Written by

Updated :

Reviewed by

Under current Income Tax laws, it is mandatory for individuals with an annual taxable income above Rs. 2.5 lakh to file an Income Tax Return (ITR). While there are a number of ITR forms to choose from, one of the most popular ones is the ITR Form 1 or Sahaj form. Read on to know key details about ITR 1 Sahaj form and how to file ITR 1.

What is the Structure of ITR 1 Form?

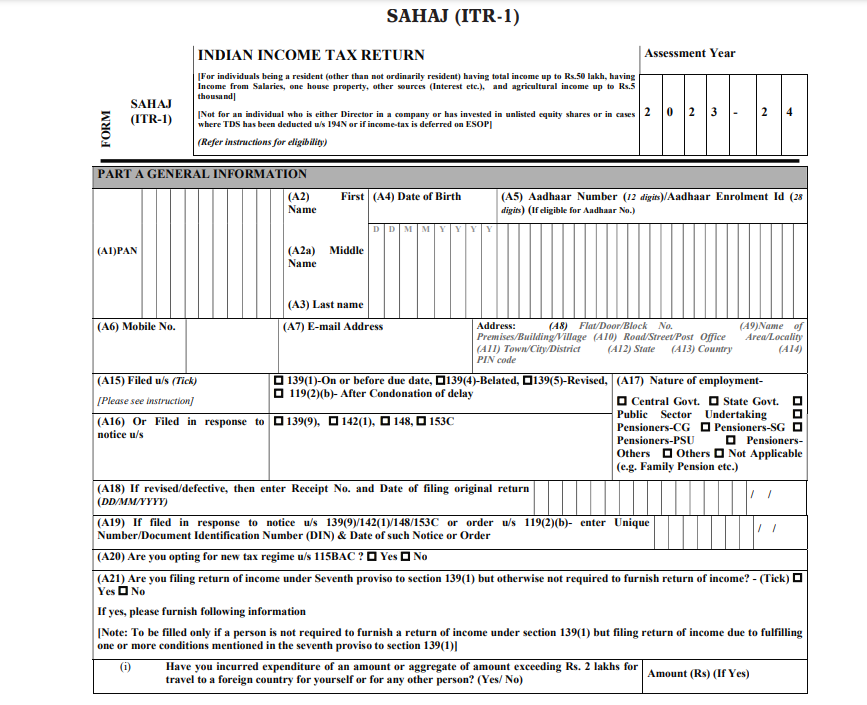

ITR 1 form for AY 2023-24 consists of multiple parts, including:

1. Part A General Information which looks like this:

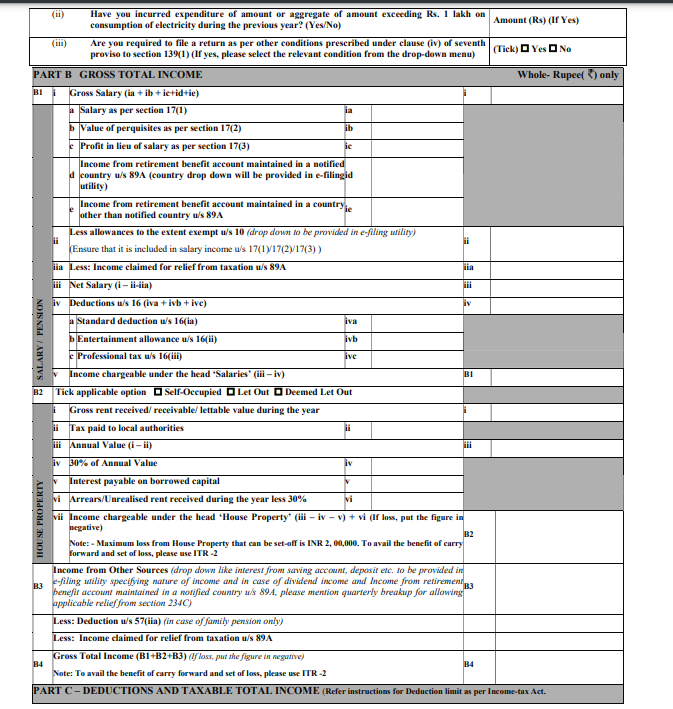

2. Part B – Contains details of Gross Total Income

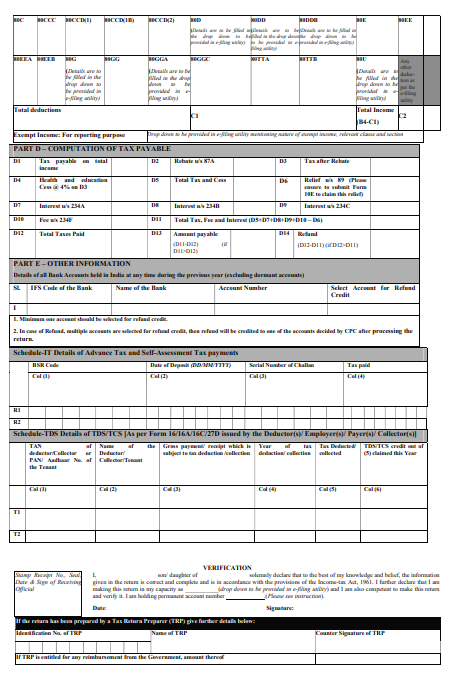

3. Part C – This section covers details related to deductions and taxable total income

4. Part D – Here you need to provide details of computation of tax payable. Using an income tax calculator is an easy way to complete this calcilation.

5. Part E – In this section the taxpayer can include other information like Bank Account details including account number, IFSC, etc. of all bank accounts held in India during the applicable financial year. This section also allows the tax payer to select a specific bank account for availing any due income tax refund.

6. Schedules – ITR 1 Form for AY 23-24 contains two schedules. The first of the these allows the tax payer to declare any self-assessment tax or advance tax paid during the applicable FY. While on the other schedule one can declare details of any tax deducted at source (TDS) or tax collected at source (TCS) for the applicable financial year.

7. Verification – This section contains fields for date, place of filing and signature/name of the tax payer along with the option of including details of TRP (tax return preparer), if applicable.

Eligibility Criteria for Filing ITR 1 Form in AY 2023-24

Before we get into the details of how to file taxes using ITR 1, first its necessary to understand who is eligible to use this form. In Assessment Year 2022-23, ITR Form 1 can be filed by a resident individual who meets the following criteria specified by the Income Tax Department:

Total income for FY 2022-23 is not in excess of Rs. 50 lakh

Income of tax payer for the applicable FY is limited to salary, single house property, family pension, and some specified sources

If the annual income from agriculture is up to Rs. 5,000

When income of spouse or minor is clubbed in the annual income declared

Other sources of income for which tax filing using Sahaj Form 1 is allowed include:

Interest income from saving account and term deposits held with co-operative society, bank or post office

Other interest income including that from income tax refunds, enhanced compensation, etc

Who is Not Eligible to File ITR 1 Sahaj Form for AY 2023-24?

Not all taxpayers are allowed to use ITR Form 1 for filing their income tax return for FY 2022-23 ( AY 2023-24). The Sahaj form cannot be used in the following cases:

1. If annual income for FY 2022-23 is above Rs. 50 Lakhs and/or agricultural income for the FY exceeds Rs. 5,000

2. A tax payer who has invested in unlisted equity shares or is a director in a company cannot file ITR Form 1.

3. NRI (Non-Resident Indians) and RNOR (Resident Not Ordinarily Resident) cannot file returns using Sahaj form.

4. Individuals who have taxable short or long-term capital gains are not eligible for filling ITR 1 form.

5. People having income from business and professional fees cannot use this form.

6. The tax payer owns and has income from more than one house property

7. If the individual has income from legal gambling, horse racing (including owning and maintaining race horses), lottery, etc. during the applicable FY

8. Tax payers who have deferred income tax from ESOP (employee stock option) received from eligible start-ups

Apart from the above, an individual tax payer is also not allowed to file income tax return using Sahaj form if tax has been deducted u/s 194N of the Income Tax Act. A clear understanding of the various eligibility criteria to file ITR 1 is necessary in order to ensure you do not get an income tax notice due to filing taxes using the wrong form.

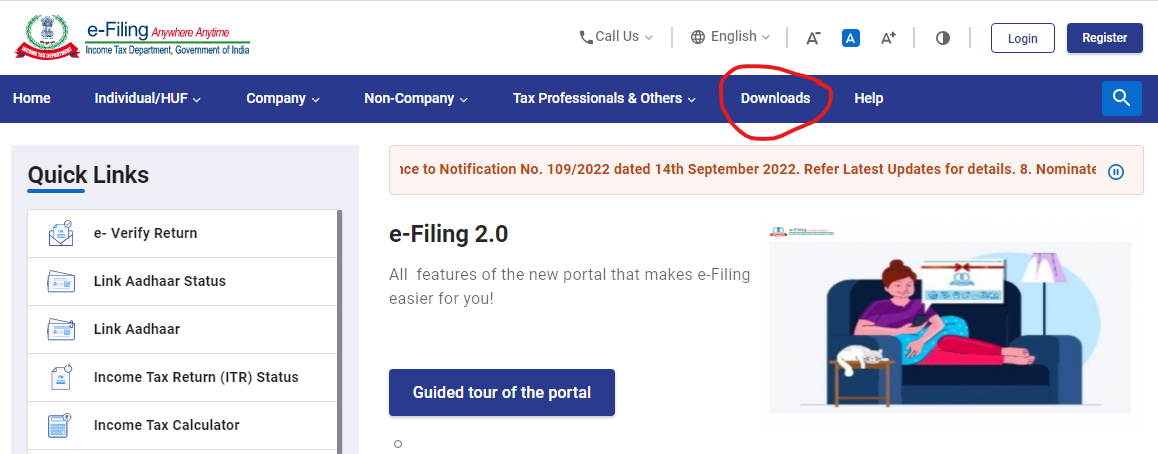

How to Download ITR 1 Form?

Below are the steps you need to follow in order to download the ITR 1 form.

Step 1. Go to the Income Tax e-Filing Portal and click on Downloads

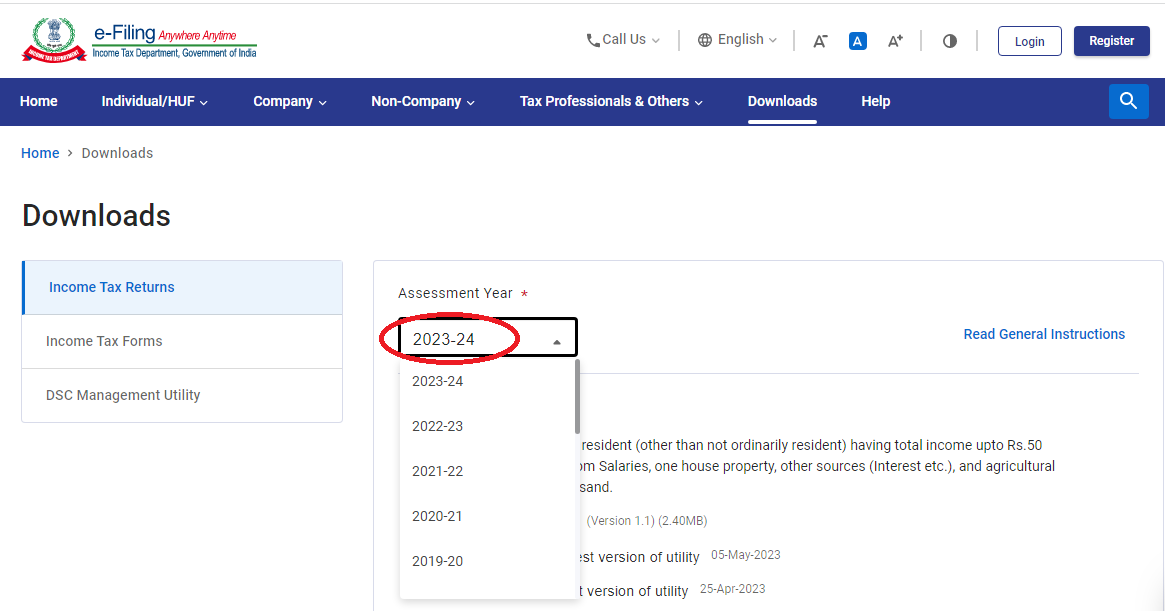

Step 2. On the subsequent page you can choose the applicable assessment year:

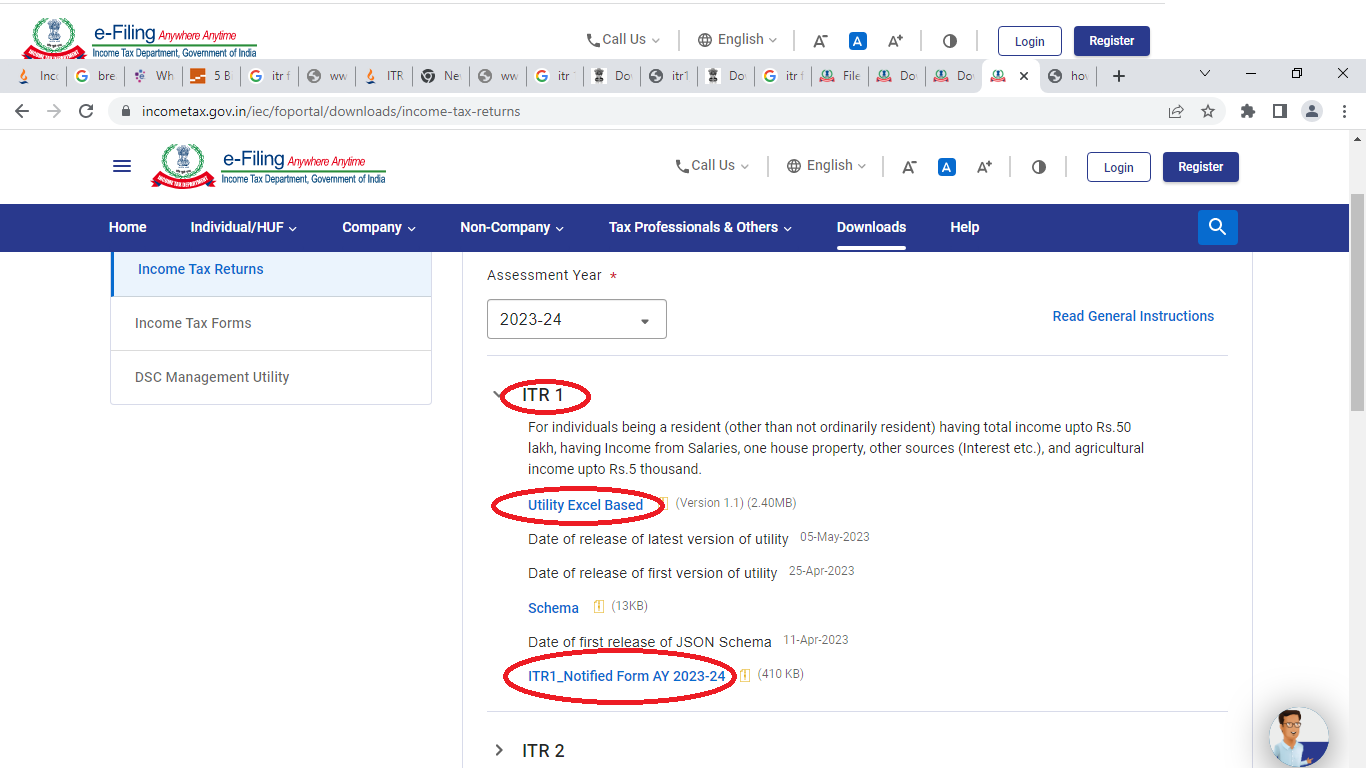

Step 3. Next the complete list of ITR Forms for the applicable AY is displayed. ITR 1 will the first one displayed in this list and you have the option to download the copy of the form as well as the ITR 1 Excel Utility on this page.

Once you have downloaded the applicable ITR-1 form or Excel-based utility you can proceed with filing your ITR form 1 as per your requirement.

How to File ITR 1 Form?

There are two ways you can follow for ITR 1 filing process:

1. Online Method

- You need to transmit the data electronically first and submit the return verification as ITR-V to CPC, Bengaluru

- You can file the return online and then opt for e-verification of ITR-V via net banking, EVC, or Aadhar OTP

- Next to ITR 1 filing online, you will receive the acknowledgement on your registered email address

1. Online Method

- You need to transmit the data electronically first and submit the return verification as ITR-V to CPC, Bengaluru

- You can file the return online and then opt for e-verification of ITR-V via net banking, EVC, or Aadhar OTP

- Next to ITR 1 filing online, you will receive the acknowledgement on your registered email address

Another way you can choose for ITR 1 filing is to download the form from the Income Tax website, fill it and send it to the CPC office of the Income Tax Department within 120 days after e-filing income tax.

2. Offline Method

Only the following two categories of individuals can opt for ITR 1 filing in paper form:

- Individuals of age 80 years or more during the previous year

- Individuals or HUF (Hindu Undivided Families) who have income under Rs. 5 Lakhs and have not claimed any return refund

- For offline ITR 1 filing, you need to furnish the return in a physical paper form and submit the same to the Income Tax Department.

Last Date to File ITR 1 Form

As a taxpayer who is eligible for ITR 1 form filing, you need to submit the duly completed form by July 31 of each assessment year. For instance, for the income earned between April 1, 2022, and March 31, 2023, the last date to file ITR 1 form in the assessment year 2023-24 is currently July 31, 2023. However, the Government may extend this ITR filing deadline at its discretion.

Further, an individual can file ITR post 31st July but before 21st December after payment of maximum fine of Rs. 5,000.

What are the Documents Required to Fill Out ITR 1 Form?

Here are the documents required before you file ITR 1 form:

a) Form 16, as issued by your employer for a specific financial year

b) Form 26AS

c) Proof of tax exemptions or deductions in case you have not submitted them to your employer timely

d) PAN Card

e) Bank investment certificates, like FD certificate or the bank’s passbook

Also Read: Income Tax Documents To Claim Deductions

What are the Major Changes Made in ITR Form 1 for the Last Few Assessment Years?

For AY 2020-21:

1. Taxpayers need to disclose the amount invested for tax-saving separately from April 1, 2020, till the end of June 2020.

2. Individuals having a single property in joint ownership with income up to Rs. 50 Lakhs can also file ITR 1 online or offline.

3. Individuals who fulfil the following criteria should also file ITR 1 online:

- Cash deposits above Rs. 1 crore

- Incurred foreign travel expense of Rs. 2 Lakh

- Expenditure on electricity above Rs. 1 Lakh

For AY 2019-20:

1. For the financial year 2018-19, an individual who is either a company’s director or has invested in unlisted equity shares is not eligible to file the Sahaj Form.

2. Pensioners checkbox introduced in Part A of ITR 1 form.

3. A column of Section 80TTB has been included for senior citizens.

4. Bifurcation must be done for deductions under salary into three parts – standard deduction, professional tax, and entertainment allowance.

For AY 2019-20:

1. For the financial year 2018-19, an individual who is either a company’s director or has invested in unlisted equity shares is not eligible to file the Sahaj Form.

2. Pensioners checkbox introduced in Part A of ITR 1 form.

3. A column of Section 80TTB has been included for senior citizens.

4. Bifurcation must be done for deductions under salary into three parts – standard deduction, professional tax, and entertainment allowance.

Also Read: TDS on Salary

For AY 2018-19:

1. ITR 1 form has been made applicable only for resident individuals, not RNOR.

2. Break-up of salary must be furnished, which was previously included only in Form 16.

3. Break-up of income under house property must be furnished, which was mandatory for ITR 2 form.

Also Read: Components of Salary Slip

Important Terms Related to ITR 1 Form

1. Notice Number

You need to fill this number only if you have received a notice from the Income Tax Department and are filing the return in response to it.

2. Revised Return

It is the return you re-file in case you later realize you have made a mistake while filing the ITR (Income Tax Return).

3. Annexure-less Return

It is the return with which you do not have to attach any documents. ITR 1 form is an example of this type of return.

4. Advance Tax

TDS mostly covers the advance tax payment. However, you might have to consider other sources of income as well. If the tax on income is Rs. 10,000 in a year, you are liable to pay Advance tax.

FAQs About ITR 1 Form

Q. Should I file ITR 1 form if my total exempt income exceeds Rs. 5,000?

A. You should file ITR 2 in case the total exempted income goes beyond Rs. 5,000. As per Section 10 of the IT Act, exempt income includes agricultural income, LIC maturity amount, and Long-Term Capital Gains.

Q. Should I show interest income as ‘income from other sources’ if TDS has been deducted?

A. While filing ITR 1 form, you should always consider interest income under ‘Income from other sources’, even if the bank has deducted TDS.

Q. Do I have to fill my bank account details in ITR even when there is no refund due?

A. As per the guidelines from the Income Tax Department, every taxpayer must fill the bank account details while filing ITR 1 or other forms. It is done to send refunds to them timely in case they end up paying more than their tax liability. Not filling these details may end up delaying the refund transfer process.

Q. Is there any limit to the returns I can file using my email id and phone number?

A. One email id and mobile number can be used to file ten returns at maximum.

Q. Can I file ITR for AY 2023-24 now?

A. Yes, you can choose to file your ITR for AY 2023-24 now or later as per your convenience and availability of key documents like Form 16 from your employer. But, please keep the current deadline of 31st July, 2023 in mind as delayed filing can lead to penalties under current Income Tax rules.

Sources:

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1601475

https://www.incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/ITR-1_eBook.pdf

https://www.incometaxindia.gov.in/_layouts/15/dit/mobile/faqs/faq-questions.aspx?key=FAQs+on+filing+the+return+of+income&k=

https://www1.incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/Instructions_ITR_1_AY_2019-20.pdf

https://incometaxindia.gov.in/forms/income-tax%20rules/2023/itr1_english.pdf

https://www.incometax.gov.in/iec/foportal/help/e-filing-itr1-form-sahaj-faq

https://economictimes.indiatimes.com/wealth/tax/new-itr-forms-for-ay2023-24-notified-key-changes-in-income-tax-return-forms-last-date-to-file-itr-more/separate-section-for-vda/slideshow/97981061.cms

ARN: June23/Bg/26A