Written by

Updated :

Reviewed by

Income tax refund, also known as IT refund, arises in the cases in which tax paid by an Assessee is higher than the amount he is liable to pay. It is calculated as per various tax laws and sections of the Income Tax Act, 1961.

Income Tax Refund – Illustration

Rahul is a 26-year old digital marketer living in Delhi. His total income, as per assumption, is defined as follows:

Basic Salary: Rs. 20,000 per month

Components |

Amount (in rupees) |

Deductions (in rupees) |

Taxable amount under new income tax regime (in rupees) |

Basic Salary |

2,40,000 |

|

2,40,000 |

HRA |

1,20,000 |

60,000 |

1,20,000 |

Special Allowance |

60,000 |

|

60,000 |

Gross Income |

|

|

4,20,000 |

Basic Salary: Rs. 20,000 per month

House Rent Allowance (HRA): Rs. 10,000 per month

Special Allowance: Rs. 5,000 per month

Rent paid: Rs. 5,000 per month

As per Income tax slabs defined under Budget 2020 [1], the tax liability came out to be nil based on the taxable income and other deductions. But due to miscalculations done at his end or by the hired tax professionals, he paid income tax while filing the ITR.

In such cases, the income tax refund procedure is followed as per the rules defined by the government.

Also Read: Components of Salary Slip

Is it Mandatory to file Income Tax Return to Process the Refund?

If a taxpayer wants to claim income tax refund to get back the excess tax paid in a financial year, filing the Income Tax Return (ITR) is mandatory. Failing to file the ITR in the applicable assessment year will prevent you from getting a tax refund. Neither you can check IT refund status online.

Also Read: How to File ITR Online?

How to Claim an Income Tax Refund?

The government now utilize e-transfer facility to process income tax refund. Hence, one can claim a refund by filing the ITR for a specific financial year. It is crucial to ensure that the ITR should be verified electronically via OTP or physically by posting signed ITR-V [2] to the Centralized Processing Centre (CPC) within 120 days of filing the ITR. Also, the excess tax paid must be reflected in Form 26AS.

How to Claim an Income Tax Refund?

The government now utilize e-transfer facility to process income tax refund. Hence, one can claim a refund by filing the ITR for a specific financial year. It is crucial to ensure that the ITR should be verified electronically via OTP or physically by posting signed ITR-V [2] to the Centralized Processing Centre (CPC) within 120 days of filing the ITR. Also, the excess tax paid must be reflected in Form 26AS.

Once verified by the Income Tax Department, the income tax refund will be credited to the taxpayer’s bank account timely.

Which ITR Form should you file for Income Tax Refund?

Previously, the taxpayers need to file Form 30 to claim the income tax refund. However, you can claim income tax refund by filing ITR with the right ITR Form based on your income.

For instance, you can file ITR Form 1, also known as Sahaj, if your total income from salary, house property, and other sources is up to Rs. 50 Lakh. You can choose your ITR depending on the source of income you have earned in the financial year.

Read More: ITR Forms

How to Check ITR Status Online?

You can check ITR filing status using the link given below:

https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/ITRStatusLink.html

You need to enter the PAN details and the acknowledgement number to check the status online.

How to Check Income Tax Refund Status?

You can check income tax status for refund in any of the following ways:

a) Using the NSDL website

b) Using the e-filing portal of IT (Income Tax) Department

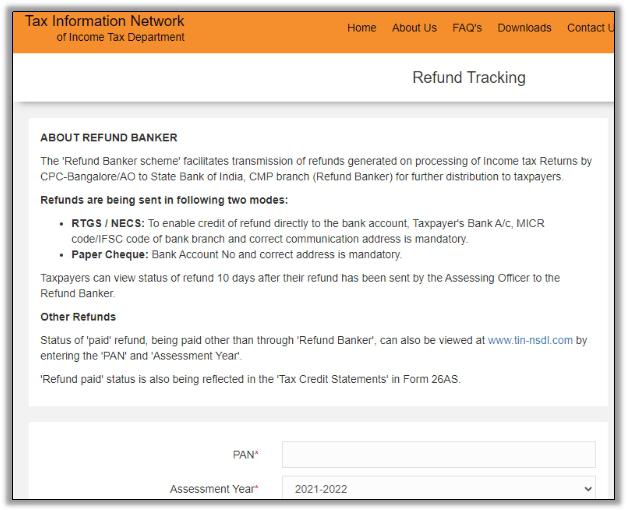

Steps to Check Status of Income Tax Refund Online on NSDL Website

Step 1: Visit the NSDL website to check the IT refund status online:

https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

Step 2: On the page that appears, enter your PAN and select the assessment year to proceed further for income tax refund tracking.

Step 3: You will see the income tax status for refund appearing on the screen.

Also Read: TDS Refund Status

Steps to Check Status of Income Tax Refund Online on E-filing Portal

Step 1: Visit the e-filing portal using the link:

https://portal.incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html

Step 2: Log into your user account using the correct credentials.

Step 3: Click on ‘View Return/Forms’ link.

Step 4: Go to the ‘My Account Tab’ and then select ‘Income Tax Returns’ from the given dropdown menu.

Step 5: Click on the acknowledgement number that appears in one column.

Step 6: It will lead you to a page that contains the details of your ITR and income tax refund status.

Interest on Income Tax Refund

In many cases, the income tax refund amount received by the taxpayers is slightly higher than the amount claimed in their ITRs. This difference is the interest they earn on an income tax refund.

As per income tax refund rules [3], it is mandatory for the Income Tax Department to pay the interest on the refund if it is 10% or more of the tax paid.

Section 244A of the Income Tax Act governs the income tax refund rules and provides a simple interest at the rate of 0.5% per month or part of the month on the income tax refund amount.

The interest is calculated from April 1 of the applicable assessment year till the date of income tax refund transfer, provided the return of income is furnished on or before the due date. In case the ITR is filed after the due date, the interest is calculated from the return filing date.

Also Read: Income Tax Due Date Extension for FY 2019-20 & AY 2020-21

If you notice any discrepancy in the interest computation over income tax refund, you can raise a request for rectification of the same online through your user account.

What to do if a Refund is not Processed at CPC?

The Income Tax Department does its best to ensure that the taxpayers get an income tax refund within 3 to 4 months after July 31 of every assessment year.

In case you do not receive the refund even after 3-4 months, you are advised to connect with the CPC of the IT Department on the following numbers to inquire about the same:

1800 4250 0025

080-2650 0025

Adjustment of Refund Against Outstanding Demand

However, there can be cases in which a specific tax amount is outstanding against the taxpayer who claims an income tax refund.

For example, you might have tax dues for any of the previous years but are eligible for an income tax refund in another year. In such cases, the IT department may not pay you the income tax refund due to you.

Adjustment of Refund Against Outstanding Demand

However, there can be cases in which a specific tax amount is outstanding against the taxpayer who claims an income tax refund.

For example, you might have tax dues for any of the previous years but are eligible for an income tax refund in another year. In such cases, the IT department may not pay you the income tax refund due to you.

However, there can be cases in which a specific tax amount is outstanding against the taxpayer who claims an income tax refund.

For example, you might have tax dues for any of the previous years but are eligible for an income tax refund in another year. In such cases, the IT department may not pay you the income tax refund due to you.

Frequently Asked Questions About Income Tax Refund (FAQs)

Q. Is the income tax refund taxable?

A. The amount you receive as income tax refund refers to the excess tax paid by you. It cannot be considered as a part of your income and is thus, non-taxable. However, the interest you receive over the income tax refund is regarded as an income and is subject to taxation rules.

Q. What is the time limit to claim income tax refund?

A. The entire income tax refund procedure depends on the timely submission of ITR. Hence, the time limit to claim the refund is the end of that assessment year. Thus, for FY 2020-21, the last date to apply for income tax refund is March 31, 2021.

Q. How will get the income tax refund?

A. While filing the ITR, you must provide bank details in all of the ITR forms. The IT department will use the details to credit tax refund into your bank account once the refund request is successfully verified.

Q. Whom should I contact for my queries related to the income tax refund?

A. You need to contact Aaykar Sampark Kendra for the queries about an income tax refund. You can contact this support center either by calling on 1800-180-1961 or sending an email to refunds@incometaxindia.gov.in.

Q. What are the special cases related to an income tax refund?

A. Some special cases related to the income tax refund are covered under Section 238 of the Income Tax Act. Under this section, if an individual is unable to claim an income tax refund due to insolvency or death, then his legal representative can request the refund.

Sources:

https://www.incometaxindia.gov.in/_layouts/15/dit/mobile/viewer.aspx?path=https://www.incometaxindia.gov.in/acts/income-tax%20act,%201961/2018/102120000000071239.htm&k=

https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/EverifyHomeLink.html?lang=eng

https://www.incometaxindia.gov.in/tutorials/8-interest%20on%20excess%20refund.pdf

https://www.incometaxindiaefiling.gov.in/eFiling/Portal/Notice_245_FAQ.pdf

ARN:- Aug21/Bg/18TT