COVID Insurance

Written by

:Reviewed by

The COVID-19 pandemic has forced people all across the world to adjust to a new reality. The economic and social order have been restructured in front of our eyes. Prior to the pandemic, most Indians thought of insurance as a ‘investment’ or a tax-saving tool, but the last year has made us recognize the need for financial protection.

There has been a noticeable shift in terms of insurance awareness and advantages. In addition, customers’ perceptions of life insurance have shifted as a result of their concern about what the future holds. As a result of these uncertainties, insurance firms have had to adapt their policies.

With this in mind, more individuals are willing to learn more about COVID insurance and how it may help them and their families. It is critical to protect your family financially from potentially terrible life events by purchasing a COVID 19 insurance policy.

What is COVID Insurance?

COVID 19 insurance, like many other life insurance products, provides financial protection against the most terrifying human life event: death. Although human life cannot be measured in monetary terms, a precise sum assured aids the deceased’s family in dealing with financial matters in case of the insured person’s untimely demise.

The relevance of COVID insurance plan cannot be overstated, given the global disaster caused by the virus. COVID-19, a deadly virus, has claimed the lives of millions of people around the world and left innumerable people’s lives in disarray. The cases are still on the rise after over a year of dealing with the virus.

In light of this, people are becoming increasingly concerned about the costs of treatment as a result of Covid-19. The Insurance Regulatory Development Authority of India (IRDAI) has authorised two basic Covid-19 Health Insurance policies, Corona Kavach and Corona Rakshak, to help consumers protect themselves from the financial burden of Covid-19 medical bills. Both corona health insurance policies are designed to cover you against the expense of Covid-19 treatment at a low cost.

Let’s discuss how this COVID insurance works:

1.Corona Kavach Insurance

It is a typical indemnity-based insurance policy. Only hospital/medical expenditures up to the sum covered amount will be repaid, subject to policy terms and limitations. It is a short-term covid insurance plan having a minimum and maximum sum insured of Rs. 50,000 and Rs. 5 lakhs, respectively, with a tenure of 3.5 months, 6.5 months, and 9.5 months.

2.Corona Rakshak Insurance

Corona Rakshak is a standard benefit-based policy. If you are hospitalised for a minimum of 72 hours after testing Covid-19 positive at any government-approved testing centre, the insurance company will pay a lump sum payment equal to the sum insured under this covid 19 insurance policy. It is a regular fixed benefit plan in which you will receive 100% of the sum insured amount, according to the corona insurance policy’s terms and conditions.

Why Do You Need COVID Insurance?

Given the rapid spread of Covid-19 across the country and the economic effects of the lockdown, many people have faced devastating effects of the disease and financial hardship. When you combine this with India’s low insurance penetration, you have a void that insurers are trying to fill with specialty health solutions.

But, as a policy buyer, you may wonder, do I really need a COVID 19 insurance policy?

The answer is yes. We are currently living in the most insecure of times. With so many people contracting the virus and suffering tremendously, you never know what may happen next. COVID insurance advantages can be obtained by purchasing a proper insurance plan and securing your family’s future in this difficult time.

Now is the moment to plan how you will create a safety net for your family in case the worst happens. The premiums for corona health insurance are nominal to ensure that each individual can protect their loved ones against unforeseeable circumstances. Not to mention, the benefits of COVID insurance plans are undeniably valuable.

We, at Max Life Insurance, offer comprehensive policies that provide insurance for eventualities related to COVID-19. Opting for a suitable corona insurance policy will allow you to bring your emergency funds in order and prepare for uncertainties efficiently.

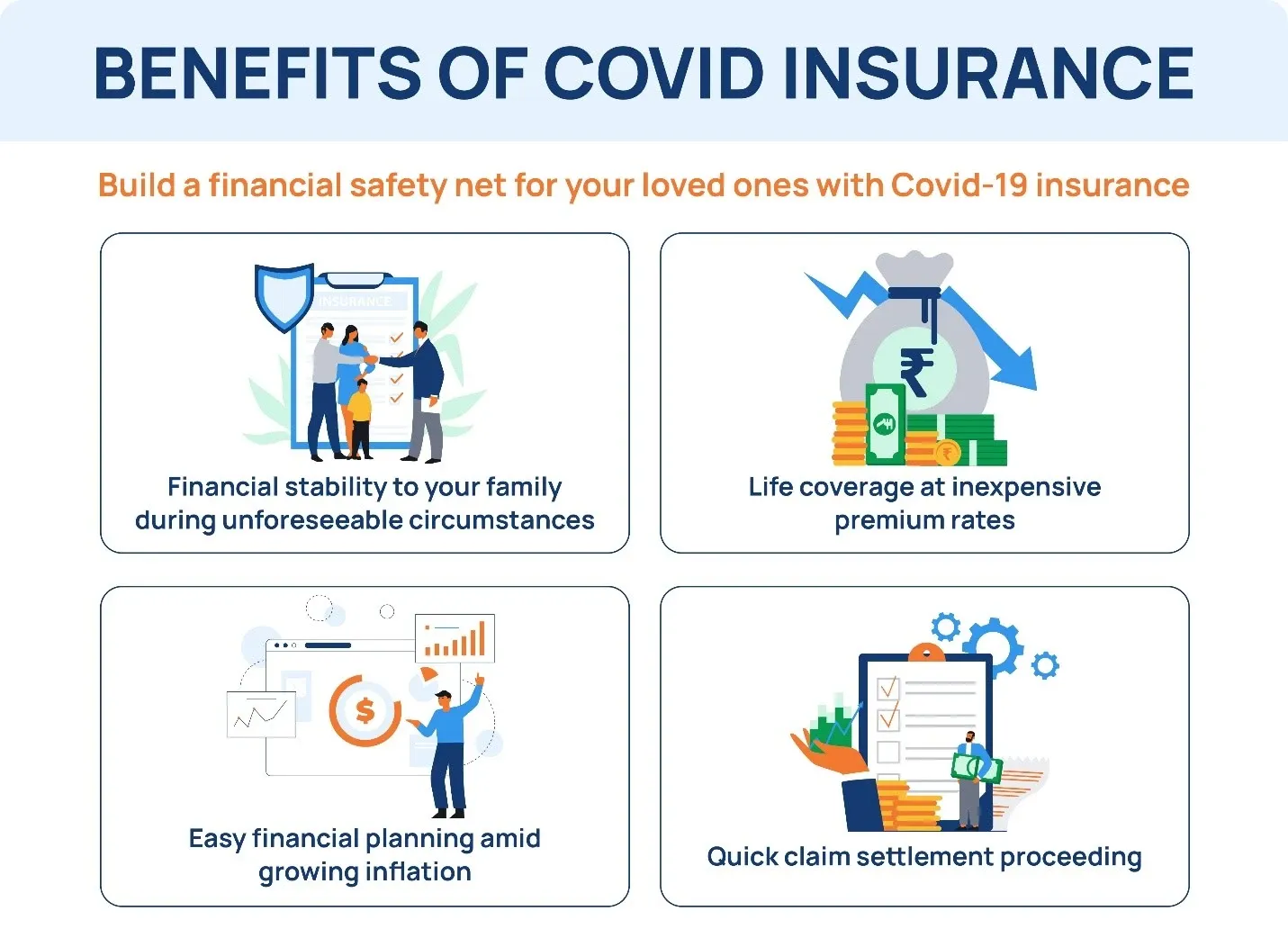

Benefits of COVID Insurance

Purchasing COVID-19 insurance policy ensures that your loved ones have a financial safety net in case something unforeseen occurs to you. The earlier you purchase this sort of life insurance, the better the coverage and the lower the premium. It would be beneficial if you researched about the various types of coronavirus insurance policies available in the market and then purchased a life insurance policy as part of your financial planning. Also, before making a selection, you should thoroughly examine the benefits of COVID insurance. Here are some of them discussed in detail:

1. Financial Protection to Your Loved Ones

One of the key advantages of COVID health insurance is that it provides financial stability to your family in the event of your untimely death.

It means that if you contract coronavirus and do not survive as a result, your dependents will receive the entire sum assured. When you are not with your family, the money might be very useful in allowing them to maintain their lifestyle without interruption.

2. Insurance at Affordable Premium Rates

With a corona insurance policy, you can get coverage for your life at nominal premium rates. Furthermore, by offering the guaranteed death benefit, the corona insurance policy provides security for your loved ones in the event of your untimely death. Your dependents are free to use the insurance money as they see fit.

You can be confident that purchasing corona insurance plans is a wise move because you will be able to keep your family and loved ones financially secure even if you are unable to look after them. Rather than regretting not spending a small sum in a covid insurance policy, you and your family can remain protected during medical emergencies with the benefits of COVID insurance.

While you may not be able to prevent unpleasant occurrences from occurring, you can certainly construct a safety net for your loved ones. As a result, if you are not present, your dependents are entitled to the sum insured. Most people designate their family members as covid health insurance nominees.

Given the current bleak climate of risk and uncertainty, COVID insurance policy benefits serve as a beacon of hope throughout this pandemic.

3. Uncomplicated Claim Settlement Procedure

Quick claim settlement is of the main advantages of COVID insurance plan. It will help you stay safe and get your claims handled as quickly as possible. One of the COVID insurance perks that adheres to social distancing norms is that the insurers offer a cashless/online settlement option, which eliminates the need to speak with the insurance agents directly. It will assist you in maintaining social distance and will expedite the resolution of your claims.

4. Inflation-Proof Your Financial Planning

The expense of healthcare has risen tremendously, and it is even more noticeable during the pandemic. As a result, in the event of a medical emergency, people are forced to spend their money, jeopardising their future goals. Most people rely on their funds to deal with medical emergencies without a corona insurance policy.

However, you do not have to be concerned about growing inflation with COVID insurance benefits on your side. Your family will be able to keep their lifestyle with the benefits of COVID insurance plan that they would receive after you pass away.

Who Needs COVID Insurance?

The simple answer to this question is anyone who wishes to secure their loved ones against financial distress can opt for COVID insurance policy. With a suitable coronavirus insurance policy, you can rest assured in times of uncertainty that your family will continue to live a comfortable life, in case you are not around anymore.

Having the financial support of a COVID insurance policy can make a significant difference in your loved ones’ life in a time of difficulty. Hence, make sure you evaluate your financial planning carefully to purchase the best corona insurance for them.

Furthermore, if you have a history of health issues which can make you more susceptible to contracting the virus, or if you are present in high-risk environments frequently, then corona insurance can be a favourable choice. It will be a wise decision to include a covid insurance policy in your financial plan in such a scenario.

Although you cannot prevent the mishaps of the future, you can keep your finances in order to support those who are left behind.

How to Buy COVID Insurance?

Firstly, it is crucial to decide the type of COVID insurance policy that is best to support your family’s requirements. For this purpose, you must assess your current financial status, health condition, future requirements according to life goals, inflation, etc. These personal factors will help you choose the corona insurance policy with the suitable benefits. So, in case of an unfortunate event, your family has adequate funds to rely on.

Once you have mapped your requirements, compare the corona insurance plans thoroughly to determine the one that aligns best with your family’s needs. Buying covid insurance online is quick and hassle-free today, considering the urgent need for the financial protection in these unprecedented times.

In a few simple clicks, you can get a death cover against covid-19.. Here are the steps you should follow:

Visit the online portal of the insurance provider and find the COVID death insurance policy.

Proceed with the process of buying the COVID insurance policy by filling personal details such as name, age, occupation.

Select the sum-assured that works best for you.

Once you have completed the formalities, pay the premium for corona insurance online.

You will receive the life insurance policy document shortly.

Remember to check the corona insurance policy exclusions and details carefully before making the purchase. This will help you avoid any confusion or disappointment in the future regarding the benefits of the COVID insurance plan.

Covid-19 FAQs

ARN NO: PCP/C19I/051223

*Subject to policy terms and conditions. Issuance of policy subject to underwriting guidelines.

www.irdai.gov.in/ADMINCMS/cms/LayoutPages_Print.aspx?page=PageNo4165

www.irdai.gov.in/ADMINCMS/cms/whatsNew_Layout.aspx?page=PageNo4166&flag=1

Policy Links

Get ₹1 Crore Life Cover @ just ₹609*1/month

Popular Searches

- 0124 648 8900(09:00 AM to 09:00 PM Monday to Saturday)

- service.helpdesk@maxlifeinsurance.comEmail

- SMS ‘LIFE’ to 5616188Message

- Let us call you back

- 1860 120 5577(9:00 AM to 6:00 PM Monday to Saturday)

- Chat with us

- Write to usPlease write to us incase of any escalation/feedback/queries.

- 011-71025900, 011-61329950(9:00 AM to 6:00 PM Monday to Saturday)

- nri.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.