Written by

Updated :

Reviewed by

On this Page

All Indian taxpayers must pay income tax as defined under the Income Tax Act, 1961. Based on the tax liability defined under different sections of this Act, an individual has to file various Income Tax Return (ITR) forms, one of which is ITR 6 form.

What is ITR 6?

ITR Form 6, commonly known as ITR 6, is a form used by companies to file income tax return online if they do not claim tax exemption under Section 11 of the Income Tax Act, 1961.

What is the Structure of ITR Form 6?

Along with knowing who can fill ITR 6 form, it is crucial to remember that ITR 6 has two parts – Part A and Part B, along with 42 schedules. Here is brief information about all these segments of ITR 6 form:

Part A – General Information About the Taxpayer

1) Part A-BS: This segment of ITR 6 form covers the balance sheet as on March 31 of the FY 2019-20

2) Part A-BS-Ind AS: Under this part of ITR 6,comes the balance sheet on March 31, 2020, or as defined on the date of the business combination

3) Part A – Manufacturing account for the financial year 2019-20

4) Part A – Trading account for the fiscal year 2019-20

5) Part A-P&L: This part of the ITR 6 form covers the details of profit and loss account for FY 2019-20

6) Part A-Manufacturing Account-Ind AS: It talks about the manufacturing account for the FY 2019-2

7) Part A-Trading Account Ind-AS: This part of the ITR 6 form includes the trading account for the financial year 2019-20

8) Part A-P&L Ind-AS: Under this segment of ITR 6 form, the profit and loss account for the FY 2019-20 is covered

9) Part A-OI:This subpart of ITR 6 includes other information related to the taxpayer

10) Part A-QD: This section contains quantitative details for FY 2019-20

11) Part A-OL: Under this part, comes the company’s receipt and payment account under liquidation

Part B

1) Part B-TI: It covers the computation of total Income

2) Part B-TTI:This includes computation details of tax liability on the Total Income

Also Read: What is ITR Form 5 & Who Should File It?

Schedules of ITR 6 Form

Here are some of the essential schedules of ITR 6 form:

1) Schedule-HP: This schedule of ITR 6 covers the computation details of Income under the head ‘Income from House Property.’

2) Schedule-BP: In this schedule, the computation of Income that comes under the head ‘Profits and gains from business or profession’ is covered

3) Schedule-DOA:This schedule of ITR 6 form covers the details of computation of depreciation of ‘other assets’ as defined under the Income Tax Act

4) Schedule-DEP: This schedule talks about the summary of depreciation of all the assets as defined in the Income Tax Act

5) Schedule-DPM: This schedule of ITR 6 form covers the computation of depreciation on plant and machinery as covered under the Income Tax Act

6) Schedule-DCG:This schedule covers computation details of deemed capital gains when the depreciable assets are sold

7) Schedule-CG:It covers the computation details of Income that falls under the head ‘Capital gains’, including both short-term and long-term capital gains

8) Schedule-OS: This schedule of ITR 6 includes computation of Income that comes under the head of ‘Income from other sources’

9) Schedule-ESR: It covers the details of deductions under Section 35, which includes the expenditure on scientific research related to the business

10) Schedule-ICDS: This schedule of ITR 6 form covers the effect of income computation disclosure standards on the profits

11) Schedule-10AA:It covers computation of deductions availed under Section 10AA of the Income Tax Act

12) Schedule-80G:This schedule of ITR 6 form talks about the deductions of donations given to relief funds and charitable institutions as covered under Section 80G

Also Read: Income Tax Slab 2020-21 for Companies & Partnership Firms

See how the latest budget impacts your tax calculation. Updated as per latest budget on 1 February, 2020. No deductions will be allowed under the new tax regime.

How to Download ITR Form 6?

You can download ITR 6 online at the official website of the Income Tax Department for free. As of now, there are no offline provisions available to file ITR 6 form.

Here are the steps to be followed to download ITR 6 online:

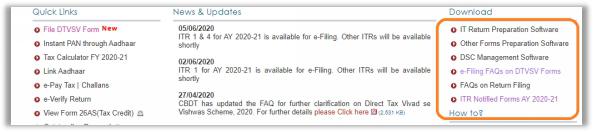

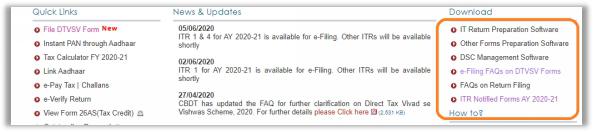

Step 1: Visit the official Income Tax website- https://www.incometaxindiaefiling.gov.in/home.

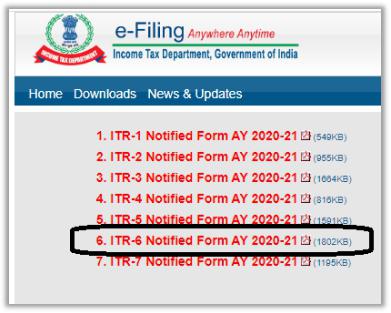

Step 2: Locate the ‘Download’ section in the right-hand sidebar, as shown below:

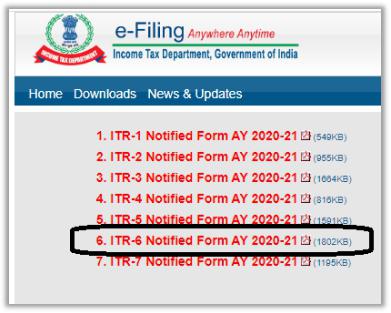

Step 3: Click ‘ITR Notified Forms AY 2020-21’.

Step 4: Click on ‘ITR 6 Notified Form AY 2020-21’ for ITR 6 download.

You can also opt for ITR 6 download using this link:

https://www.incometaxindia.gov.in/forms/income-tax%20rules/2019/itr6_english.pdf

Also Read: Income Tax Filing Due Date Extension

How to File the ITR 6 Form?

Keep in mind the following convenient sequence to file ITR 6 form:

-Fill Part A of ITR 6 and all its subsections, including the schedules

-Fill Part B of the form and its subsections for verification

How to File the ITR 6 Form?

Keep in mind the following convenient sequence to file ITR 6 form:

-Fill Part A of ITR 6 and all its subsections, including the schedules

-Fill Part B of the form and its subsections for verification

The income tax return has to be furnished electronically with a digital signature to the Income Tax Department. Being an annexure-less form, you need not attach any document while filing ITR 6 form.

You should also make sure you tally the data with your tax credit statement – Form 26 AS about all the taxes collected, deducted and paid by you.

Eligibility Criteria

Who is Eligible to File ITR Form 6?

In general, every company registered under the Companies Act, 2013 or the Companies Act, 1956, has to file ITR through form ITR 6 if it does not claim any tax exemption under Section 11 of the Income Tax Act.

As per the rules of income tax, only the companies having Income from a property that is held for religious/charitable purpose can claim exemption u/s 11.

Furthermore, the tax assessee who is liable to file ITR 6 form has to obtain an audit report under Section 44-AB. This section also says that if the sales, gross receipt, or turnover of a company crosses the INR 1 crore mark in a financial year, it must get the audit of the accounts done by a Chartered Accountant.

Who Cannot File ITR 6 Form?

The following taxpayers cannot file ITR 6:

1)Companies claiming exemption under Section 11

2)Firms

3)Individuals

4) Hindu Undivided Families (HUFs)

Who Cannot File ITR 6 Form?

The following taxpayers cannot file ITR 6:

1)Companies claiming exemption under Section 11

2)Firms

3)Individuals

4) Hindu Undivided Families (HUFs)

5) Body of Individual

6) Local authorities

In simple words, any entity seeking tax exemption u/s 11 cannot file ITR 6 form.

Things to Consider While Filling Verification Document

1) Fill the required details in the verification document accurately and strike out sections that are not applicable in your case

2) Make sure you sign the verification document and choose the right designation/capacity before you furnish the return

3) A false in the return or the schedules accompanied shall make you liable for prosecution. This is covered under Section 277 of the Income Tax Act. If convicted, you shall be punishable with imprisonment and fine.

4) Ask for help from tax professionals to avoid making any mistake while filing ITR 6 form

Key Changes Made in the ITR 6 Form in the Last Few Years

In AY 2020-21:

1) Inclusion of a separate schedule – 112A in ITR 6 to calculate the long-term capital gains on the sale of units of a business trust or equity share liable to STT

2) Tax computation details for secondary adjustments u/s 92CE(2A) while filing ITR 6 form

3) Details of tax deduction claims for investments made during April 1, 2020, to June 30, 2020

In AY 2019-20:

1) Startup recognition details as considered by the Department for Promotion of Industry and Internal Trade (DPIIT)

2) Declaration details as filled in Form 2

3) Bifurcations of donations as per cash or non-cash mode of payment

4) Details of the turnover/gross receipt as reported for GST

FAQs About ITR Form 6

Q. I received a notice covered under section 139(9). How should I file ITR 6 form?

A. If you are filing ITR 6 in response to a statutory notice under section 139(9), you need to tick the appropriate checkbox corresponding to that section while filling the form.

Q. I am an NRI. Do I need to confirm if I have a Permanent Establishment (PE) in India?

A. If you are a non-resident, you do need to specify if you have a PE in India while filing ITR 6 form. Ask a tax professional about the related in-depth details.

Q. Can a representative Assessee file my ITR 6?

A. In case the return is being filed by a representative Assessee, you need to first tick the applicable checkbox, along with furnishing the following details about him:

1) Name

2) Capacity

3) Address

4) PAN

Q. Do I need to indicate if my company is recognized by DPIIT?

A. In case you own a recognized startup, you need to tick the applicable checkbox along with the recognition number allotted by DPIIT.

Q. What is the due date for filing ITR 6 form?

A. The last date to file ITR 6 is September 30.

Sources:

[1]: https://www.incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/Instructions_ITR_6_AY_2018-19.pdf

[2]:https://www.incometaxindia.gov.in/_layouts/15/dit/Pages/viewer.aspx?grp=Act&cname=CMSID&cval=102120000000095000&searchFilter=[%7B%22CrawledPropertyKey%22:1,%22Value%22:%22Act%22,%22SearchOperand%22:2%7D,%7B%22CrawledPropertyKey%22:0,%22Value%22:%22Income-tax%20Act,%201961%22,%22SearchOperand%22:2%7D,%7B%22CrawledPropertyKey%22:29,%22Value%22:%222019%22,%22SearchOperand%22:2%7D]&k=&IsDlg=0

[3]: https://www.incometaxindia.gov.in/Pages/utilities/Notified-Place-of-Worship.aspx

[4]: https://www1.incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/Instructions_ITR_6_AY_2019-20.pdf

ARN: Aug21/Bg/18OO