Written by

Updated :

Reviewed by

Picture yourself as a batter – batting confidently on a scoring wicket – dispatching every ball to the boundary. As you knock another one out of the park, you sub-consciously start celebrating your upcoming century in your head, which is just a couple of runs away. At that very moment, the bowler delivers a well-disguised slower ball, which catches you completely off guard. Even as you try to go big, the ball slips through your bat, and knocks the stumps out!

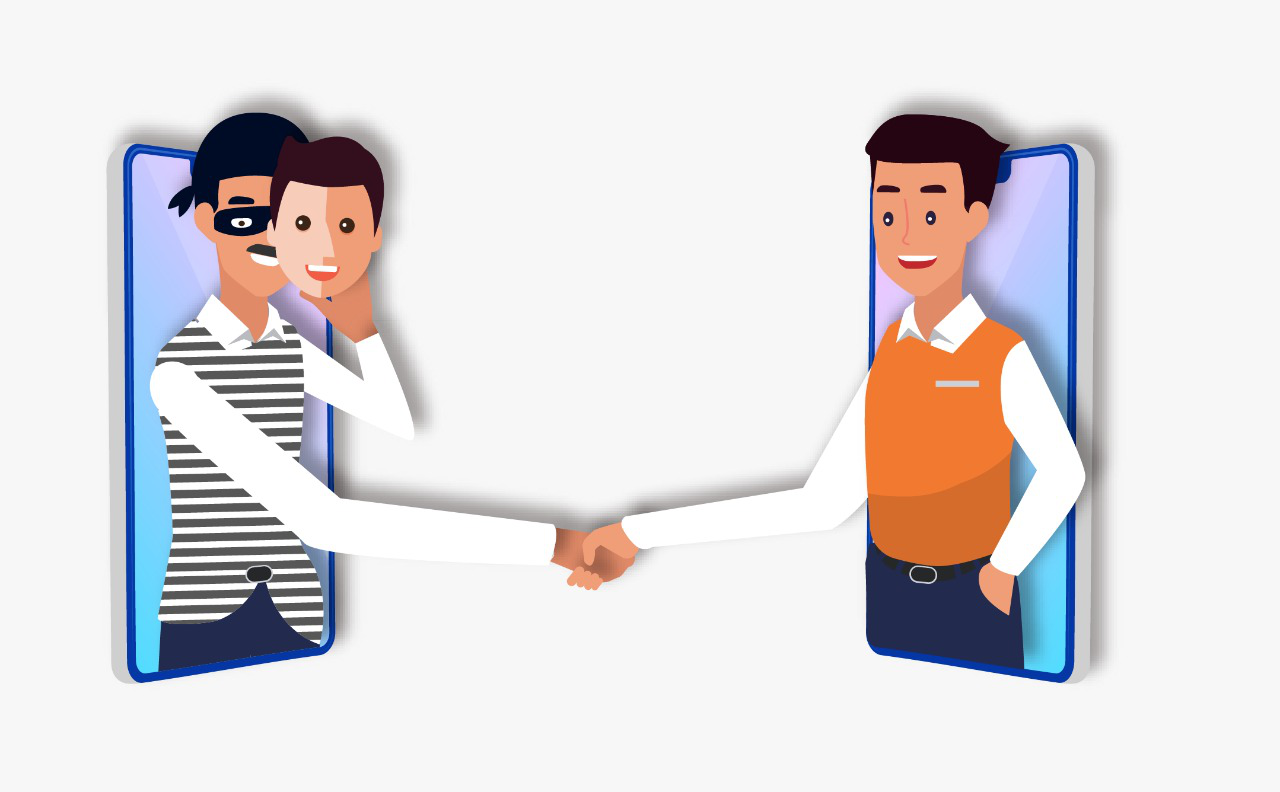

This is precisely how typical cybercriminals operate.

When you click on that seemingly safe premium payment link, start sharing your personal information with a caller who’s supposedly representing Max Life, or get overexcited about availing a special offer which will let you withdraw your benefits early by paying a small ‘facilitation fee’ – you are simply replicating a batsman’s casual approach when he’s playing on a wicket he thinks he can trust. And that’s when he - and you - are the most vulnerable; fraudsters take advantage of that very vulnerability to prey on you to cheat you of your hard-earned money.

Guess what, you’re not alone in this battle against cybercrime.

Here’s a list of Dos & Don’ts which will help you safeguard yourself & your loved ones from fraudsters!

Dos |

Don’ts |

|

|

Frequently Asked Questions

Q. How do fraudsters target you?

Fraudsters use illegal means to access information from various sources and then use it to sound as authentic as possible – this information is then used to scam innocent people. You may have come across such incidents and notifications in media.

This is a global menace, and that’s why we’re trying our best to enable you to avoid getting targeted by these fraudsters and their typical modus operandi.

Q. If you’ve realized that you have made a payment to fraudster’s account mistakenly/in error <xx> days back, what are the immediate steps you need to take?

Please file a complaint with your bank immediately regarding the same preferably within 2-3 working days. Also, reach out to us and we will guide you on next steps.

In such cases (wherein the incorrect payment has been reported within xx days of the incident), it’s highly probable that your bank will take corrective action against the fraudulent payee and help you with the reversal process. However, you need to contact your bank immediately – either virtually or in person – and also share a copy of your complaint with us. This will help us keep track of such fraudsters & further enable us to develop checks & balances to deal with them in the future.

Q. Once I report an incident to Max Life, what actions will they take to help me out?

We remain strongly committed to help all our customers whenever any such incident is reported to us. We follow a three pronged approach in all such matters-

1. Our investigation team is available to aid you in filing police, bank or cyber security complaints if required, in all such matters

2. We caution our customers through regular communication- SMS and emails on modus operandi of fraudsters and ways to stay vigilant

3. We also work closely with various authorities on behalf of our customers like RBA, TRAI, Cyber cell etc.

Q. How does a fraudster manage to sound so genuine?

These fraudsters usually operate in well organized gangs. They gather information from various social media sources and then use it in a manner which appears to be authentic. Such racketeers pose a threat to customers all across.

Please keep track of our communication regarding this topic. We try our best to educate & empower you to deal with such fraudsters through various collateral (SMSes, Emails, Videos etc.), shared with you at timely intervals.

Q. How do fraudsters target you?

While it isn’t possible to identify every fraudster through a sure-shot system, here are some red flags to watch out for (to help you spot a potential fraud/fraudster in advance):

Any call/communication offering discounts* on renewal premiums or commissions bonuses or early maturity, replacement policy etc in other words, any kinds of offer in form of lump sum payment, discount, another policy/item in return of a payment made by you earlier in advance in name of Max life.

Any payment solicitation requests for beneficiaries like Max, Max Life, MLI etc. Please note that we accept payments solely through “Max Life HSBC Account no 1165 <followed by policy no>” or through payment modes mentioned on our website “www.maxlifeinsurance.com”

We never ask for OTP on phone hence this should be a red flag for you

We never solicit payment to discontinue services of your agent and we never solicit payments to disburse your agent commission into your account

Go with your gut feeling, if something sounds suspicious, it usually is. It is better to cross check with us

Q. What can I do to ensure the safety and security of my data available with Max Life?

While we certainly have a strong governance mechanism & robust controls to ensure the confidentiality of our policyholders’ information, we also request you to adhere to the following tips in order to protect the sanctity of your data:

DON’T share your personal and policy details with strangers

DO NOT share your account password etc. with anyone

Pay premiums only on Max Life prescribed payment modes - www.maxlifeinsurance.com Do not make payments to any individual account/third party.

Please be aware of any offers soliciting payments as a means to provide extra discounts*/early maturity etc. for your policy; as we never make any such offers to customers

ARN No: Feb22/Bg/28