View in (हिन्दी)

Life Insurance Plan

Life Insurance Plan

Having a family that cares for you is the most precious gift in life. You do everything possible to be with your loved ones and take care of their needs – both emotional and financial. To make sure that your loved ones are protected and happy throughout their lives, you must take steps to protect their financial future if something unexpected happens to you.

It is where the decision to buy a life insurance policy plays a vital role. Life insurance acts as a tool to protect your family from potential financial losses that may come up after your unfortunate demise. The life insurance benefits your family members will receive help pay off debts, meet regular living expenses, and support various life goals.

What is Life Insurance Policy?

A life insurance policy refers to the contract between an insurance provider and an individual [1]. As per the agreement, the policyholders pay a certain amount as the policy premium while the insurer pays a specific amount to their family on untimely demise of life insured.

With death being the only sure thing in life, it is crucial to buy the best life insurance policy that suits your financial needs.

Why Choose Life Insurance Plans?

A life insurance policy helps you safeguard the financial interests of your family when you are not around. Millions of people buy life insurance for reasons that are often difficult to put into words. It forms a crucial component of a sound financial plan because of the following benefits:

1. Financial Protection for Family

A life insurance policy will provide a specified sum to your family (the chosen nominee) at the time of your untimely demise. They can use the sum assured to fulfil various financial needs.

2. Critical Illness Benefit

You can opt for critical illness rider with a life insurance policy, which offer protection against critical health ailments, such as cancer, kidney failures, and cardiovascular issues. This way, you or your family need not worry about the financial side of medical emergencies.

3. Tax Deductions

The premium you pay for a life insurance policy is eligible for tax deductions up to Rs 1.5 lakh under Section 80C of the Income Tax Act, 1961.

4. Peace of Mind

With the best life insurance policy by your side, you get peace of mind, knowing that there is a financial safety net your loved ones can bank upon after you.

.png)

Why Choose Life Insurance Plans?

A life insurance policy helps you safeguard the financial interests of your family when you are not around. Millions of people buy life insurance for reasons that are often difficult to put into words. It forms a crucial component of a sound financial plan because of the following benefits:

1. Financial Protection for Family

A life insurance policy will provide a specified sum to your family (the chosen nominee) at the time of your untimely demise. They can use the sum assured to fulfil various financial needs.

2. Critical Illness Benefit

You can opt for critical illness rider with a life insurance policy, which offer protection against critical health ailments, such as cancer, kidney failures, and cardiovascular issues. This way, you or your family need not worry about the financial side of medical emergencies.

3. Tax Deductions

The premium you pay for a life insurance policy is eligible for tax deductions up to Rs 1.5 lakh under Section 80C of the Income Tax Act, 1961.

4. Peace of Mind

With the best life insurance policy by your side, you get peace of mind, knowing that there is a financial safety net your loved ones can bank upon after you.

.png)

5. Extensive Coverage at Low Cost

insurance companies offer significant payouts for life insurance (like term plan) at a low premium, depending on your age and health condition.

6. Opportunities to Create Wealth

Life insurance plans like ULIP (Unit Linked Insurance Plan) gives you the benefit of life cover along with market linked returns from your investment.

For example, Max Life Online Savings Plan – Variant 1 comes with the benefit of life cover along with a lump sum payout for your financial goals. You can also select the funds that suit your investment style.

7. Financial Planning for Life

Along with providing financial support against the event of untimely demise, life insurance plans also work as long-term investments to meet various goals in life. By investing in life insurance at the right age, you can plan well for different life stages.

8. Planning for your Child’s Higher Education

Saving money for your child’s education might be one of the biggest priorities for you, being an Indian parent. By investing in the best life insurance policies, you can plan for your child’s future and help him secure various educational milestones in life.

9. Assured Income for Retirement

Life insurance is a financial instrument that you can choose to plan for retirement. The steady payouts it can offer in the form of annuities can become the source of income for your retired life.

Who Can All Buy Life Insurance Policy?

Any individual, either male or female, falling into the age-group of 18-65 years, can buy life insurance in India as per the life insurance terms & conditions

Age Group |

Importance of Buying Life Insurance in a Specific Age |

20-30 |

Significant coverage at a low premium which will help in repaying education loan if any along with other financial needs |

30-40 |

Financial protection for the entire family and regular monthly income as per the life insurance plan chosen |

40-50 |

Opportunity to create wealth child’s higher education and retirement planning |

50 and Above |

Ease of repaying huge financial debts for the family if any along with other benefits |

Here are some other related aspects of buying life insurance you must know:

1. Just like non-smokers, even smokers can avail life insurance, though the rate of the premium may differ. Also, they must inform the insurer about their habit of smoking while buying a life insurance policy.

2. Disabled individuals can also purchase the best life insurance policy if they can prove that they provide for their family members. They also need to undergo medical tests to determine the policy premium based on the degree of risk involved.

3. People suffering from pre-existing medical conditions can buy life insurance. They need to inform the insurance company about the pre-existing health conditions if any. Failing to disclose the same while purchasing a policy may lead to claim rejection later.

At Max Life Insurance, we offer life insurance policies to individuals having pre-existing illnesses.

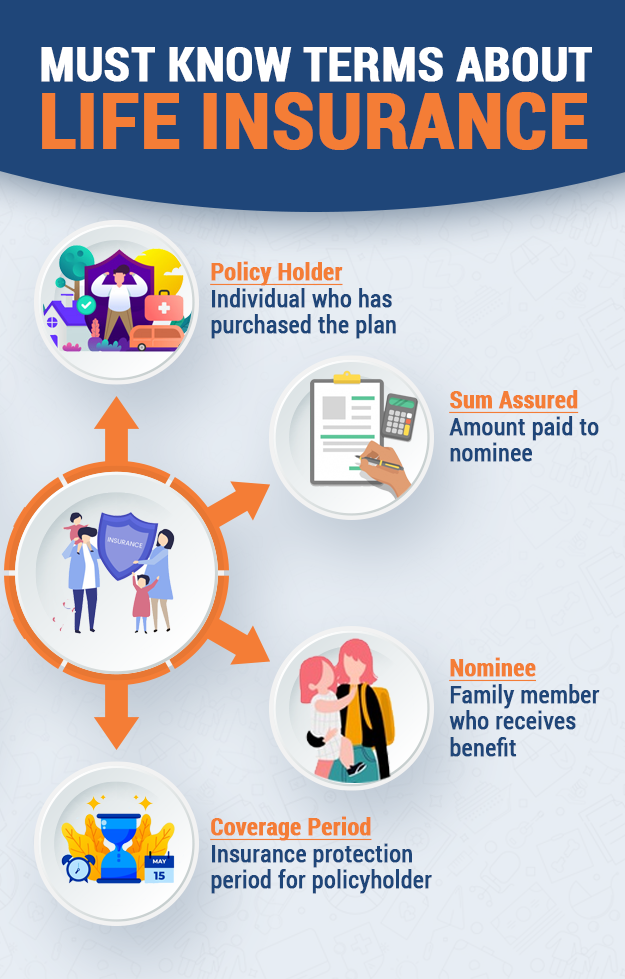

Important Terms About Life Insurance Policy[4]

1. What is a Policy?

Policy means the contract of insurance entered into between you and the insurance company as evidenced by this document, the Proposal Form, the Schedule and any additional information/document(s) provided to the insurance company, in respect of the Proposal Form along with any written instructions from you subject to the insurance company’s acceptance of the same and any endorsement issued by the insurers;

2. What is Sum Assured?

It refers to the amount payable to a nominee after the event of the unfortunate demise of the insured, as specified in the chosen life insurance policy. You can use an online life insurance premium calculator to get an estimate of the premium payable for a specific sum assured.

3. What is Annualised Premium?

Annualised Premium is the essentially the amount specified in the Policy Schedule, and denoted the Premium payable during a Policy Year chosen by you (as policyholder), excluding any additional premium paid for the Underwriting, loadings for modal premium, Rider Premiums and applicable taxes, cess, or levies, if any;

4. What is Life Insurance Coverage Period?

It is the duration for which the insured is covered under a life insurance policy. It can be different from the premium payment term/period during which you need to pay a life insurance premium.

Important Terms About Life Insurance Policy[4]

1. What is a Policy?

Policy means the contract of insurance entered into between you and the insurance company as evidenced by this document, the Proposal Form, the Schedule and any additional information/document(s) provided to the insurance company, in respect of the Proposal Form along with any written instructions from you subject to the insurance company’s acceptance of the same and any endorsement issued by the insurers;

2. What is Sum Assured?

It refers to the amount payable to a nominee after the event of the unfortunate demise of the insured, as specified in the chosen life insurance policy. You can use an online life insurance premium calculator to get an estimate of the premium payable for a specific sum assured.

3. What is Annualised Premium?

Annualised Premium is the essentially the amount specified in the Policy Schedule, and denoted the Premium payable during a Policy Year chosen by you (as policyholder), excluding any additional premium paid for the Underwriting, loadings for modal premium, Rider Premiums and applicable taxes, cess, or levies, if any;

4. What is Life Insurance Coverage Period?

It is the duration for which the insured is covered under a life insurance policy. It can be different from the premium payment term/period during which you need to pay a life insurance premium.

5. What is Maturity Date for the life Insurance Policy?

It is the means the date specified in the Schedule, on which the Policy Term expires;

6. What is Life Insurance Premium?

It denoted an amount specified in the Policy Schedule, payable by You, by the due dates to secure the benefits under the Policy, excluding applicable taxes, cess, and levies, if any.

7. What is Premium Payment Mode or Frequency?

An individual can pay the life insurance premium in:

1. Regular mode, which is monthly, quarterly, half-yearly, or annually throughout the policy tenure

2. A specific premium payment tenure, which can be a certain pre-fixed number of years (not till the end of the policy term)

8. What are Life Insurance Riders?

Riders are essentially features, which are in addition to basic benefits under the Policy. These include accidental death benefit rider, critical illness rider, and waiver of premium rider.

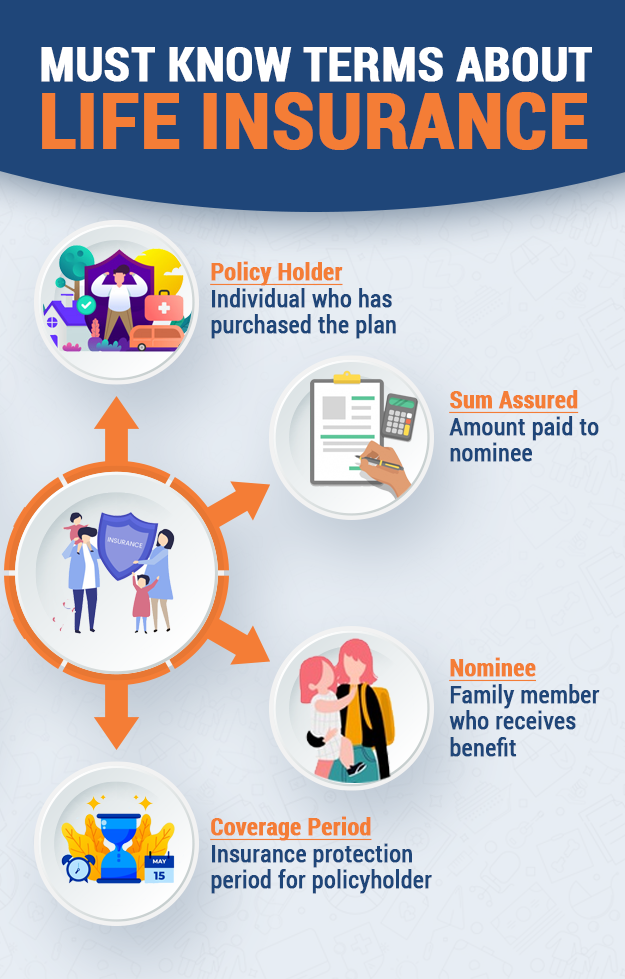

What are the Types of Life Insurance Plans?

Every policy buyer must understand different types of life insurance [2] before buying any of them.

1. Term Insurance

It is an affordable type of life insurance that offers a high sum assured at affordable premiums. The insurance company offers to pay a sum assured to the policy nominee in case of your untimely demise.

2. Unit Linked Insurance Plans (ULIPs)

ULIP is a unique type of life insurance that offers dual benefits of life cover and market linked returns on your investment. A portion of the amount paid as premium is invested in different fund options while the rest is used to provide life cover.

3. Child Plans

A child plan is another form of ULIP with which you can create wealth to support the higher education plans of your child. With a child plan, you also get the flexibility to invest money into various funds based on your financial condition and long-term goals.

4. Endowment Plans

These plans are known as a combination of life insurance and savings. By investing in an endowment plan, you will receive life cover as well as savings benefit. You will get the maturity benefit on outliving the term of your plan, along with periodic bonuses (if any).

What are the Types of Life Insurance Plans?

Every policy buyer must understand different types of life insurance [2] before buying any of them.

1. Term Insurance

It is an affordable type of life insurance that offers a high sum assured at affordable premiums. The insurance company offers to pay a sum assured to the policy nominee in case of your untimely demise.

2. Unit Linked Insurance Plans (ULIPs)

ULIP is a unique type of life insurance that offers dual benefits of life cover and market linked returns on your investment. A portion of the amount paid as premium is invested in different fund options while the rest is used to provide life cover.

3. Child Plans

A child plan is another form of ULIP with which you can create wealth to support the higher education plans of your child. With a child plan, you also get the flexibility to invest money into various funds based on your financial condition and long-term goals.

4. Endowment Plans

These plans are known as a combination of life insurance and savings. By investing in an endowment plan, you will receive life cover as well as savings benefit. You will get the maturity benefit on outliving the term of your plan, along with periodic bonuses (if any).

5. Retirement Plans

Also known as deferred pension products, these plans aim at helping you create wealth for your retired life to enjoy financial independence. Your nominee will receive immediate payment in case of your demise during the policy term. Otherwise, you will receive the vesting benefit on surviving the term.

5. Retirement Plans

Also known as deferred pension products, these plans aim at helping you create wealth for your retired life to enjoy financial independence. Your nominee will receive immediate payment in case of your demise during the policy term. Otherwise, you will receive the vesting benefit on surviving the term.

How to Select the Best Life Insurance Policy?

With a multitude of life insurance plans available in the market, it is critical to choose the right one. The selection of a life insurance plan must be based on a broad spectrum of financial needs.

Here are a few steps to consider while buying the best life insurance policy:

1. Gain Knowledge About Various Types of Life Insurance

Without proper knowledge of how life insurance works, people feel incapacitated to decide about buying the right policy. Hence, it is crucial to gain a thorough understanding of different types of life insurance products before zeroing in on any of them.

With a multitude of life insurance plans available in the market, it is critical to choose the right one. The selection of a life insurance plan must be based on a broad spectrum of financial needs.

Here are a few steps to consider while buying the best life insurance policy:

1. Gain Knowledge About Various Types of Life Insurance

Without proper knowledge of how life insurance works, people feel incapacitated to decide about buying the right policy. Hence, it is crucial to gain a thorough understanding of different types of life insurance products before zeroing in on any of them.

2. Assess Your Financial Needs

A life insurance plan that is suitable for your peers may not be ideal for you. Thus, you must consider your specific needs, be it affordability, choice of sum assured or riders before you start comparing different plans.

3. Compare Plans in Terms of Benefits

Owing to the wide variety of life insurance plans available, you need to be sure you select the right one which offers adequate benefits. For this, you should do the required homework of comparing the plans across several parameters like premium, the sum assured, and investment component, if any.

How to Choose the Best Life Insurance Company for Your Family?

The selection of the right life insurance provider is essential to ensure that you or your loved ones will get the benefits they seek from the purchase plan.

Consider the following aspects while choosing the best life insurance provider:

1. Claim Settlement Ratio (CSR)

This ratio defines the claims settled by an insurer over the ones received in a financial year. The higher the CSR, the higher are the chances of getting your life insurance claim paid.

2. Solvency Ratio

It refers to how well an insurance company can manage sufficient cash flow to deal with the debts. An insurer can provide hassle-free claim settlement if this ratio depicts its strength to meet the related liabilities.

3. Premium

All life insurance plans are priced differently. Thus, you need to choose the one that seems cost-effective for you. To avoid the risk of losing the life cover, make sure you do not select a plan whose premium is too high and unaffordable to you.

4. Persistency Ratio

It defines the percentage of policyholders that pay the premium over the total active policyholders. It is a good indicator of customer satisfaction delivered by the insurer.

5. Claim Settlement Process

A simplified claim settlement procedure implies your family will not have to face any hassle to receive life insurance benefits. It is advisable to choose an insurance company which follows a streamlined process to settle claims.

Why Buy Life Insurance Policy Online?

Every policy buyer must understand different types of life insurance [2] before buying any of them.

There are several reasons that support the decision to buy life insurance online, including

1. Transparency

From the features of a life insurance plan to its premium and other details, everything is transparent in front of you while buying a policy online. You can count upon this transparency to make an informed decision.

2. Convenience to Compare Plans

You can get online access to various informative articles, case studies, and calculators that helps in selecting the most suitable life insurance plan. In other words, you can make a well-informed decision to buy life insurance online quickly.

3. Secure Payment Modes

While buying the life insurance policy online, you utilize secure online payment options. Quick and hassle-free payment processing is ideal for times when you need to furnish policy documents to claim tax deductions.

4. Easy Life Insurance Policy Renewal

The process of life insurance policy renewal is quite easy and hassle-free. You can get the policy renewal done in just a few clicks made online.

.png)

Why Buy Life Insurance Policy Online?

Every policy buyer must understand different types of life insurance [2] before buying any of them.

There are several reasons that support the decision to buy life insurance online, including

1. Transparency

From the features of a life insurance plan to its premium and other details, everything is transparent in front of you while buying a policy online. You can count upon this transparency to make an informed decision.

2. Convenience to Compare Plans

You can get online access to various informative articles, case studies, and calculators that helps in selecting the most suitable life insurance plan. In other words, you can make a well-informed decision to buy life insurance online quickly.

3. Secure Payment Modes

While buying the life insurance policy online, you utilize secure online payment options. Quick and hassle-free payment processing is ideal for times when you need to furnish policy documents to claim tax deductions.

4. Easy Life Insurance Policy Renewal

The process of life insurance policy renewal is quite easy and hassle-free. You can get the policy renewal done in just a few clicks made online.

Documents Required to Get Life Insurance Plan

You need the following officially valid documents [3][5][6] while purchasing life insurance from a renowned insurer:

- Passport

- Voter ID

- NREGA job card

- Aadhar Card

- PAN Card/Form 60

In case these documents do not contain the updated address, you need the following documents:

- Utility bills of any service provider

- Property tax receipt

- Family Pension Payment Orders issued to the retired individuals

- Letter of allotment of accommodation from the employers such as PSUs and other statutory bodies

How Do You Save Tax with Life Insurance Plan?

Life insurance policies are considered efficient tools for tax-planning. It is because the policyholder is eligible to get tax benefits under the Income Tax Act, 1961. The premiums paid for various life insurance schemes are tax-deductible Section 80C, while the payout or maturity benefit is tax-exempt under Section 10(10D) of the Act.

How Can You Pay for Life Insurance Policy?

You can choose to pay the premium of life insurance plans in one go or with regular payments over time. Life insurance policies usually provide the option to choose between a single (one time) payment, regular (throughout the policy tenure) payment and limited premium payment tenure (for a payment tenure less than the policy coverage period).

With regular premium payment mode, you can select any of the following payment options:

- Annual

- Semi-annual

- Quarterly

- Monthly

You must also know that the life insurance premiums paid online are processed through secure payment gateways, thus ensuring the safety of transactions.

How Will Your Family Receive the Life Insurance Claim Money?

After your (Life insured) untimely demise, your loved ones will get the policy benefits by claiming the same from your insurer.

Follow these steps to claim life insurance policy benefits:

1. Inform the insurer at the earliest

2. Ask for the claim intimation form

3. Ask for the documents to be submitted with the claim form

4. If the policy was bought online, apply for the claim online as well

The nominee of a policy should not wait too long after the insured’s demise to ensure quick and easy claim settlement.

Which Life Insurance Plan Suits Your Need?

Everyone has different financial needs and life goals, based on which he/she should choose a life insurance plan.

With Max Life Insurance, you get the flexibility to buy life insurance plans that can be personalized to meet your specific needs. Here is a small guide to help you select the right plan:

Which Life Insurance Plan Suits Your Need?

Everyone has different financial needs and life goals, based on which he/she should choose a life insurance plan.

With Max Life Insurance, you get the flexibility to buy life insurance plans that can be personalized to meet your specific needs. Here is a small guide to help you select the right plan:

Life Stage/Need: 20 – 25 years (Young and unmarried)

Plans to Consider

1. Max Life Online Savings Plan (A Unit Linked Non Participating Individual Life Insurance Plan UIN: 104L098V03

2. Max Life Cancer Insurance Plan (A Non-Linked Non-Participating Individual Pure Risk Premium Health Insurance Plan UIN: 104N093V03)

Benefits

1. Adequate coverage at a low premium

2. Convenience to buy life insurance plans anytime and from anywhere

3. Flexibility to choose policy tenure and sum assured

Life Stage/Need: 25 – 30 years (Married with no children)

Plans to Consider

1. Max Life Smart Term Plan

2. Max Life Online Savings Plan (A Unit Linked Non Participating Individual Life Insurance Plan UIN: 104L098V03)

3. Max Life Cancer Insurance Plan (A Non-Linked Non-Participating Individual Pure Risk Premium Health Insurance Plan UIN: 104N093V03)

Benefits

1. Dual benefit of insurance and investment

2. Protection against various critical illnesses

3. Return of total premium at maturity (with Smart term plan premium back variant)

4. Flexible investment options

Life Stage/Need: 30 – 35 years (Married with young children)

Plans to Consider

1. Max Life Smart Term Plan (A Non Linked Non Participating Individual Pure Risk Premium Life Insurance Plan UIN: 104N113V04)

(RM :Preferably pitch smart term here, and online term plus only in younger segments)

2. Max Life Online Savings Plan (A Unit Linked Non Participating Individual Life Insurance Plan UIN: 104L098V03)

3. Max Life Cancer Insurance Plan (A Non-Linked Non-Participating Individual Pure Risk Premium Health Insurance Plan UIN: 104N093V03)

4. Max Life Future Genius Education Plan (A Non-Linked Participating Individual Life Insurance Savings Plan UIN: 104N094V03)

5. Max Life Shiksha Plus Super (A Unit-Linked Non-Participating Individual Life Insurance Plan UIN: 104L084V04)

Benefits

1. Increasing life cover as defined in the policy terms to beat inflation

2. Tax benefits under various sections of the Income Tax Act

3. Additional riders for enhanced protection

Life Stage/Need: 35 – 45 years (Parents with teenage children)

Plans to Consider

1. Max Life Smart Term Plan (A Non Linked Non Participating Individual Pure Risk Premium Life Insurance Plan UIN: 104N113V04)

2. Max Life Online Savings Plan (A Unit Linked Non Participating Individual Life Insurance Plan UIN: 104L098V03)

3. Max Life Cancer Insurance Plan (A Non-Linked Non-Participating Individual Pure Risk Premium Health Insurance Plan UIN: 104N093V03)

4. Max Life Future Genius Education Plan (A Non-Linked Participating Individual Life Insurance Savings Plan UIN: 104N094V03)

5. Max Life Shiksha Plus Super (A Unit-Linked Non-Participating Individual Life Insurance Plan UIN: 104L084V04)

Benefits

1. Flexible payout options

2. Comprehensive cover at affordable prices

3. Survival benefit as per the chosen plan

Life Stage/Need: Nearing retirement

Plans to Consider

1. Max Life Smart Term Plan

2. Max Life Online Savings Plan (A Unit Linked Non Participating Individual Life Insurance Plan UIN: 104L098V03)

3. Max Life Cancer Insurance Plan (A Non-Linked Non-Participating Individual Pure Risk Premium Health Insurance Plan UIN: 104N093V03)

Benefits

1. Financial security for retirement goals

2. Wealth creation opportunities for your child’s future goals

What is the Right Life Insurance Cover for You?

Once you have decided to buy life insurance, the next big step is to choose a specific life cover, or sum assured. Here are some aspects to keep in mind while determining a ballpark figure for the life cover:

1. Consider Your Working Years

A life insurance plan serves as an income replacement tool. Hence, you need to consider the number of active working years it would replace while choosing the sum assured. For instance, if you are 25 right now and have planned your retirement at the age of 50, you have 25 future earning years to consider.

2. Chart Out Your Regular Expenses

The sum assured should cover recurring financial outgoes, including household expenses, bills, and existing loan EMIs on a year-on-year basis. By charting out these expenses for a specific period, you will get a better idea of the sum assured to be chosen.

3. Consider Landmark Stages in Your Family’s Life

Certain stages or events in life require large lump sum amounts. These include wedding, retirement, or child’s higher education. The sum assured should cover them all majorly to ensure your family will not face a financial burden after you.

Difference Between Life Insurance, General Insurance, and Health Insurance

The following table summarizes the differences between various types of insurance plans:

Parameters |

General Insurance |

Life Insurance |

Health Insurance |

Basic Benefit |

Insurance coverage for non-life assets, like home, health, and travel |

Life cover benefit to be given to the family |

Health cover to deal with medical emergencies in life |

Premium Payment |

The entire premium is usually paid at the time of buying/ renewing the policy |

A fixed amount to be paid for a specific tenure (in years) |

A specific amount to be paid at first and then after every year for policy renewal |

Policy Duration |

Short term |

Long term |

Short term |

Claim of insurance |

In case of unfortunate events defined in the policy terms |

Either on the insured’s death or maturity |

During a healthcare emergency |

Tax benefit Under income tax act 1961 |

Under section 80D (for health insurance) |

Under section 80C |

Under section 80D |