Written by

Updated :

Reviewed by

What is Sum Assured?

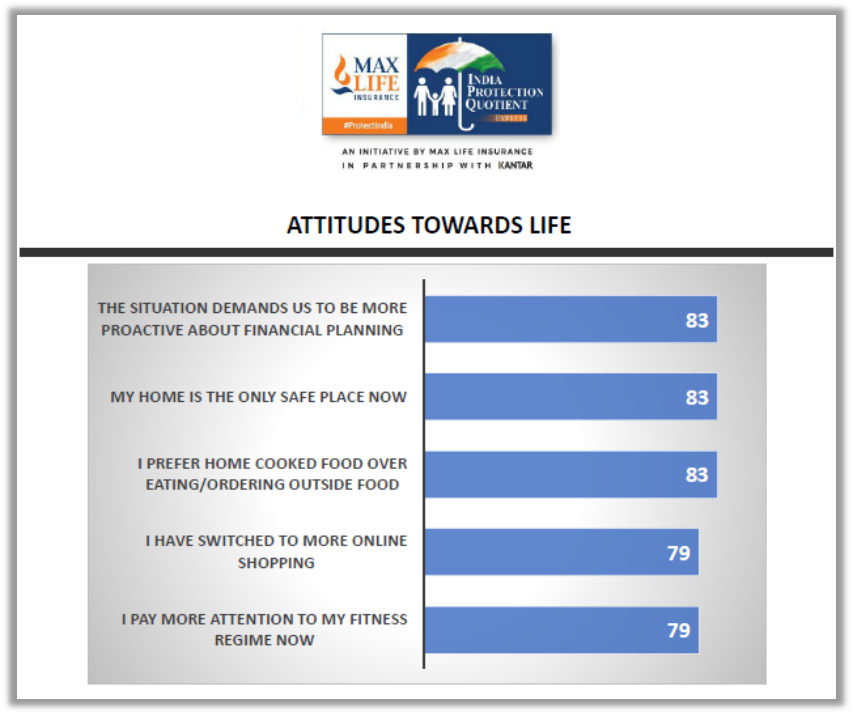

Life insurance is one of the most trustworthy ways to safeguard your family against the uncertainties of life. During the current COVID-19 pandemic, more people are now thinking about financial planning, one pillar of which is life insurance.

Source: Max Life India Protection Quotient Express

To get a comprehensive life insurance coverage, it is crucial for everyone to understand the terminologies of insurance. Life insurance is planned for financial assistance that takes care of your family’s expenses in your absence. As a part of the policy, sum assured is a crucial term to learn about while buying life insurance. It determines the coverage level of your insurance policy.

1. Sum Assured Definition

2· What is the Difference Between Sum Insured and Sum Assured?

3. What Should You Consider While Selecting Sum Assured?

4. FAQs

Sum Assured Definition

Sum assured refers to the pre-decided amount payable to the policyholder or beneficiary on the occurrence of insured event. There are two insured events in a savings oriented life insurance plan – maturity or death, while in pure protection plans the insured event is only death; in health-oriented life insurance plans, it could be the survival post occurrence of the insured event such as a critical illness or disability. It is an amount that you need to choose at the time of buying the life insurance policy. There are plans where this amount can increase or decrease over the policy tenure. The insurance company guarantees to pay the sum assured in return for receiving regular premiums from the policyholder.

For instance, when you buy pure protection life insurance, the insurance company guarantees (subject to underwriting) to pay a sum assured as a death benefit to the policy nominee in case of your unfortunate demise. On the other hand, you get the benefit of peace of mind that you have planned for financial security of your loved ones.

Sum assured also has a significant impact on the premium of a life insurance policy. If you choose to increase the sum assured of your existing life insurance policy, the premium will increase accordingly. Hence, it is advisable to select adequate sum assured based on your specific needs.

If you already have a life insurance policy, you might have chosen insufficient sum assured. To top it up, you would either have to buy another life insurance policy or add specific riders that may offer additional protection benefits, such as term rider (for all-cause death benefit), accidental death and disability rider (for enhanced death/disability cover in case of accident), critical illness rider (on survival and diagnosis of the listed illnesses).

What is Sum Insured?

Sum insured, on the other hand, refers to the payable amount in case of an unforeseen event such as a medical emergency. It is a monetary benefit, unlike sum assured which is a maturity benefit.

Non-life insurance policies like motor insurance or health insurance provide protection as the sum insured. In short, it is the compensation payable to the policyholder in case of an injury/hospitalization or damage based on the concept of indemnity.

What is the Difference Between Sum Insured and Sum Assured?

Sum Assured |

Sum Insured |

Sum assured is the value of life cover defined under life insurance policies. |

Sum insured is the value applicable to non-life insurance policies like car insurance. |

Your Sum Assured is usually calculated by taking into account the economic value of your life (Human Life Value) which may actually go up in time for a person |

Sum Insured usually depreciates for assets. The essential difference is coverage for the creator of the asset vs the asset itself.

|

It is a pre-fixed amount that the insurer pays to the policyholder or nominee in case of a misfortune. |

It is a reimbursement/compensation based on the concept of indemnity against damage/loss. |

Sum assured refers to the benefit availed by the insured person or beneficiary. One can choose to get maturity benefit under specific types of life insurance plans. |

There is no maturity benefit involved related to the sum insured. |

What Should You Consider While Selecting Sum Assured?

For many people, buying life insurance is about having financial protection in life that is guaranteed. They do not want to take chances but plan for their family’s future by selecting an adequate sum assured. On the other hand, some people undermine the role that sum assured plays by buying life insurance as a formality, without doing proper research.

Here’s what you should consider while choosing sum assured under a life insurance plan:

Age

Your age is a crucial determinant when it comes to choosing the right sum assured. The current age helps you determine the extent of coverage you require. For instance, if you are young and healthy, you can begin with a lower sum assured and gradually increase it over the policy period.

Whereas, if you are middle-aged and experience some health problems, you can select a higher sum assured or add riders like Critical Illness cover. It will act as a shield against increasing medical expenses without causing any burden on your finances.

This way, you can benefit from your life insurance plan in taking care of your health while your loved ones will get financial assistance after you.

Income

As per the Handbook on Indian Insurance Statistics of IRDAI, the count of total life insurance policies in India was 328 million in 2017. If you assume each policy to correspond to a unique Indian citizen, this data accounts for around 25% of Indian population with life cover, implying the truth about lack of life insurance coverage amongst the masses.

One crucial factor behind it is lower average income, which keeps many people in India under the threat of financial setbacks.

This is what makes your budget an essential factor to consider while selecting the sum assured. Make sure you analyze your needs along with your monthly income to reach a definitive point of selecting sum assured. You should be able to set aside funds for regular premium payments.

Make a balanced decision to avoid skipping premium payments and choose a sum assured that can safeguard your family’s future. You can also plan to increase the sum assured of your life insurance policy as your income increases over time and choose return of premium option to get survival benefits.

Lifestyle

The selection of sum assured should also be based on your lifestyle needs. For instance, if you are dealing with a job having high-stress levels, you need greater protection in the form of a higher sum assured. If you consume alcohol or tobacco, it is advisable not to hide such details with the insurer. It can lead to further complications in the policy, especially at the time of claims.

On the bright side, if you live a healthy lifestyle, the chances are high that you will outlive the policy period. Since the basic life insurance plan like pure term plan does not offer any benefits on survival, you can choose return of premium cover to get the premiums paid back as maturity benefit.

So, consider your lifestyle and habits while selecting a sum assured to cover all the possible contingencies.

Inflation

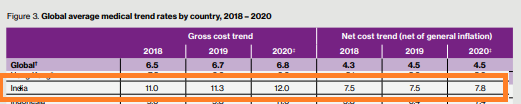

There is no doubt that medical expenses, your child’s education expenses and you’re your/spouse’s retirement expenses are increasing. Statistical data shows the medical inflation increase in the last 3 years.

Source: Global Medical Trends Survey Report

Not everybody can afford quality healthcare treatment from a reputable hospital nor handle the loss of breadwinner in the family. Therefore, it is advisable that you invest in an insurance policy considering the inflation rates and choose an adequate sum assured.

Alongside, you can add a critical illness cover to your life insurance plan to get coverage against various life-threatening diseases. Think of it as the additional benefit for you and your family to deal with a health crisis, and supplement the reduction on, or worse, loss of income earning capability.

If you have already invested in a life insurance policy, ask your insurer about ways to increase the sum assured at different life stages. An adequate sum assured will help your family deal with tough time after you without worrying about arranging for funds.

Instead of running out of funds and spending all your savings for just a few days in the hospital, it is better to select a sufficient sum assured by paying small amounts of premium regularly.

Medical History

If you suffer from a health ailment or have a medical history of a particular disease, it is best to inform your insurer. It will enable you to select a sum assured that will cover the related treatment charges.

As a rule of thumb, opt for a higher sum assured and include critical illness rider if you or parents/grand parents have had a medical history. It will pay for the expenses of treatment you need, while also covering your life for the inevitable event of death.

Select the Right Sum Assured for a Secure Future

When it comes to the concept of life insurance, understanding a policy might be a challenge. You need not only buy life insurance to fill your checklist for financial protection, like many people do. It is important that you know the value of selecting adequate sum assured. Now that you know the difference between sum assured and sum insured, you are halfway there.

Providing financial protection to your family members is your responsibility as the sole breadwinner. It is why you should keep in mind various factors while selecting the right sum assured.

Various life insurance plans provide protection against death, disease, and disability. What is most important while buying a plan is that it fulfils your needs, provides an adequate sum assured, and is affordable to you.

For instance, you can buy a comprehensive term insurance plan that provide significant cover at low premium. Based on your need, you can also add significant add-ons/riders such as critical illness cover, waiver of premium, accidental death benefit, and return of premium.

While looking for life insurance plans online, you can use an insurance calculator to determine premium rates and the ideal sum assured for better planning of funds. Life insurance has become a quintessential expense in today’s date. With so many lifestyle diseases taking over humankind, it is vital to have a backup in the form of adequate sum assured under a life insurance plan.

In terms of its importance, the considerations surrounding sum assured has eclipsed other concerns such as premium amount among those who are purchasing life insurance in India. This is a finding that has been observed in the recent India Protection Quotient (IPQ) 6.0 survey that was recently conducted jointly by Max Life Insurance and KANTAR.

So, pick the right policy with adequate sum assured and live life worry-free!

FAQs

1. How much sum assured should I choose in a life insurance plan?

Deciding on a sum assured is a crucial aspect while buying a life insurance plan. Consider you and your family’s needs for maximum coverage. Also, make sure to keep in mind your income to plan your premium payments. Always consider the rate of inflation and buy a plan with a sum assured higher than your actual needs.

2. Should budget be the sole determinant while selecting the sum assured?

Your budget should be the last factor to consider while choosing the sum assured as a low coverage can make you underinsured. It will further negate the whole concept of insurance, and your family may suffer all the financial consequences in your absence.

So, make sure to choose a plan that covers all your dependents adequately and provides them with financial aid after you. However, make sure you don’t end up having to lapse your policy in future because you are unable to set aside the premium required in future years.

3. How to choose the best insurer?

While choosing an insurer for life insurance, make sure to check for reviews online and the insurer’s claim settlement/paid ratio which indicates the number of death claims settled.

4. Is it essential to add riders along with the basic sum assured?

Riders are optional add-ons to the policy that provides you with greater coverage by paying nominal extra premium. For instance, riders like critical illness cover offer you quality treatment for severe diseases like cancer and strokes, which may not get covered with the basic sum assured.

It is up to you to decide if you want to include riders in your life insurance policy or not.

5. Is it secure to buy a life insurance plan online?

With almost every insurer providing insurance online today, it has become the new normal. You do not need to face the hassles of offline mode and buy cost-effective life insurance policies online. You can even make regular premium payments online without much documentation and safe transfer of funds

ARN: 161020/Blog/WSA