Written by

Updated :

Reviewed by

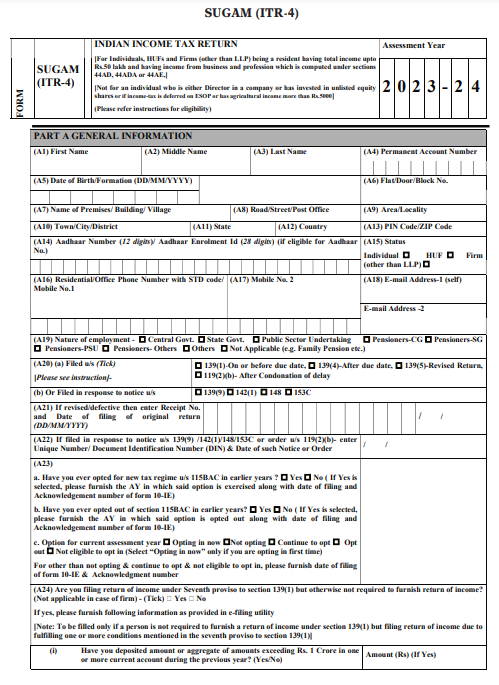

ITR refers to Income Tax Return, and ITR 4 Sugam Form is to be filed by HUF (Hindu Undivided Family), firms (except limited liability partnership) and individual taxpayers who have annual income of up to Rs. 50 lakh from business and/or profession. These taxpayers are those who are filing return under the presumptive income scheme in Section 44AD, Section 44ADA and Section 44AE of the Income Tax Act, 1961. Individuals earning gross revenue from business up to Rs.2 crore can opt for these presumptive income schemes.

Who is Required to File ITR 4?

ITR 4 is to be filed by individuals/HUF/ partnership firm (apart from LLP) whose gross income of AY 2023-24 includes:

1. Income from the business and profession computed on presumptive basis under sections 44AD, 44ADA or 44AE.

2. Income of up to Rs.50 lakh for FY 2022-23

3. Taxpayers with income from agricultural income up to Rs. 5000 in the FY and single house property

4. Those with income from other sources (except winning from lottery and income from legal bettings) and family pension income

5. Taxpayers with interest income during the FY including interest on income tax refund, interest from bank/post office/co-operative society deposits or savings accounts, interest income from unsecured loans, etc.

Eligibility Criteria

- Carrying on a business or profession

- Eligible for Presumptive Business Income only when the turnover/gross receipts does not exceeds Rs. 2 crore

- The return may include Salary/Pension

- Earn Income from House Property

- Earn Income from Other Sources

Note: Freelancers engaged in the above profession can also opt for this scheme if their gross receipts don’t exceed Rs.50 lakh.

Also Read: How to Check Salary Slip?

Who is Not Eligible to File ITR Form 4 (Sugam) in AY 2023-24?

The ITR-4 (Sugam) form cannot be used by firms (excluding LLP), HUF and individual taxpayers in certain cases including the following:

Taxpayers who are non-resident Indians or RNOR (Resident Not Ordinarily Resident)

Those with total income exceeding Rs. 50 lakh or agricultural income over Rs. 5000 in FY 2022-23

Taxpayers who are company directors or have income from more than one house property

If the taxpayer has income from lottery winnings during FY 22-23 or is eligible for income tax under special rates under sections 115BBDA or 115BBE

Those who have held unlisted shares in the previous year or has deferred income tax from employee stock options received from eligible employer

Taxpayers who are not eligible for presumptive taxation u/s 44AD, 44ADA or 44AE such as those operating business with gross receipts exceeding Rs. 2 crore.

Structure of ITR 4 for AY 2022-23

ITR 4 (Sugam) comprises the following parts:

Part A: General information

This section requires you to fill in your personal details such as name, PAN details, address, Aadhaar number and Email id. Also, you need to mention the nature of your employment. It also asks you if you are filing the return yourself or through a representative such as a chartered accountant.

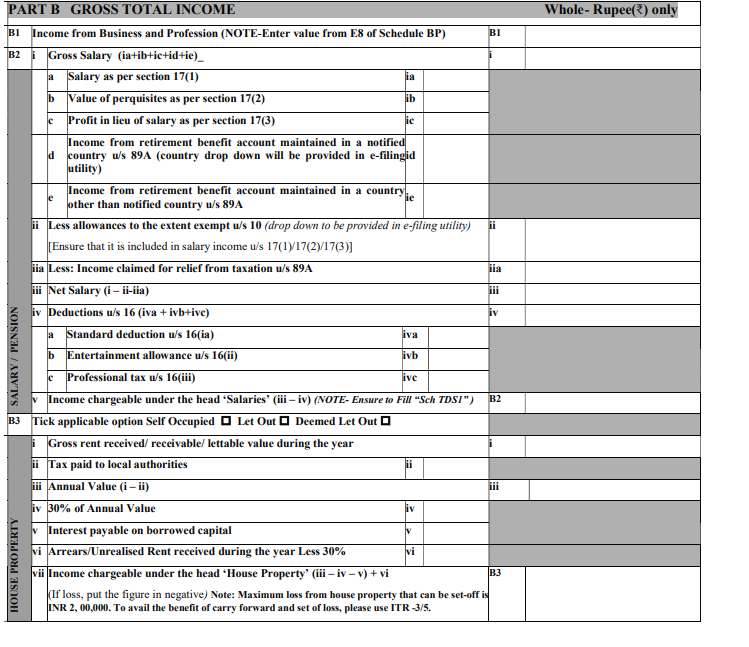

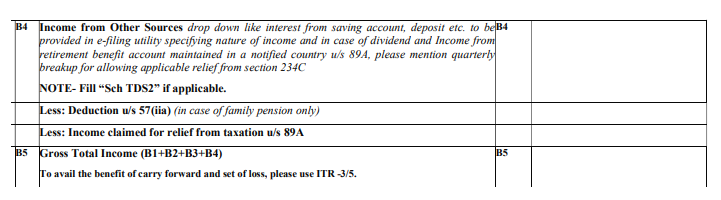

Part B: Gross total revenue from the five heads of income

This section deals with gross income. Enter the aggregate income chargeable under ‘Business or Profession’. Enter your salary, the value of perquisites and profits. Fill in the exempt allowances and the standard deduction as per Form B. Fill out all the other necessary information as required and proceed.

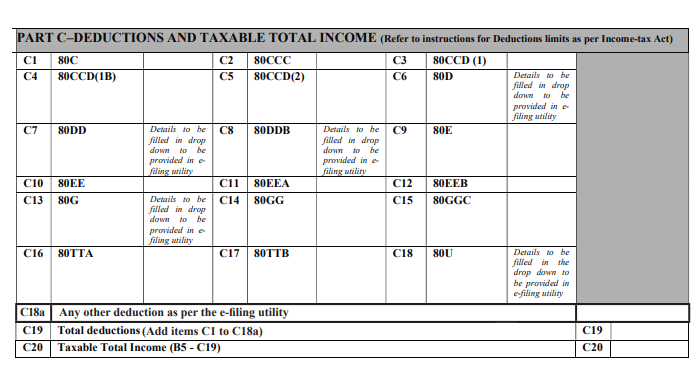

Part C: Deduction and total taxable income

Here, you have to mention the eligible deductions for you. It can be in the form of insurance premiums, contributions to provident fund, deferred annuity, and subscription to individual equity shares or debentures. Contributions to pension funds, health insurance premiums, interest on the loan for buying property or higher education, too, are excused from tax.

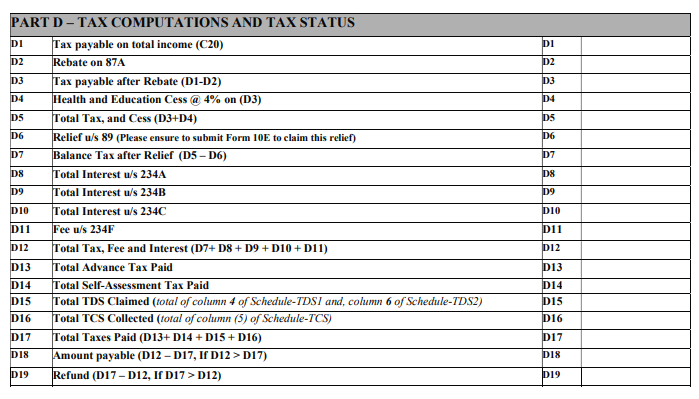

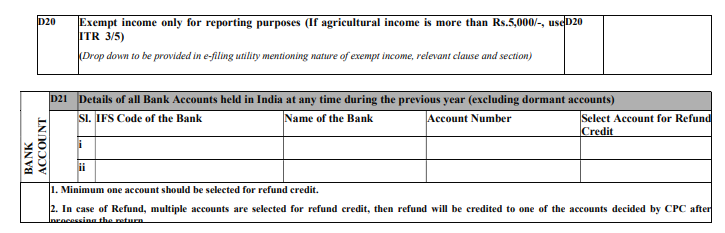

Part D: Tax status and computation

Calculate the tax payable on your gross income based on the specified formula. Also, you have to calculate the amount payable. Mention the details of all the savings/current accounts made by you at any time in India for the previous year. Provide the account details in which you want the refund to be credited.

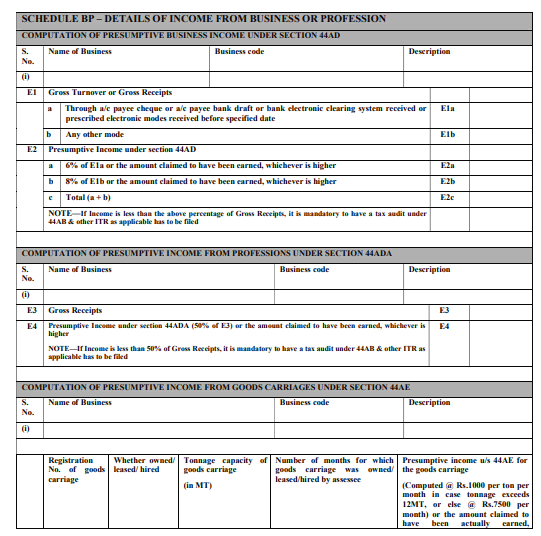

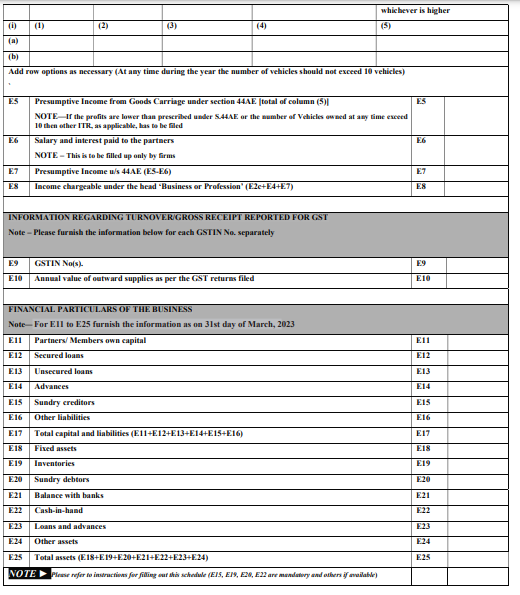

1) Schedule BP: Details of business income

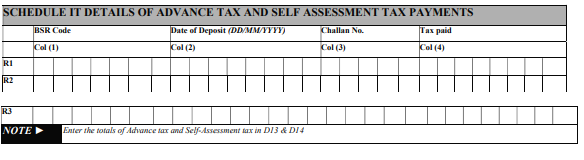

2) Schedule IT: Declaration of payment of advance tax and tax on self-assessment

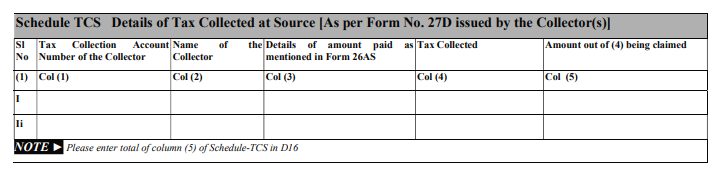

3) Schedule TCS: Report of tax collected at source

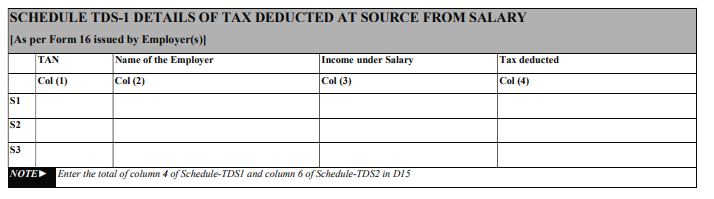

4) Schedule TDS 1: Declaration of tax deducted at source on salary

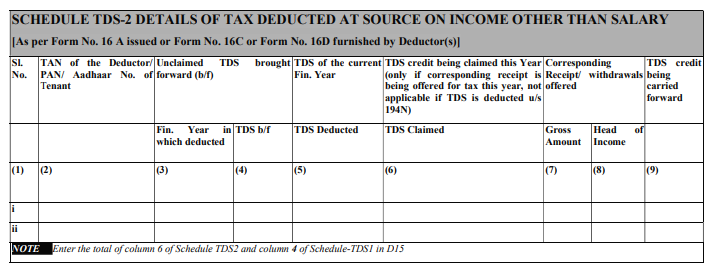

5) Schedule TDS 2: Report of tax deducted at source on income except for salary

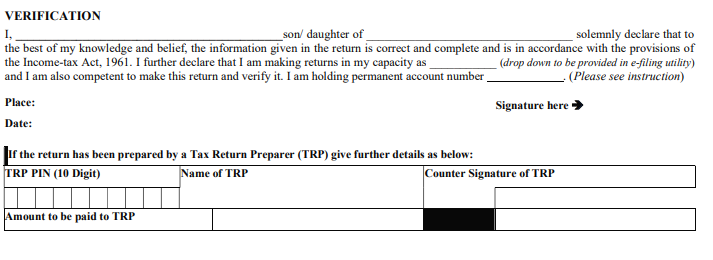

6) Verification Section: Contains fields where the taxpayer can provide name, place, date of filing, and signature of taxpayer. Also contains a section where details of TRP (tax return preparer) can be included, if applicable:

Presumptive Taxation Scheme under Section 44AD

ITR 4 form is submitted by taxpayers who file their income tax return under section 44AD of the Income Tax Act, 1961 to gain the benefits of presumptive taxation scheme. This scheme under section 44AD facilitates small scale businesses by saving them from the tedious task of maintaining their books and accounts.

Presumptive Taxation Scheme under Section 44AD

ITR 4 form is submitted by taxpayers who file their income tax return under section 44AD of the Income Tax Act, 1961 to gain the benefits of presumptive taxation scheme. This scheme under section 44AD facilitates small scale businesses by saving them from the tedious task of maintaining their books and accounts.

Companies registered under section 44AD are not required to maintain their accounts regularly. They can pay the tax according to the prescribed rate while filing their income tax return using ITR 4.

See how the latest budget impacts your tax calculation. Updated as per latest budget on 1 February, 2020. No deductions will be allowed under the new tax regime.

Changes Made in ITR 4 Sugam Form as Compared to Previous Year

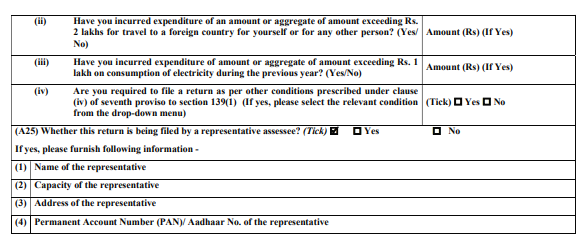

As compared to previous years, ITR-4 of AY 2023-24 has an option where, you have to answer the below questions:

Have you opted for new tax regime u/s 115BAC in earlier years? Select Yes/No

Have you opted out of Section 115BAC in earlier years? Select Yes/No

Option for current assessment year? Select one among Opting in now/Not opting/Continue to opt/opt out/Not eligible to opt in

If you answer “Yes” to any of the above details, you have to provide filing details for the same. Please note that individual or HUF opting for new tax regime u/s 115BAC has to mandatorily file Form 10-IE before due date of filing of return u/s 139(1). After filing Form 10-IE, original return or revised return is required to be filed mandatorily to avail the benefit of new tax slab u/s 115BAC and Acknowledgement Number and date of filing Form 10IE are mandatory fields in ITR-4.

How to Download ITR 4?

You can file ITR 4 (SUGAM) online using the digital signature certificate. It has been mandatory by the Income Tax department. Only those individuals who are above 80 years of age or who have a gross income, not Rs.5 lakh are allowed to file Form 4 SUGAM offline or on paper. The offline filing is only permitted when the returns claimed are zero.

You can download Form 4 SUGAM from the official website of the Income Tax department--https://www.incometaxindiaefiling.gov.in/

There are no charges on the download of ITR 4 form. You can fill it online and submit the same through a digital signature certificate.

Once you have done that, complete the acknowledgement form. Take out a print of two acknowledgement form copies. Sign one copy and send it to the Income Tax Department. It is advisable to keep the second copy for your own record.

How to File ITR 4?

You can submit your ITR 4 form both ways, i.e. either online or offline.

Offline :

The ITR 4 form can be filed offline only in any of the following case:

a. The individual is of the age of 80 years or more.

b. The revenue of the taxpayer is less than Rs.5 lakh and do not need to claim a refund in the income tax return.

Also Read: How to Claim TDS Refund?

The return can be filed offline:

· By submitting a return physically through a paper form.

· By providing a bar-coded return, the Income Tax Department will issue you an acknowledgement when you submit your physical paper return.

Online :

a. By submitting the return electronically through digital signature

b. By communicating the data electronically and then submitting the verification

If you submit your ITR 4 form electronically through digital signature, the acknowledgement will be sent to your registered email id. You can also download ITR 4 manually from the income tax website. You are then required to sign it and send it to the Income Tax Department’s office within 120 days of e-filing. Remember that ITR 4 form is annexure-less, i.e. you do not have to attach any documents while sending it.

Alternatively, you can validate the Form ITR-V using electronic verification code (EVC). This code is a 10-digit verification code received by your recorded mobile number. You do need to print or send a physical copy of the return in this case.

FAQs About ITR 4 Form

Q. Is it mandatory to file ITR 4?

A. It is not mandatory. The ITR 4 is a choice available to the taxpayer who chooses to avail the presumptive income scheme.

Professionals, too, can file ITR 4 if they do not have records of their salary slips. Their gross income should not exceed Rs.50 lakh. However, if in either or both of the above cases, there are records of bookkeeping, profit and loss statements, salary statements, the taxpayer can fill the regular ITR 3 and ITR 5 form.

Q. Can I File ITR 4 Offline?

A. The only exemption to fill ITR 4 offline is for senior citizens and small businesses. Only those who are 80 years old or older and companies which have gross income less than Rs.5 lakh and do not have to claim refund can use the offline method of filing the return.

Q. What is the password for ITR-V?

A. The password to open ITR-V is the grouping of your DOB and your PAN number. It must be last 5 digits of your PAN number and DDMMYYYY of the DOB.

Q. How many times can I file the revised return?

A. You can do it several times till the expiry of one-year time limit.

Q. Can I file the return of income even if my income is below taxable limits?

A. Yes. You could file the return of income voluntarily even if your income is less than the maximum exemption limit.

Sources:

https://www.incometax.gov.in/iec/foportal/help/e-filing-itr4-form-sugam-faq

https://incometaxindia.gov.in/forms/income-tax%20rules/2023/itr4_english.pdf

https://www.incometax.gov.in/iec/foportal/help/e-filing-itr4-form-sugam-faq

ARN: June23/Bg/27A