Related Articles

What is TDS and How Does It Affect You?

An individual can earn income from various sources. Income tax is a direct tax that they need to pay, depending on which tax…

Read More

TDS Rates Chart FY 2020-21

TDS is levied on various sources of income, including those generating commissions, incentives, salaries, dividends…

Read More

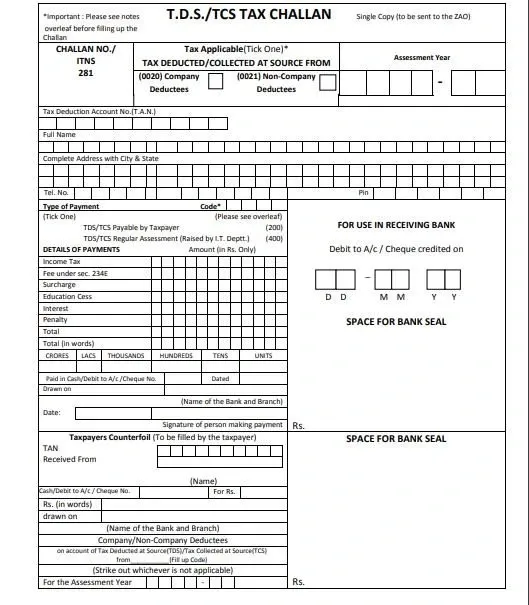

TDS Return

TDS return is essentially a summary of all the transactions pertaining to TDS completed during a quarter. In other words…

Read More