Related Articles

ITR 1 Form

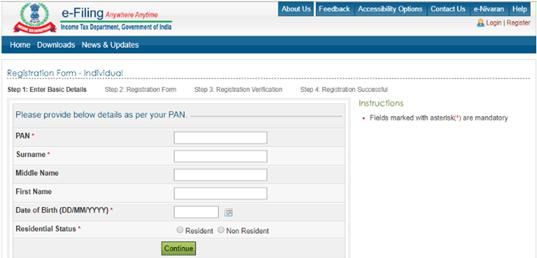

The Income Tax Department in India has categorized the taxpayers based on their...

Read Mored

ITR 4 Form

ITR refers to Income Tax Return, and ITR 4 Sugam Form means that it is applicable for the...

Read More

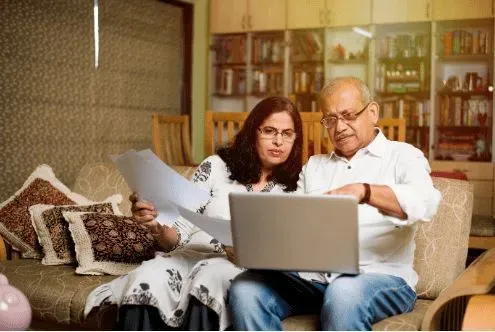

Income Tax Slab FY 2022-23

The calculation of income tax in India is based on income tax slabs and rates for the...

Read More