Written by

Updated :

Reviewed by

On this Page

The ITR 3 for AY 2020-21 applies to every individual and Hindu Undivided Family (HUF) having income from a proprietary business or carrying on a profession such as architecture, accountancy, engineering, medical and more. ITR 3 may also comprise income from house property, salary/pension and income other such sources.

ITR 3 is one of the detailed ITR forms in which the person filing the return has to give full particulars of his profit and loss during the period and the assets and liabilities as at year ending date.

What is ITR 3?

The ITR 3 is applicable for individual and HUF who have income from profits and gains from business or profession. Individuals having income from the following sources are eligible to file ITR 3:

1) Carrying on a business or profession (both tax audit and non-audit cases)

2) The income tax return may include income from House property, Salary/Pension, capital gains and Income from other sources

3) Also Read: Income Tax Return Due Date Extension

Structure of ITR 3 for AY 2020-21

The ITR 3 is divided into four major parts – Part A, Schedules, Part B-TI and Part B-TTI

PART- A: General

1) Part A-BS: Balance Sheet as of 31 March 2020 of the profession or proprietary business

2) Part A-Manufacturing Account- Manufacturing account for the AY 20-21

3) Part A-Trading Account- Trading account for the AY 20-21

4) Part A-P&L: Profit &Loss Account for AY 2020-21

5) Part A-OI [Other Information]: It includes mentioning the method of accounting followed by the taxpayer in the previous year, change in accounting method (change from accrual system of accounting to a cash system, valuation method employed for the stock). For example, FIFO or weighted average method, amount allowed and disallowed under various sections.

6) Part A–QD: Quantitative details

Schedules: Schedules of ITR 3 forms as valid relating to salary, business or profession, house property, other sources etc.

Part B-TI: Shows computation of total income and

Part B-TTI: Shows computation of tax liability on total Income.

Eligibility to File ITR 3 Form

ITR 3 Form needs to be filed by individuals and Hindu Undivided Family (HUF) if their gross income comprises of:

1) Income from a single or more than one house properties.

2) The income produced from short or long-term capital gains.

3) Income from profession or business practiced under a proprietorship business owned by an individual or HUF.

4) Income from sources such as lottery, horse race betting and other forms of legal gambling.

5) Income created from foreign assets belonging to individuals.

How to Download ITR 3 Form?

For ITR 3 download, you can log in to the official website of Income Tax Department without any cost. You can click on the following button to download ITR 3 form online from the official website.

Below are the steps to follow for downloading ITR 3:

Step 1: Visit--https://www.incometaxindiaefiling.gov.in/home

Step 2: Under the Download tab, click on “Offline Utilities”.

Step 3: Then, go to “Income Tax Return Preparation Utilities”.

Step 4: Select your Assessment Year, i.e. 2020-21.

Step 5: Click on “Excel Utility” for filling the details under ITR 3 column and download the respective file.

Step 6: Print the ITR 3 download and fill in the details carefully to avoid any unnecessary mistakes.

See how the latest budget impacts your tax calculation. Updated as per latest budget on 1 February, 2020. No deductions will be allowed under the new tax regime.

How to File ITR 3?

You can file for an income tax return through the ITR Form 3 by using either online or offline mode. Once you submit an income tax return, you will get an acknowledgement in ITR V from the Department of Income Tax. You can also download the acknowledgement from the official website.

You will have to submit the duly completed form to the Income Tax Department’s office within ten days of e-filing or e-verify.

1.) Online

Taxpayers who are eligible for ITR 3 can submit duly filled ITR form 3 online from the income tax department e-filing portal. You can file your income tax return online and verify it by using your digital signature. Also, you can submit the return online and then verify it using ITR V.

Taxpayers filing ITR 3 online using digital signature will receive the acknowledgement receipt on their registered email id. Note that ITR 3 is an annexure-free form; thus, you do not need to attach any documents with it. However, to file the ITR, you need to be registered on the e-filing portal.

2.) Offline

Only taxpayers belonging to any of the below groups are eligible to file ITR 3 offline mode:

1) Individuals who are 80 years of age or more

2) Individuals having income less than Rs. 5 lakh and do not have any income tax refund request

Individuals belonging to such classes can submit ITR 3 either through a paper form or in bar-coded form.

After submitting your income tax return by online or offline mode, you must verify the same within 120 days of filing. Let us see how.

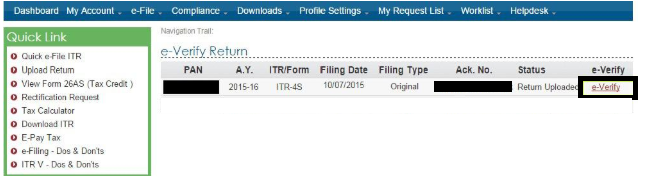

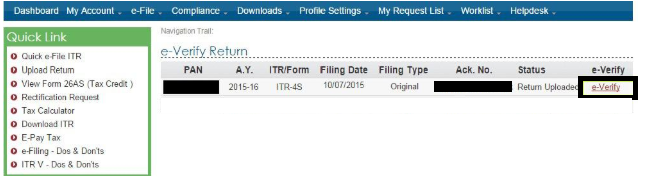

E-Verification of ITR 3

Step by step guide for e-verification of ITR 3:

Step 1: Visit the Income Tax Department e-filing portal and click on “e-Verify Return” option.

Step 2: Enter your PAN number, acknowledgement number and assessment year sent to you at the time of filing ITR 3.

Step 3: Then, the following web page will display the details of the uploaded return. Click on e-verify to start the ITR 3 verification procedure.

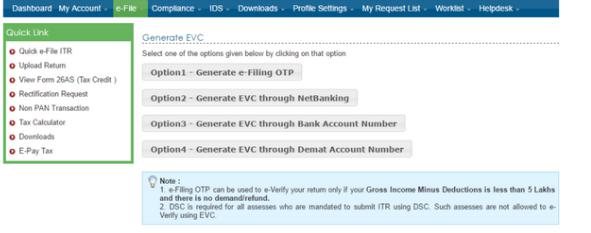

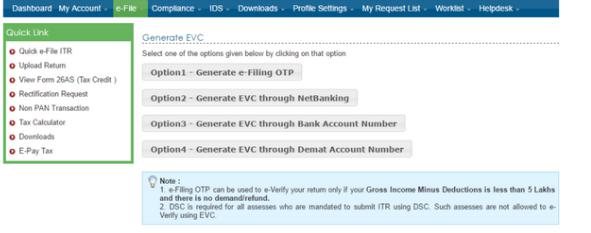

Step 4: Several methods to generate the e-verification code (EVC) will be displayed. Generate EVC using the most suitable method for you.

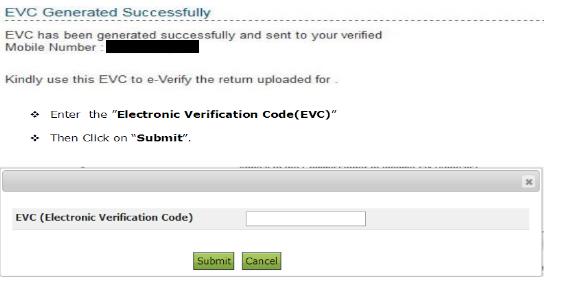

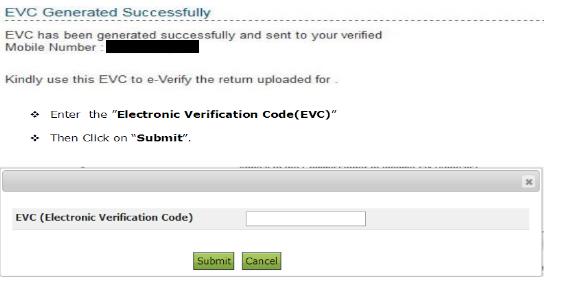

Step 5: After successfully generating the EVC, enter the code and click on the ‘submit’ option.

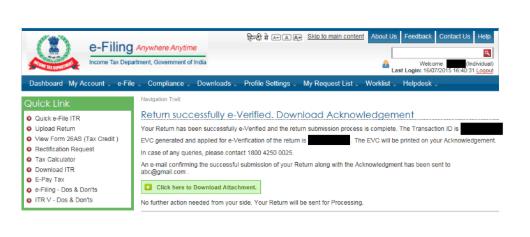

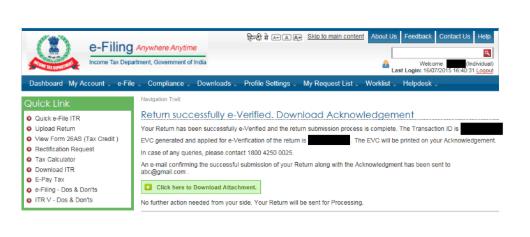

Step 6: Finally, the “Return successfully e-verified” message will display on your screen with a transaction ID after you submit the EVC. You may also download the attachment using the green button for your record.

What is the Due Date for Filing ITR 3 Form?

It is advisable to file form ITR 3 before the due dates to avoid any penalties. The due date for filing ITR for AY 2020-21 is as follows:

1.) For Individuals: 30 November 2020

2.) For Businesses: 30 November 2020

Also Read: Why you Need to File Your ITR on Time?

Significant Changes in ITR 3 for AY 2020-21

1) The taxpayer must disclose the amount of cash deposits above Rs.1 crore in the current accounts with a bank, expenditure incurred above Rs.2 lakh on foreign travel and the expense incurred above Rs.1 lakh on electricity.

2) In case the taxpayer is a director in a company or holds unlisted equity investments, the ‘type of company’ must also be disclosed.

3) In case of short-term or long term capital gains from the sale of land or building or both, the details of the buyer(s), i.e. name, percentage share of ownership, PAN or Aadhaar and address have to be shared too.

4) A discrete schedule 112A for the calculation of the long-term capital gains on the sale of equity shares or units of a business trust which are liable to STT.

5) Under ‘income from other sources’, a taxpayer must provide the details of ‘any other income’ that may concern the taxpayer.

6) The details of the deductions against ‘income from other sources’ must be given.

7) The ‘Schedule VI-A’ for tax deductions is amended to include deduction under section 80EEA and section 80EEB.

8) In the case of a business trust or investment fund, the details of ‘capital gains’ income and ‘dividend’ income should be provided.

9) The details of tax on secondary adjustments to transfer price under section 92CE(2A).

10) The details of tax deduction claim for investments or payments or expenditure made between 1 April 2020 until 30 June 2020.

11) While providing the details of bank accounts, if a taxpayer selects multiple bank accounts for credit of refund, the income tax department may choose any account for processing the return.

Also Read: How to Save Income Tax?

9) The details of tax on secondary adjustments to transfer price under section 92CE(2A).

10) The details of tax deduction claim for investments or payments or expenditure made between 1 April 2020 until 30 June 2020.

11) While providing the details of bank accounts, if a taxpayer selects multiple bank accounts for credit of refund, the income tax department may choose any account for processing the return.

Also Read: How to Save Income Tax?

Difference between ITR 3 and ITR 4

Fundamentally, ITR 3 and ITR 4 are the two separate income tax return forms that apply to taxpayers earning income from a business and profession. ITR 3 means that individuals earning an income from salary, business profession, and other sources can use, whereas ITR 4 applies to taxpayers who opt for declaring income under the presumptive scheme.

1) The ITR 3 for AY 2020-21 applies to every individual and HUF having income from a proprietary business or carrying on a profession like architecture, accountancy, engineering, and medical

2) The ITR-4 Form for AY 2020-21 is the Income Tax Return form for those taxpayers who have chosen the presumptive income scheme. This scheme was framed to provide relief to small taxpayers from the tedious job of maintenance of books of accounts and getting them audited.

FAQs About ITR 3 Form

Q. What is ITR verification?

A. ITR verification is the procedure of validating your uploaded ITR. If you do not verify your ITR on time, it will be considered null and void. In such a case, you will have to file a return again along with late filing penalties.

Q. What is EVC?

A. EVC denotes Electronic Verification Code. It is a 10-digit alphanumeric code, i.e. unique to every PAN number.

Q. Who can use ITR 3?

A. An individual or a Hindu Undivided Family (HUF) carrying out a proprietary business or profession can file ITR 3.

Q. How to generate EVC or Electronic Verification Code?

A. You can generate EVC through Bank ATM, bank account number, netbanking, Aadhar OTP and Demat account.

Q. What happens after E-verification?

A. Once you verify ITR 3 online, check the ITR status. ITR will be processed, and you will get notified with an intimation from the IT department.

ARN: Aug21/Bg/18KK