Written by

Updated :

Reviewed by

On this Page

TDS return is essentially a summary of all the transactions pertaining to TDS completed during a quarter. In other words, TDS Return is a quarterly statement of TDS that is submitted to the Income Tax Department, by the deductor.

TDS (Tax Deducted at Source) is a source of collecting tax by the Government of India at the time of making specified payments. These include—rent, commission, professional fees, interest, and salary. The tax is deducted at the time money is credited to the payee's account or at the time of payment, whichever is earlier.

In this article, we look at the various aspects of TDS return.

What is TDS Return?

TDS Return denotes the quarterly statement that is submitted by the deductor/employer to the Income Tax Department. It can also be defined as a sum total of all the TDS associated transactions carried during a quarter.

TDS return showcases the summary of all TDS entries collected that are paid by the deductor to the Income Tax authority. TDS return statement contains the following details:

1. Deductee's PAN number

2. In-detail particulars of the TDS contributed to the government's income

3. Information regarding TDS Challan

4. Payment amount

5. Section under which TDS is deducted

What are the Types of TDS Returns?

The type of TDS return form to be submitted is mainly based on the nature of income of the deductee. It is crucial to note that there are several types of TDS return forms for different conditions.

Here are the types of TDS return forms:

Related Articles

1. Form 24Q

Under Section 192 of the Income Tax Act, 1961, it is used for preparing eTDS returns for a deduction on salaries. It needs to be submitted quarterly by the deductor and contains details like salaries paid and the TDS deducted.

It contains 2 annexures:

a) Annexure-I comprises of the details of the deductor, deductees and challans

b) Annexure-II comprises of the salary details of the deductees

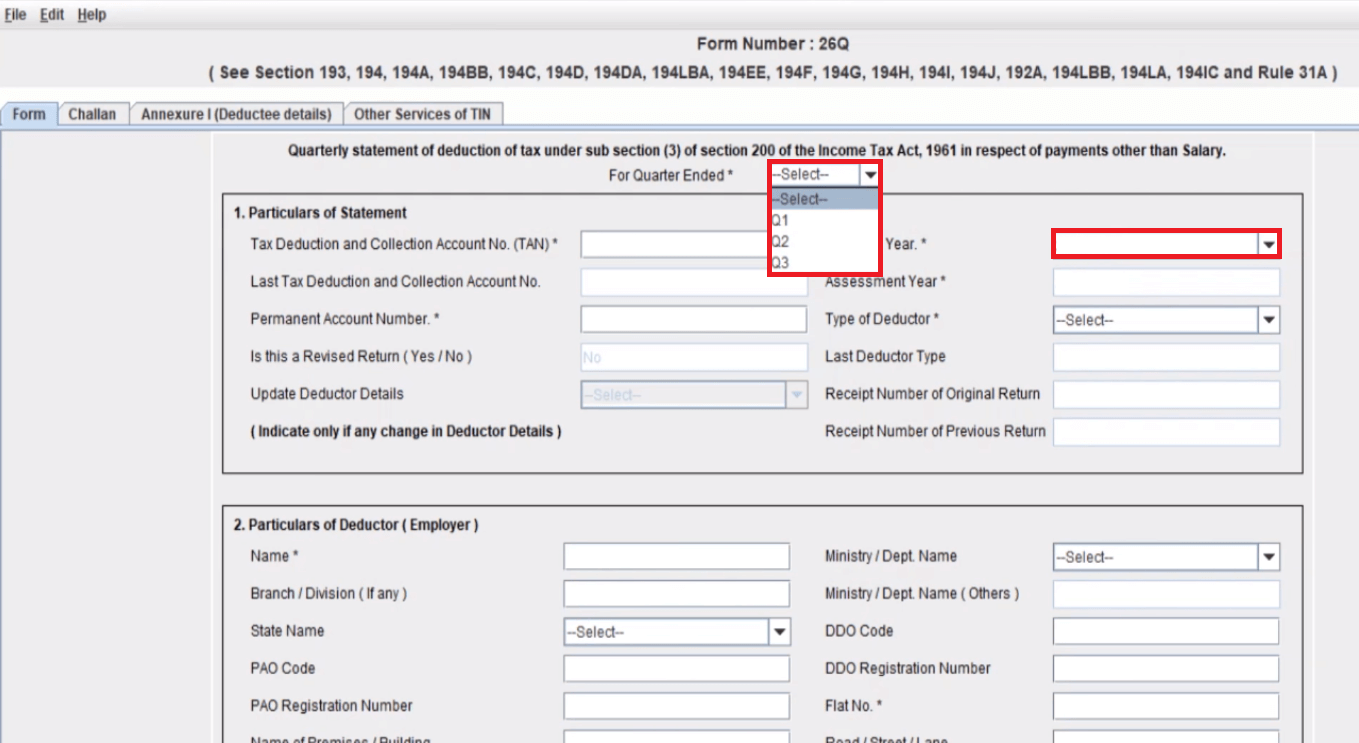

2. Form 26Q

Form 26Q needs to be submitted for tax deduction at source for all payments except salaries. It is also submitted quarterly under Section 200(3), 193 and 194 of the Income Tax Act. The payments on which the tax is deducted include interests, dividends, professional fees and director's sitting fee. It is mandatory to present PAN by the non-government deductors.

3. orm 27Q

TDS for the NRIs and foreigners under Section 200(3) of the Income Tax Act is applicable for payments other than salary made to non-resident Indians and foreigners. It is deductible on payments including interests, bonus, any additional income or sum owed to a non-resident of India.

4. Form 27EQ

In this TDS return form, it is mandatory to furnish TAN and is submitted quarterly. The tax is collected at source under Section 206C of the Income Tax Act, by the seller when a buyer purchases certain commodities. The tax is collected either in cash, credit, demand draft, cheque or any other route of payment.

Types of TDS Return Forms |

What does it include? |

Form 24Q |

Statement for tax-deductible at source from salaries

|

Form 26Q |

Statement for tax deducted at source on payments except for salaries

|

Form 27Q |

Statement for a tax deduction on income made from interest, dividends and any other sum payable to non-residents

|

Form 27EQ |

Statement of collection of tax at source

|

Where is TDS Applicable?

The following is where TDS is applicable:

1. The employer deducts TDS as per the income tax slab rates applicable.

2. Banks deduct TDS @10%. They may deduct 20% if they do not have your correct PAN information.

Where is TDS Applicable?

The following is where TDS is applicable:

1. The employer deducts TDS as per the income tax slab rates applicable.

2. Banks deduct TDS @10%. They may deduct 20% if they do not have your correct PAN information.

3. Rent payments made by individuals and HUF (Hindu Undivided Family) exceeding Rs 50,000 per month, has a deductible TDS @ 5% even if the individual or HUF is not liable for a tax audit.

The TDS Rates are specified under the income tax act, and TDS is deducted based on these specific rates.

3. Rent payments made by individuals and HUF (Hindu Undivided Family) exceeding Rs 50,000 per month, has a deductible TDS @ 5% even if the individual or HUF is not liable for a tax audit.

The TDS Rates are specified under the income tax act, and TDS is deducted based on these specific rates.

Related Articles

How is TDS Calculated?

As per the government, tax deductions are allowed under section 80C and section 80D of the Income Tax Act, 1961. This, in turn, will enable you to look for various types of investments for a particular financial year.

You can calculate TDS on salary by reducing the exemption from total annual earning as specified by the Income Tax department. In case of tax exemption, the employer obtains a declaration and proof from the employees to approve a tax declaration.

Below are a few steps to calculate TDS on your income:

1) First calculate your gross annual income, allowances and perquisites

2) Estimate The exemptions under Section 10 of the Income Tax Act on allowances such as medical, house rent and travel.

3) Reduce the exemptions from the gross monthly income

4) If you have any other source of income such as from house rent, subtract this amount from the figure calculated above

5) Now, calculate your investments for the year under Chapter VI-A of ITA and deduct the amount from the above estimated gross income

6) Finally, deduct the maximum allowable income tax exemptions on your salary

Also Read: How to Check & Claim TDS Refund?

See how the latest budget impacts your tax calculation. Updated as per latest budget on 1 February, 2020. No deductions will be allowed under the new tax regime.

TDS Return Eligibility

Any individual making specified payments mentioned under the Income Tax Act are required to deduct TDS at the time of payment. But no TDS is deductible if the person making the payment is an individual or HUF (Hindu Undivided Family) whose books are not to be audited.

Can you File TDS Return Online?

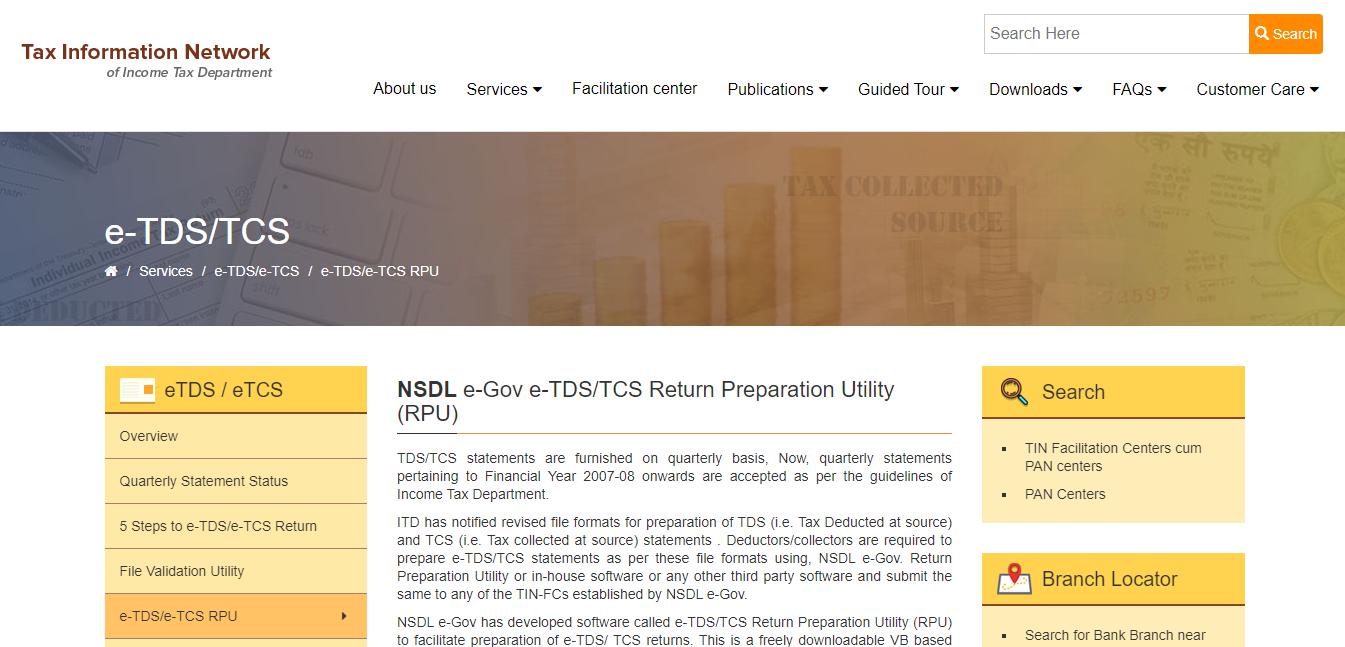

Filing TDS return online can be done through Return Prepare Utility Software available on NSDL website. If you file the returns online, then they can be submitted directly at the NSDL TIN website. Through the online mode, the deductor has to sign the return through digital signature.

Let us now see how to file TDS return online.

How to File TDS Return Online?

Follow the steps below to file TDS returns online:

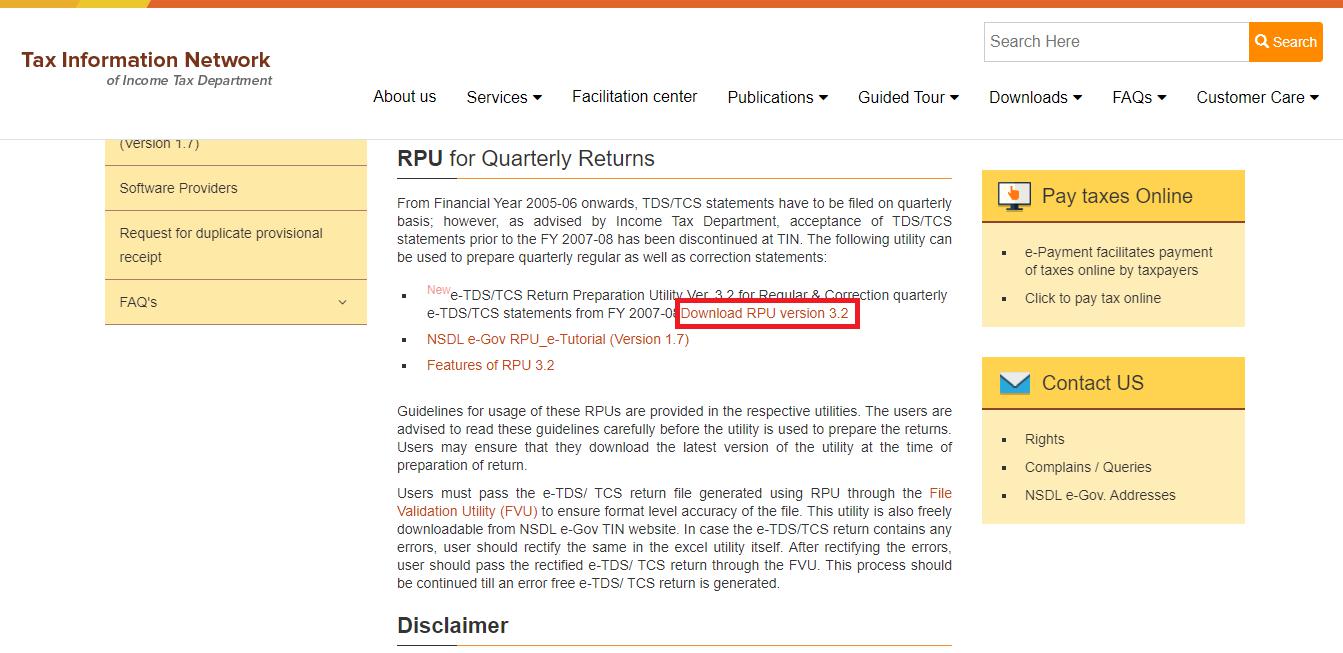

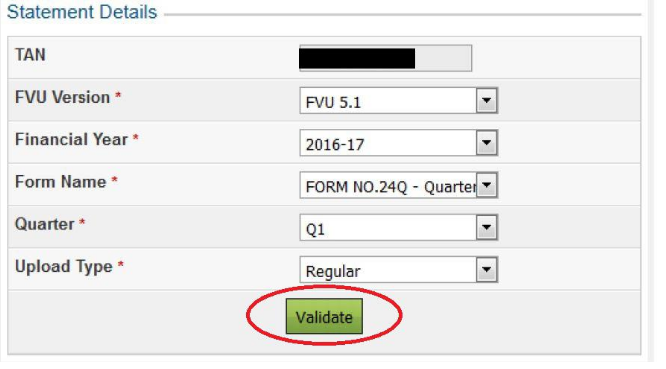

Step 1: Check out the file format in which the e-TDS return is to be prepared and is notified in TIN-NSDL's e-Gov e-TDS/TCS Return Preparation Utility (RPU) webpage.

Step 2: Prepare e-TDS/e-TCS return as per the file formats in clean text ASCII format with 'txt' as the filename extension. You can also prepare the returns by making use of the Return Preparation Utility provided by NSDL or any other software.

Step 3: After you create the file following the format, it needs to be verified through the File Validation Utility provided by NSDL.

Step 4: The File Validation Utility shall report the errors in case of any discrepancy. Then you will need to rectify the error(s), and the file will once again send it for verification through the File Validation Utility.

Step 5: The .fvu file that has been generated can be submitted at TIN-FC or uploaded on the Income Tax Department's e-filing page.

TDS Return Due Dates

After knowing how to file TDS Return, you must also be well aware of the due dates.

Due dates for TDS return filing 2020 are as follows:

Month of Deduction |

Quarter Period |

Due dates for filing TDS return for all deductors |

April May June |

1st April to 30th June |

31st July |

July August September |

1st July to 30th September |

31st October |

October November December |

1st October to 31st December |

31st January |

January February March |

1st January to 31st March |

31st May |

At Max Life Insurance, we offer a range of insurance plans which help in securing financial future along with tax benefit, Insurance plans such as, life insurance plans, and retirement plans. Beyond TDS, life insurance is one of the most popular tax-saving instruments that help reduce your overall tax liability. Life insurance plans ensure long-term protection and tax-saving benefits. You can avail of a significant amount of tax deductions and exemptions under Section 80C and 10(10D) of income tax act 1961 respectively.

So, ensure your family's secure future by investing in life insurance today and avail tax benefits with Max Life Insurance, today. You can use different calculators to compare the unique benefits of these plans before making a decision.

FAQs

Q. Which software can be used for filing TDS Return procedure online?

A. NSDL e-Gov has made available a freely downloadable facility, known as Return Preparation Utility, for preparation of e-TDS statements.

Q. Is TDS return filing form difficult to fill online?

A. You can visit the website of the Income-Tax Department website or the NSDL e-Gov-TIN anytime for assistance and fill the form with ease.

Q. Who can file TDS return?

A.TDS returns can be filed by any employer, organization or individual who avail Tax collection and Deduction Account Number (TAN) and make specified payments mentioned under the Income Tax Act, 1961 is required to deduct tax at source.

Sources:

https://www.incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/TDS_TCSStatement_Upload_User_Manual.pdf

https://economictimes.indiatimes.com/topic/TDS-returns

Disclaimer:

Save 46800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are:

- Regular Individual

- Fall under 30% income tax slab having taxable income less than Rs. 50 lakh

- Opt for Old tax regime

ARN:- Aug21/Bg/18BB