one cause behind Chronic Kidney Disease (CKD).

These factual data points are alarming and indicate that health has taken a backseat for many Indians. A sedentary lifestyle, higher work stress, and the increasing cost of medical treatments make us move a step closer to a health crisis every day.

As a prevention method, you can choose critical illness coverage under a life insurance policy to be prepared for various eventualities. If you have plans to buy life cover, you can easily add a critical illness rider to the chosen life insurance policy for additional benefits.

Benefits of Opting for Critical Illness Rider with Life Insurance

1. Protection Against Critical Illnesses

Irrespective of age, the occurrence of life-threatening diseases is a reality. Many Indians neglect their health because of the lack of adequate funds to get good quality treatment. With critical illness coverage by your side, you can avoid worrying about the financial side of medical treatments.

On diagnosis of any critical illness defined in the policy, you will receive a lump sum amount to avail the treatment and focus on improving your health.

Another advantage of investing in a critical illness rider is that you can keep your savings intact for various life goals. In general, an individual resorts to his savings first when a health crisis occurs. The rising treatment cost for critical illnesses can lead to loss of life-long savings in the least time, which can be avoided with critical illness coverage. You can select the rider sum assured based on your current health condition.

2. Financial Advantage for Your Family

One of the most saddening results of critical illnesses is the loss of victim’s life. While many illnesses are recoverable in their initial stages, loss of life can occur if the illness has caused significant damage to the body. Other than the emotional stress of losing a loved one, family members of the deceased may have to go through financial troubles to make ends meet.

A life insurance policy combined with critical illness cover can help a lot in this regard. While critical illness cover helps in getting medical treatment, the base plan ensures the financial security of your loved ones. In case of your unfortunate demise resulting from a life-threatening disease, your family will receive insurance payouts under the chosen life insurance plan. Think of it as dual protection under one plan. Even after you receive the critical illness rider benefits, the base policy will continue to provide the chosen life cover.

3. Total and Permanent Disability Cover

Total and Permanent Disability is yet another face of critical illnesses. The long-term effect on a life-threatening ailment in the body can lead to such a disability, hurting an individual badly emotionally and financially. This can also lead to job loss as the victim would not be able to return to work in the same capacity as before.

Choosing the right critical illness rider can also be advantageous in this regard. Many such riders include disability cover, which works on the occurrence of the total, permanent disability resulting from an unfortunate accident or disease. Such benefits are payable on the valid claim during the rider tenure as per the policy's terms.

4. Peace of Mind

In a life full of uncertainties and rush hours, peace of mind has become a rare commodity. While some people are worried about their health, others stress more about managing finances in life to keep their loved ones happy. Buying life insurance with critical illness cover helps avoid the stress that would otherwise result because of various diseases.

When you know you have purchased a critical illness rider, you can rest assured that you will not have to dig into your savings or borrow loans to get medical treatment. Taking care of your health no matter how much you earn then becomes the source of peace.

Get Critical Illness Coverage the Max Life Way

Protection against critical illness is the need of the hour, and Max Life Insurance is there to provide the same. We provide Max Life Critical Illness and Disability Rider for additional protection against various life-threatening illnesses. You can include this Rider with various insurance products we offer.

A unique Max Fit Program has also been designed under this Rider with the aim to help you live a healthy lifestyle. You can get a discount on renewal premiums under this program by accumulating the maximum number of healthy weeks during the policy years. In other words, the healthier you will be, the lower will be your insurance premium.

This e-super Customer week, our focus is to make sure the thought of a healthcare emergency will not trouble you anymore. You also get free access to the MaxLife fit app for five years. This advanced app will help you follow a healthy regime and prevent the risk of suffering from various critical illnesses.

At Max Life Insurance, we know how important it is for you to maintain good health in life. That is why, we want you to achieve that goal with our offerings. For us and your loved ones, #YouarethedifferenceTM.

*Note : By submitting, you are giving Max Life Insurance consent to connect with you on the mobile no. provided by you.

ARN : Dec/CI/LF-1