Written by

Updated :

Reviewed by

Life-threatening health ailments such as cancer, stroke, heart attacks (myocardial infarction) and paralysis are categorised as Critical Illnesses. When diagnosed with a critical illness, you require intensive care and continuous monitoring, which, in turn, can put much pressure on your finances.

Thus, you need the protection of Critical Illness Insurance to handle the treatment expenses in any such situation.

What is Critical Illness Insurance Benefit?

A critical illness insurance benefit offers coverage against various life-threatening diseases like heart attacks, cancer, renal failure, and stroke. Max Life Insurance provides Accelerated Critical Illness (ACI) Benefit with Max Life Smart Term Plan (A Non-Linked Non-Participating Individual Pure Risk Premium Life Insurance Plan UIN: 104N113V04).

Under Max Life Smart Term Plan, you receive coverage amount basis the cover option choosen at the initia stage, when diagnosed with any of the 40 life-threatening diseases covered under the plan. You can then use the lumpsum amount to pay for medical bills, hospitalisation expenses and surgery costs. The amount can also be used by your family to take care of their daily expenses.

Also Read: Features & Benefits of Max Life Smart Term Plan

Features of Accelerated Critical Illness (ACI) Benefit

The Sum Assured under ACI Benefit is payable on the diagnosis of any of the specified Critical Illnesses during the policy period.

You must remember that the ACI benefit is accelerated and not an additional benefit. In other words, it implies that the insurance coverage under the policy will continue to protect you, while the Death Benefit Sum Assured will get reduced by the extent of the ACI Sum Assured paid.

The maximum total payout under ACI benefit is 100% of the ACI Sum Assured, Once 100% of ACI Sum Assured is exhausted,no further ACI claims can be made.. There are two options available under Accelerated Critical Illness (ACI) cover to choose from:

1. Level ACI Benefit

The ACI Sum Assured is fixed herein and remains the same throughout the ACI policy term. You can choose any ACI Sum Assured in intervals of 5 lakhs subject to specific boundary condition as mentioned below –

Minimum ACI Sum Assured that can be chosen |

Maximum ACI Sum Assured that can be chosen |

Rs 5 lakhs |

50% of the base policy Sum Assured chosen at inception or Rs 50 lakhs, whichever is lower |

2. Increasing ACI Benefit

The ACI Sum Assured will increase at a simple rate of 5% per annum of the ACI Sum Assured, opted for at the policy inception. You can choose any ACI Sum Assured in intervals of 5 lakhs subject to specific boundary condition as mentioned below –

Minimum ACI Sum Assured that can be chosen |

Maximum ACI Sum Assured that can be chosen |

Rs 5 lakhs |

25% of the base policy Sum Assured chosen at inception or Rs 25 lakhs, whichever is lower |

The maximum increase in ACI Sum Assured allowed is –

a) Rs 50 lacs

b) 50% of the base policy Sum Assured chosen at the inception of the policy

c) 200% of the ACI Sum Assured chosen at the policy inception

The ACI benefit will stop increasing once an ACI claim has been made (including Angioplasty).

3. Protection Against 40 Critical Illnesses

The ACI Benefit under Max Life Smart Term Plan includes coverage for up to 40 life-threatening ailments, including stroke, cancer, heart diseases, epilepsy, and liver diseases.

4. Lumpsum Payment

You can claim the ACI Sum Assured immediately after getting diagnosed with a critical illness, in the form of a lumpsum amount.

5. Hassle-free Claim Process

You can make quick and hassle-free claims online after providing all the necessary documents.

Advantages of Accelerated Critical Illness Insurance Benefit

Accelerated Critical Illness (ACI) Benefit under Max Life Smart Term Plan can serve as the best protection against financial instability, in case you are diagnosed with a life-threatening ailment. With the comprehensive cover provided under the ACI Benefit, you can opt for the best possible treatment without worrying about burning a hole in your savings pocket.

1) Tax benefits under section 80C and Section 80D of Income Tax Act on the premiums paid for Smart Term Plan and ACI Benefit respectively as per applicable tax laws (Please note that all the tax benefits are subject to tax laws prevailing at the time of payment of premium or receipt of benefits by you. It is advisable to seek an independent tax consultation)

1) Tax benefits under section 80C and Section 80D of Income Tax Act on the premiums paid for Smart Term Plan and ACI Benefit respectively as per applicable tax laws (Please note that all the tax benefits are subject to tax laws prevailing at the time of payment of premium or receipt of benefits by you. It is advisable to seek an independent tax consultation)

2) Payment of 100% of the ACI Sum Assured following a confirmed diagnosis of any one of the insured Critical Illness conditions (except Angioplasty) during the ACI benefit policy term

3) A Lumpsum amount is payable under ACI Benefit which you can then use for payment of treatment costs

4) Quick claim settlement after completion of documentation

Let's understand with an example of what is critical illness insurance, and why is it essential:

For instance, a person bought a policy with ACI Sum Assured of say Rs. 10 Lakhs. He is diagnosed with cancer three years after buying the policy. In this case the individual will receive 100% of of the ACI Sum Assured (i.e. 10 lakhs) following a confirmed diagnosis of one of the insured Critical Illness conditions (except Angioplasty). In case he was diagnosed with Angioplasty, ACI benefit pays lower of ₹5,00,000 or ACI Sum Assured and the policy will continue with reduced ACI Sum Assured for other insured Critical Illness conditions.

Also, since you have bought Accelerated Critical Illness Option as an add-on to the Max Life Smart Term Plan, your family will still receive the remaining Death Sum Assured under the policy, in case of your unfortunate demise due to the illness.

Now, you must have understood 'what is critical illness insurance?' and how does ACI benefit option offered by Max Life helps you during the times of need. Like simplicity of the features of critical illness benefit, the process of buying it also easy.

How to Buy Critical Illness Insurance Protection with Max Life Insurance?

Buying critical illness insurance protection with Max Life Insurance is seamless and hassle-free as the entire procedure is online, where you can also get help from customer executives to go through it.

Step 1: Click here to open Max Life Critical Illness Insurance page on our official website

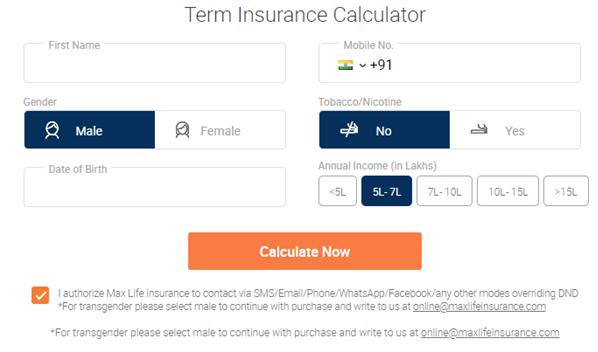

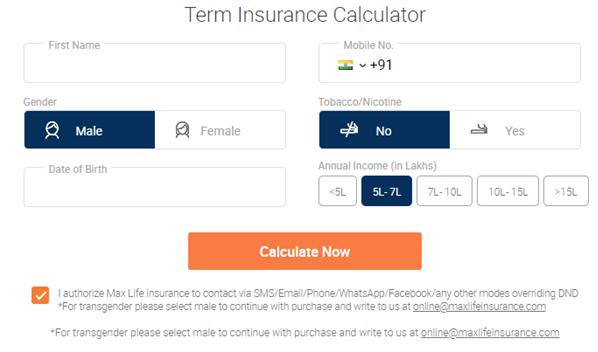

Step 2: Click on calculate premium. It will redirect you to term insurance calculator

Step 3: Enter your details. Click on calculate now.

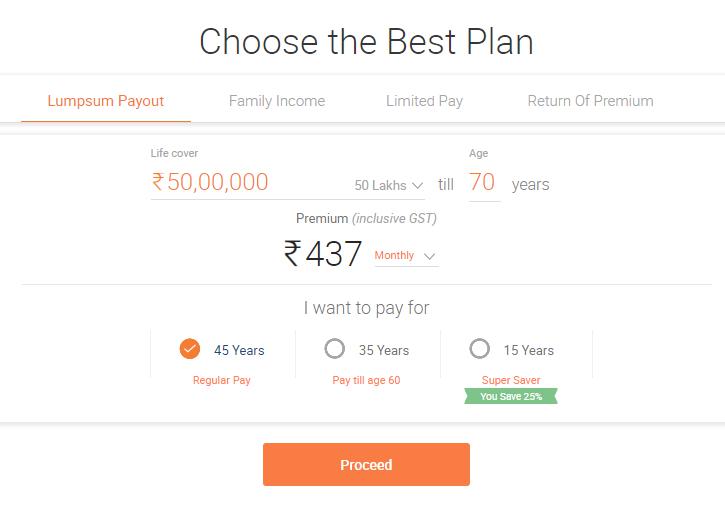

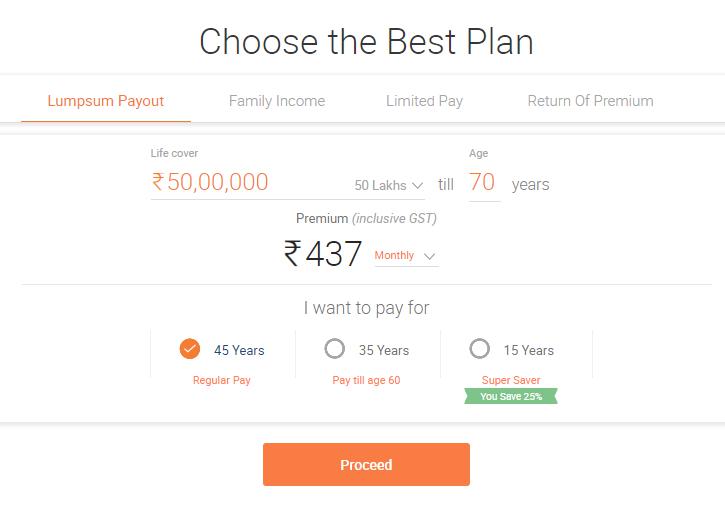

Step 4: Choose the required life cover amount under Max Life Smart Term Plan (UIN - 104N113V04; Non Linked Non Participating Individual Pure Risk Premium Life Insurance Plan). After filling details as per your requirement, click on proceed.

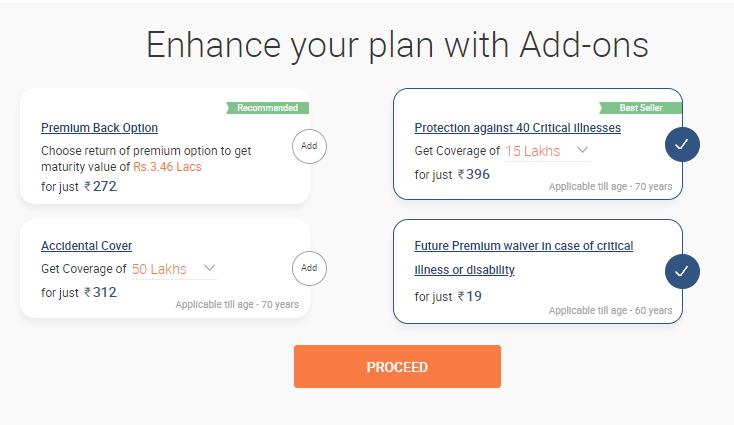

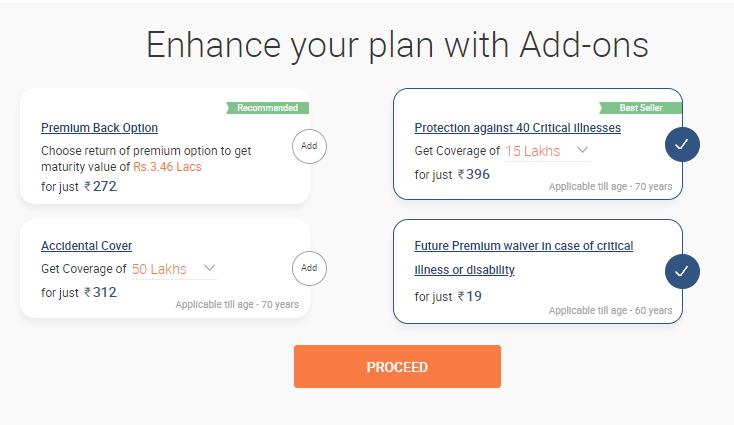

Step 5: Select Max Life critical illness add-on option to include coverage against life-threatening diseases (after paying a nominal additional amount of premium.) Apart from critical illness protection, you can also select Waiver of Premium Plus Rider (UIN 104B029V03; Non-Linked Non-Participating Individual Pure Risk) option in case you get diagnosed with any critical illness.

Step 6: Click on proceed after selecting the required add-ons

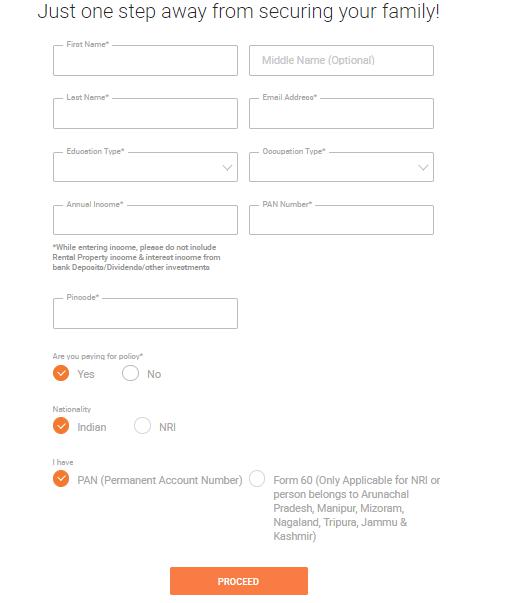

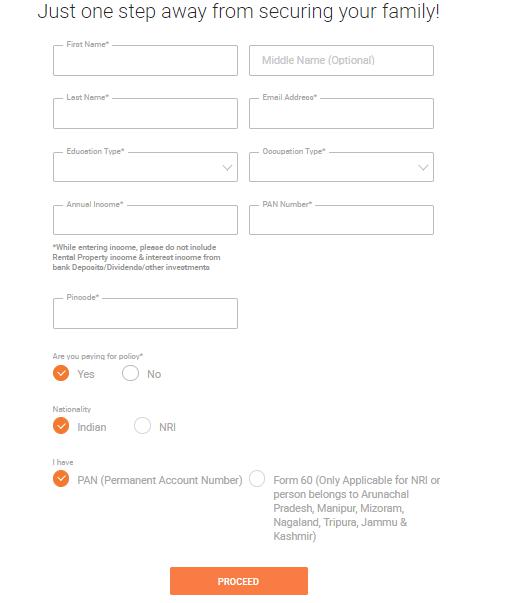

Step 7: Fill out the remaining details in the blocks to complete the policy buying procedure. Once all the details are filled, you can click on proceed.

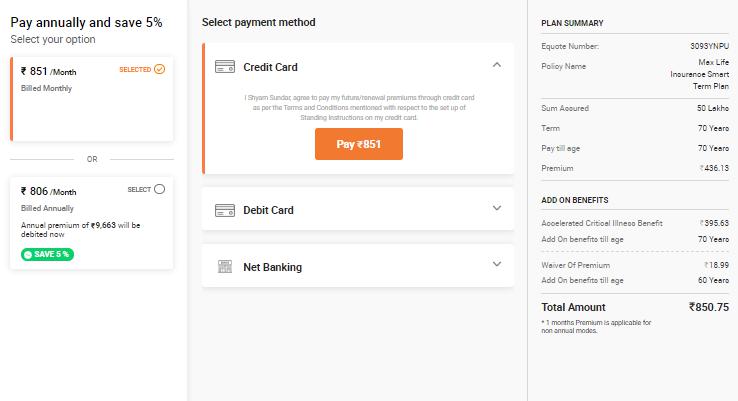

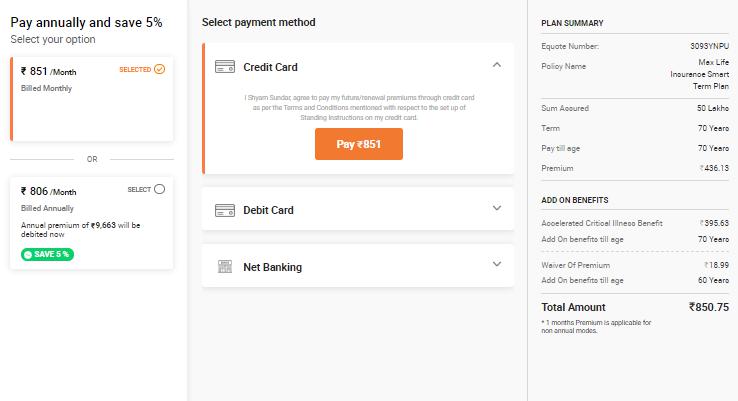

Step 8: You will now be redirected to the payment window. If you want to edit the policy, you can go back, otherwise, proceed with making the payment.

You can choose between annual and monthly premium payment options for purchasing your critical illness insurance benefit under Max Life Smart Term Plan. Also, you can select between different payment methods to buy the policy.

After making the payment, you must fill out the proposal form, which mentions about your medical history, lifestyle habits, and more. Once you have filled the details, you will be contacted by executives of Max Life Insurance to proceed with medical tests as the final procedure for buying your critical illness benefit.

If you still have any queries about what is critical illness insurance, here are your common questions and their answers:

Frequently Asked Questions (FAQs)

Q. What is the procedure for claiming Accelerated Critical Illness Insurance Benefit?

A. If you get diagnosed with any of the life-threatening ailments covered under critical illness benefit option, you can claim the policy by contacting our customer support. Reach out to your customer care executive and provide them with policy details along with your medical information. Our customer executives will guide you further.

Q. What are the documents required for claiming Accelerated Critical Illness Insurance Benefit?

A. Primary documents required for claiming critical illness insurance benefits are:

1· Claim form – duly filled and signed

2· Attending Physicians Statement Form – A qualified and registered medical practitioner should complete this form. Policy holder, Life insured who are also medical practioners or their spouse, or lineal relative of policy holder/life assured cannot fill it

3· Medical Certificate – confirming your diagnosed critical illness

4· Hospitalisation Documents – Discharge Summary, Pre and Post Doctor Consultations, All medical reports confirming the diagnosis

5· Test reports – relative to the diagnosed critical illness

6· KYC documents – for confirming your identity and matching it with your policy details

7· Other specified documents – required as per the instructions of your customer executive based on your critical illness

Also Read: Documents Required for Term Plan

These documents will only help you get critical illness insurance benefits quickly.

Q. What are the diseases covered under the Accelerated Critical Illness Benefit option?

A. Major illnesses covered under accelerated critical illness benefit option are:

1. Cancer of specified severity Cancer

2. Angioplasty*

3. First Heart Attack – of Specified Severity

4. Open Heart Replacement or Repair of Heart Valves

5. Surgery to aorta Heart and Artery Benefit

6. Cardiomyopathy

7. Primary Pulmonary hypertension

8. Open Chest CABG

9. Blindness

10. Chronic Lung Disease

11. Chronic liver disease Major Organ Benefit

12. Kidney Failure Requiring Regular Dialysis

13. Major Organ/ Bone Marrow Transplant

14. Apallic Syndrome

15. Benign Brain Tumour

16. Brain Surgery

17. Coma of specified Severity

18. Major Head Trauma

19. Permanent Paralysis of Limbs

20. Stroke resulting in permanent symptoms Brain and Nervous System Benefit

21. Alzheimer's Disease

22. Motor Neurone Disease with Permanent Symptoms

23. Multiple Sclerosis with Persisting Symptoms

24. Muscular Dystrophy

25. Parkinson's Disease

26. Loss of Independent Existence

27. Loss of Limbs

28. Deafness

29. Loss of Speech Others

30. Medullary Cystic Disease

31. Systematic lupus Eryth with Renal Involvement

32. Major Burns

33. Aplastic Anaemia

34. Poliomyelitis

35. Bacterial Meningitis

36. Encephalitis

37. Progressive supranuclear palsy

38. Rheumatoid arthritis

39. Creutzfeldt - Jakob disease

40. Fulminant Hepatitis

Q. How prone am I to critical illnesses?

A. In 2018, ICMR-NICPR released an India specific study from Globocan, which is a Global Cancer Observatory. It revealed that the reported number of cancer cases in India have gone up by 15.7% since 2012. Many other studies have also shown similar data.

It also reported that the death rate among all age groups has also seen a rise, 49.8% is the highest number of deaths due to cardiovascular diseases.

Overall, the working population in India between the ages of 30-74 years have found to be more prone to cardiovascular diseases due to various reasons. Some other causes include kidney failure, stroke, sclerosis.

While you do not have control over contracting life-threatening ailments, you can surely safeguard your financial health by taking the Accelerated Critical Illness benefit option with the Max Life Smart Term Plan.

Sources:

https://main.icmr.nic.in/sites/default/files/Nov1.pdf

https://www.maxlifeinsurance.com/content/dam/corporate/Brochures/Term-plans/English/smart-term-plan/smart-term-plan-prospectus.pdf

ARN: Jan21/Bg/02B